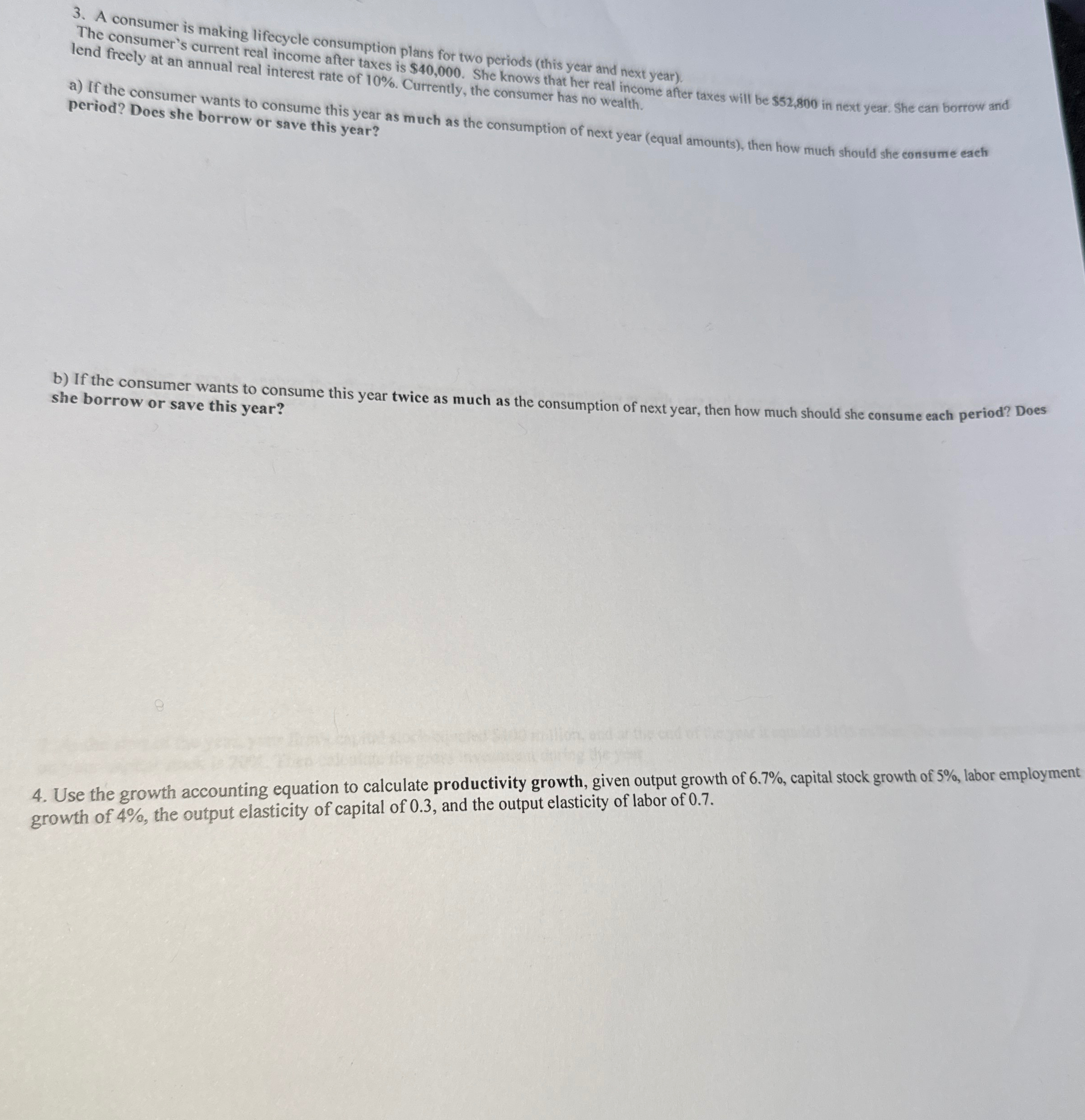

Question: A consumer is making lifecycle consumption plans for two periods ( this year and next year ) . The consumer's current real income after taxes

A consumer is making lifecycle consumption plans for two periods this year and next year

The consumer's current real income after taxes is $ She knows that her real income after taxes will be $ in next year. She can borrow and lend freely at an annual real interest rate of Currently, the consumer has no wealth.

a If the consumer wants to consume this year as much as the consumption of next year equal amounts then how much should she consume each period? Does she borrow or save this year?

b If the consumer wants to consume this year twice as much as the consumption of next year, then how much should she consume each period? Does she borrow or save this year?

Use the growth accounting equation to calculate productivity growth, given output growth of capital stock growth of labor employment growth of the output elasticity of capital of and the output elasticity of labor of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock