Question: A customer asks a bank if it would be willing to commit to making the customer a one-year loan at an interest rate of 6.5

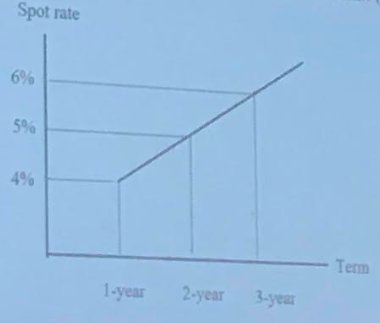

A customer asks a bank if it would be willing to commit to making the customer a one-year loan at an interest rate of 6.5 % two years from now. Since the customer has high-level creditworthiness, the bank is willing to charge the same interest rate as the expected interest rate on a Treasury bond with the same maturity (i.e., charge the 1- year forward rate two years from now implied by the Treasury yield curve) The bank estimates the liquidity (term) premium for one-, two-, and three- year bond to be 0%, 0.5%, and 1%, respectively. According to the Treasury yield curve below, should the manager be willing to make the commitment?

Spot rate - Term 1-year 2-year 3-year Spot rate - Term 1-year 2-year 3-year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts