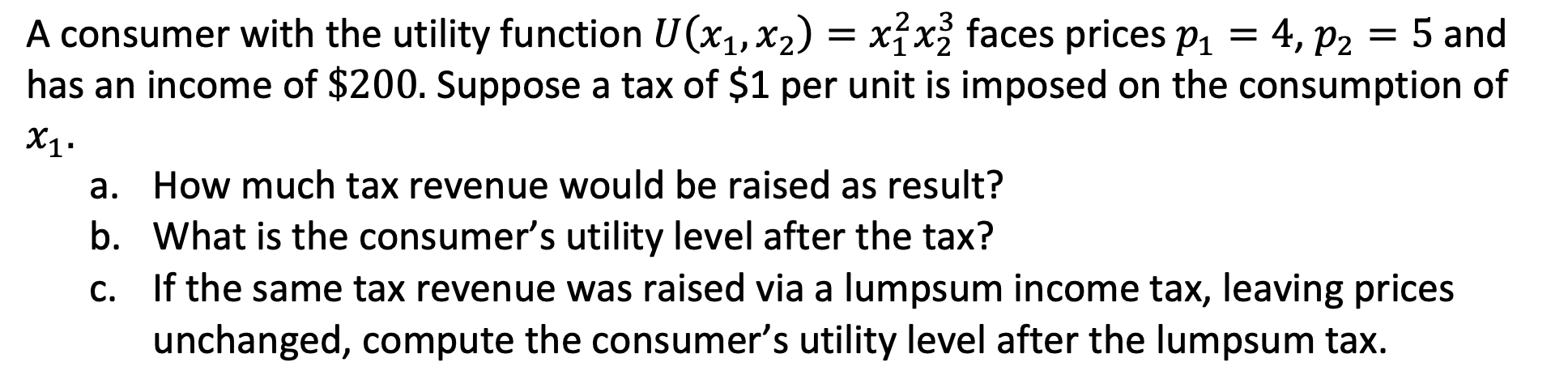

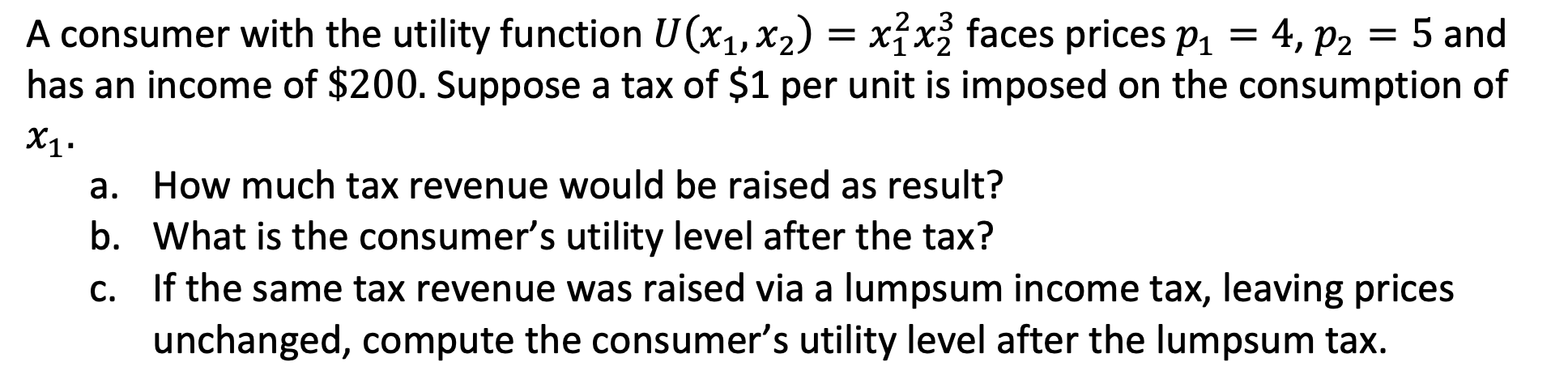

Question: A consumer with the utility function U(x1,x2) = 36fo faces prices p1 = 4, p2 = 5 and has an income of $200. Suppose a

A consumer with the utility function U(x1,x2) = 36fo faces prices p1 = 4, p2 = 5 and has an income of $200. Suppose a tax of $1 per unit is imposed on the consumption of x1. a. How much tax revenue would be raised as result? b. What is the consumer's utility level after the tax? c. If the same tax revenue was raised via a lumpsum income tax, leaving prices unchanged, compute the consumer's utility level after the lumpsum tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts