Question: A customer asks a bank if it would be willing to commit to making the customer a one-year loan at an interest rate of 14.5%

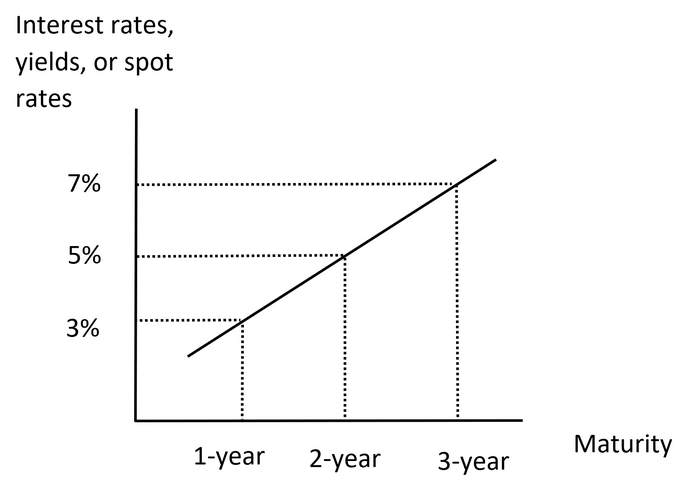

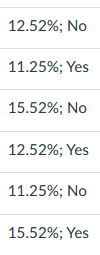

A customer asks a bank if it would be willing to commit to making the customer a one-year loan at an interest rate of 14.5% two years from now. To compensate for the costs of making the loan, the bank needs to charge three percentage points more than the expected interest rate on a Treasury bond with the same maturity if it is to make a profit. The bank estimates the liquidity (term) premium for one-, two-, and three-year bond to be 0%, 0.7%, and 1.4%, respectively. According to the Treasury yield curve below, what interest rate the loan must charge in order for the bank to make a profit on the loan? Should the manager be willing to make the commitment? Choose the closest answer below.

Interest rates, yields, or spot rates 7% 5% 3% 1-year Maturity 2-year 3-year 12.52%; No 11.25%; Yes 15.52%; No 12.52%; Yes ; 11.25%; No 15.52%; Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts