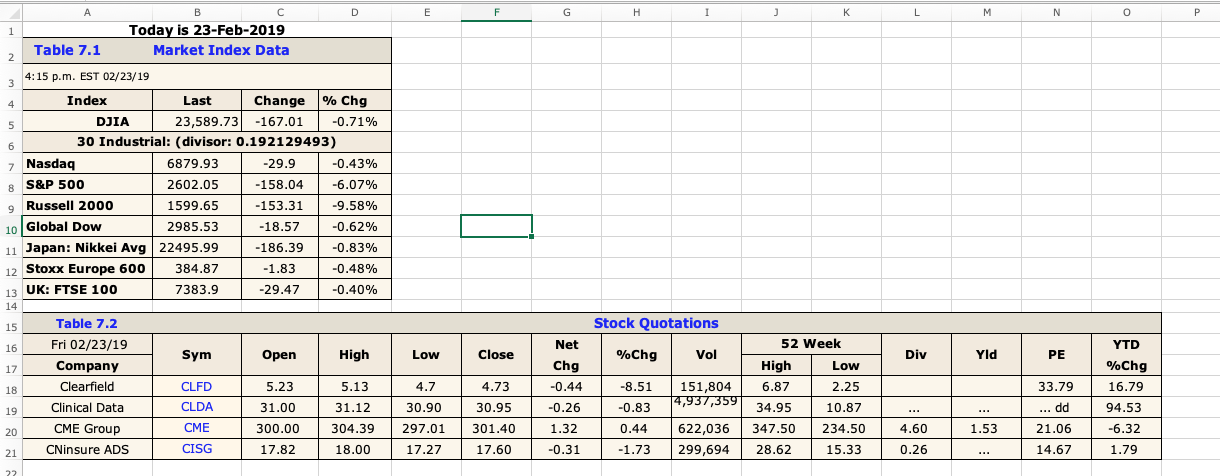

Question: A D E F G H I J K L M N O P B C Today is 23-Feb-2019 Market Index Data Table 7.1 4:15

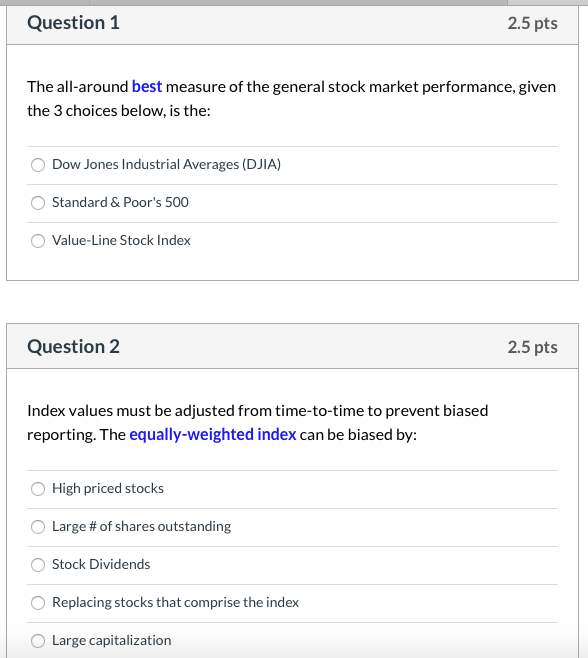

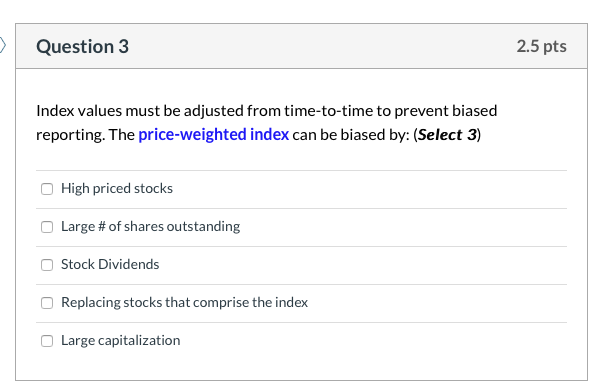

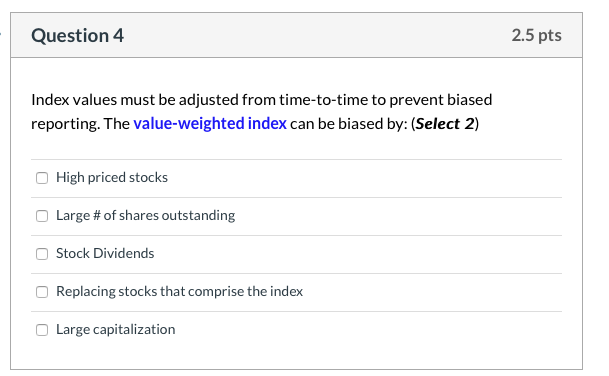

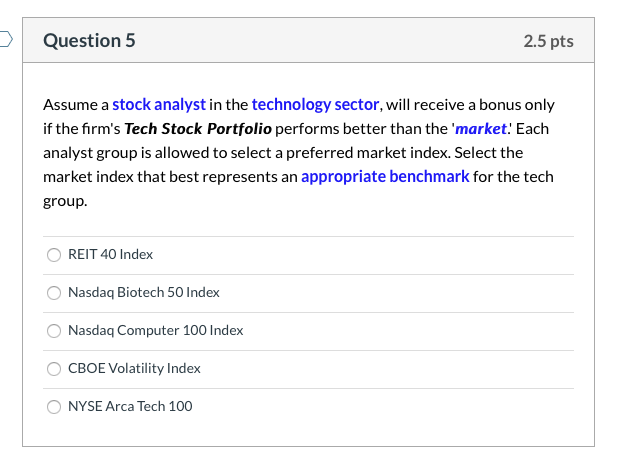

A D E F G H I J K L M N O P B C Today is 23-Feb-2019 Market Index Data Table 7.1 4:15 p.m. EST 02/23/19 Index Last Change % Chg DJIA 23,589.73 -167.01 -0.71% 30 Industrial: (divisor: 0.192129493) Nasdaq 6879.93 -29.9 -0.43% S&P 500 2602.05 -158.04 -6.07% Russell 2000 1599.65 -153.31 -9.58% 10 Global Dow 2985.53 -18.57 -0.62% 11 Japan: Nikkei Avg 22495.99 -186.39 -0.83% Stoxx Europe 600 384.87 -1.83 -0.48% 13 UK: FTSE 100 7383.9 -29.47 -0.40% Stock Quotations Net Sym Open High Low Close %Chg Vol Div Yld PE Table 7.2 Fri 02/23/19 Company Clearfield Clinical Data CME Group CNinsure ADS CLFD CLDA CME CISG 5.23 31.00 300.00 17.82 5.13 31.12 304.39 18.00 4.7 30.90 297.01 17.27 4.73 30.95 301.40 17.60 Chg -0.44 -0.26 1.32 -0.31 -8.51 -0.83 0.44 -1.73 151,804 14,957,359 622,036 299,694 52 Week High Low 6.87 2.25 34.95 10.87 347.50 234.50 28.62 15.33 33.79 ... dd 21.06 14.67 YTD %Chg 16.79 94.53 -6.32 1.79 | 1.53 4.60 0.26 Question 1 2.5 pts The all-around best measure of the general stock market performance, given the 3 choices below, is the: Dow Jones Industrial Averages (DJIA) Standard & Poor's 500 O Value-Line Stock Index Question 2 2.5 pts Index values must be adjusted from time-to-time to prevent biased reporting. The equally-weighted index can be biased by: High priced stocks Large # of shares outstanding Stock Dividends O Replacing stocks that comprise the index Large capitalization Question 3 2.5 pts Index values must be adjusted from time-to-time to prevent biased reporting. The price-weighted index can be biased by: (Select 3) High priced stocks Large # of shares outstanding Stock Dividends Replacing stocks that comprise the index Large capitalization Question 5 2.5 pts Assume a stock analyst in the technology sector, will receive a bonus only if the firm's Tech Stock Portfolio performs better than the 'market! Each analyst group is allowed to select a preferred market index. Select the market index that best represents an appropriate benchmark for the tech group. REIT 40 Index O Nasdaq Biotech 50 Index O Nasdaq Computer 100 Index O CBOE Volatility Index ONYSE Arca Tech 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts