Question: A customer is trying to decide whether to take out a fixed rate or variable rate mortgage over the next 5 years. They have come

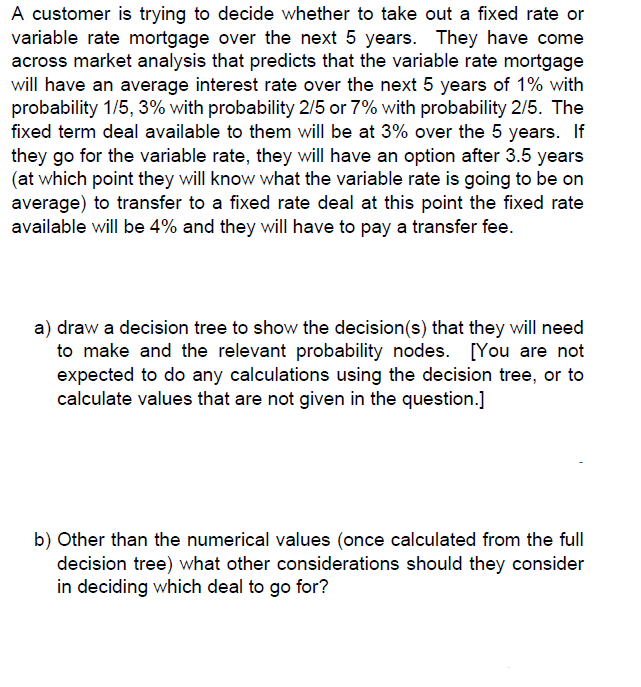

A customer is trying to decide whether to take out a fixed rate or variable rate mortgage over the next 5 years. They have come across market analysis that predicts that the variable rate mortgage will have an average interest rate over the next 5 years of 1% with probability 1/5,3% with probability 2/5 or 7% with probability 2/5. The fixed term deal available to them will be at 3% over the 5 years. If they go for the variable rate, they will have an option after 3.5 years (at which point they will know what the variable rate is going to be on average) to transfer to a fixed rate deal at this point the fixed rate available will be 4% and they will have to pay a transfer fee. a) draw a decision tree to show the decision(s) that they will need to make and the relevant probability nodes. [You are not expected to do any calculations using the decision tree, or to calculate values that are not given in the question.] b) Other than the numerical values (once calculated from the full decision tree) what other considerations should they consider in deciding which deal to go for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts