Question: A couple things: - Am I doing the work right? If not, what did I do wrong? - What did you get for this? I

A couple things:

- Am I doing the work right? If not, what did I do wrong?

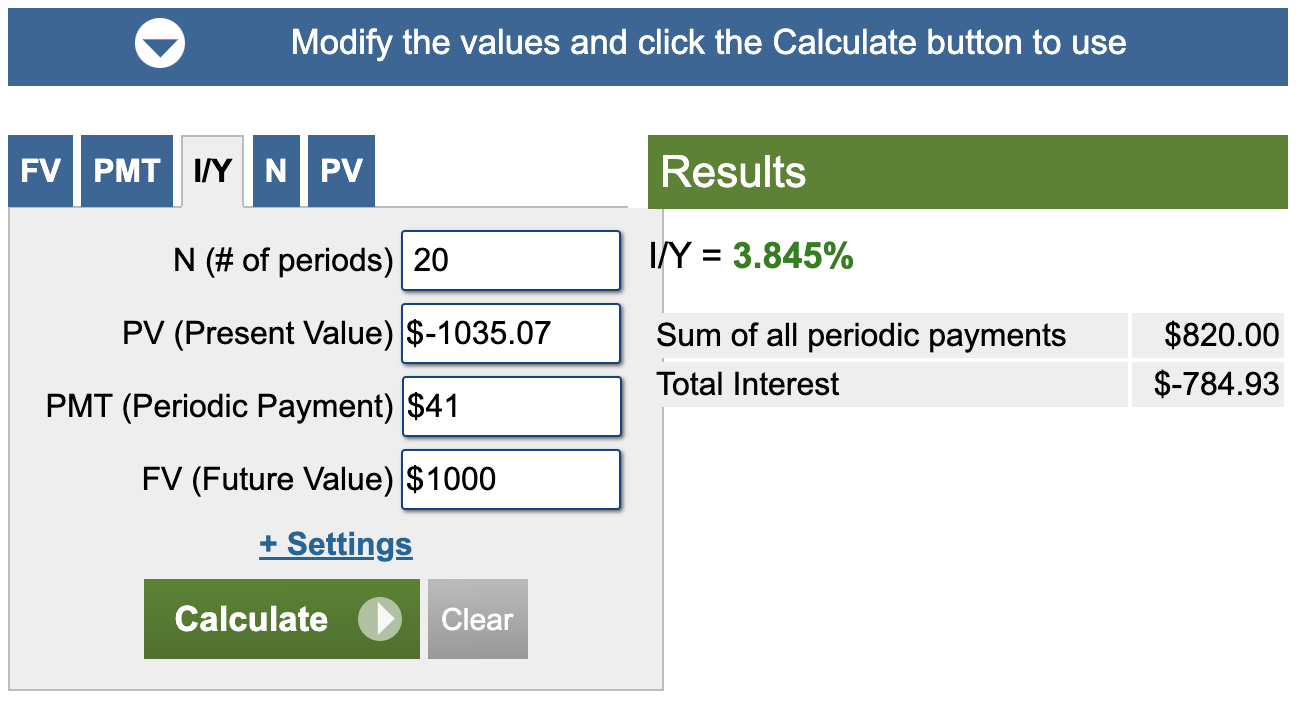

- What did you get for this? I attached a screenshot of what I got on an online financial calculator and it said I was wrong. Please help I am so bad at finance!!

Suppose a ten-year, $1,000 bond with an 8.2% coupon rate and semiannual coupons is trading for $1,035.07. What is the bond's yield to maturity(expressed as an APR with semiannual compounding)?

P = (CPN y) x (1 + (1 (1 + y)n)) + (1000 (1 + y)n)

1035.07 = (41 y) x (1 + (1 (1 + y)20)) + (1000 (1 + y)20)

N = 20

I/Y = ?

PV = -1035.07

PMT = 41

FV = 1,000

Modify the values and click the Calculate button to use FV PMT IN NPV Results N (# of periods) 20 I/Y = 3.845% PV (Present Value) $-1035.07 Sum of all periodic payments Total Interest $820.00 $-784.93 PMT (Periodic Payment) $41 FV (Future Value) $1000 + Settings Calculate Clear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts