Question: a. Construct the term structure of interest rates for these three periods. b. Your company plans to issue three-year to maturity coupon bonds. You

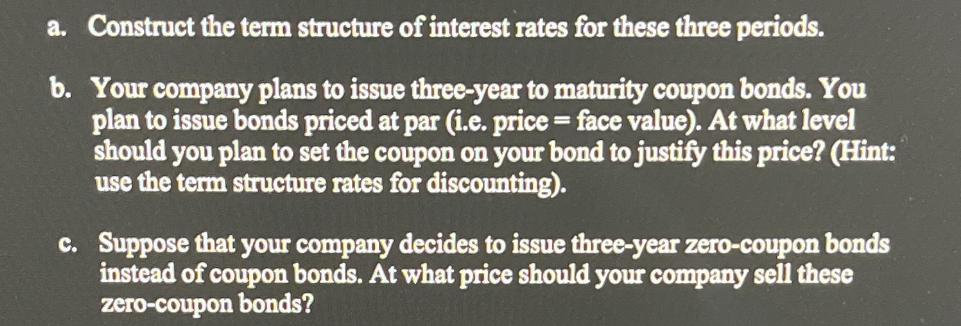

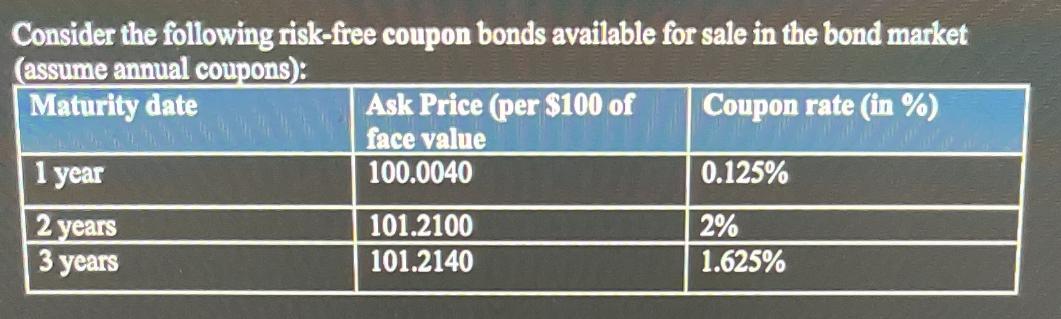

a. Construct the term structure of interest rates for these three periods. b. Your company plans to issue three-year to maturity coupon bonds. You plan to issue bonds priced at par (i.e. price = face value). At what level should you plan to set the coupon on your bond to justify this price? (Hint: use the term structure rates for discounting). c. Suppose that your company decides to issue three-year zero-coupon bonds instead of coupon bonds. At what price should your company sell these zero-coupon bonds? Consider the following risk-free coupon bonds available for sale in the bond market (assume annual coupons): Maturity date 1 year 2 years 3 years Ask Price (per $100 of face value 100.0040 101.2100 101.2140 Coupon rate (in %) 120.00 0.125% 2% 1.625%

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

a The term structure of interest rates for these three periods i... View full answer

Get step-by-step solutions from verified subject matter experts