Question: a consulting compant has conducted a scenario analysis to help asses the value of a foreign direct investment fir a client. they consider a currency

a consulting compant has conducted a scenario analysis to help asses the value of a foreign direct investment fir a client. they consider a currency appreciation and currency depreciation equally likely. they believe that the probability of a reduced slavage value of 31%

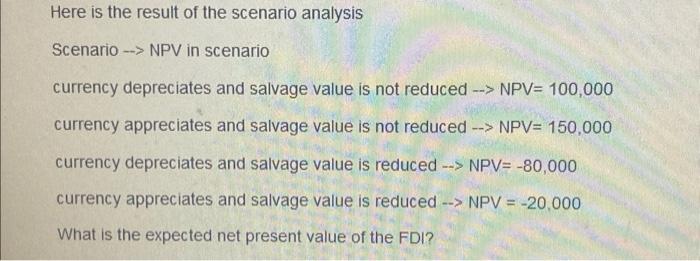

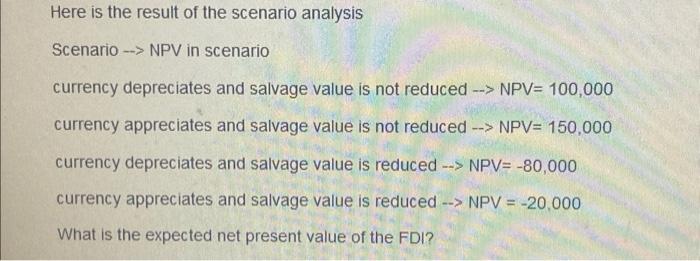

Here is the result of the scenario analysis Scenario --> NPV in scenario currency depreciates and salvage value is not reduced --> NPV= 100,000 currency appreciates and salvage value is not reduced --> NPV= 150,000 currency depreciates and salvage value is reduced --> NPV= -80,000 currency appreciates and salvage value is reduced --> NPV = -20,000 What is the expected net present value of the FDI

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock