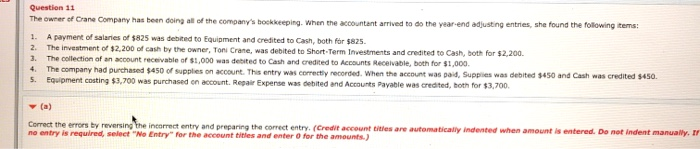

Question: a) Correct the errors by reversing the incorrect entry and preparing the correct entry. b) correct the errors without reversing the incorrect entry. Question 11

Question 11 The owner of Crane Company has been doing all of the company's bookkeeping. When the accountant arrived to do the year-end adjusting entries, she found the following items! 1. A payment of salaries of $825 was debited to Equipment and credited to Cash, both for $825. The investment of $2,200 of cash by the owner, Toni Crane, was debited to Short Term Investments and credited to Cash, both for $2,200. The collection of an account receivable of $1,000 was debited to Cash and credited to Accounts Receivable, both for $1,000 4. The company had purchased $450 of supplies on account. This entry was correctly recorded. When the account was paid, Supples was debited $450 and Cash was credited $450. 5. Equipment costing $3,700 was purchased on account. Repair Expense was debited and Accounts Payable was credited, both for $3,700. 2. Correct the errors by reversing the incorrect entry and preparing the correct entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Ir no entry is required, select "Ne Entry for the account titles and enter for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts