Question: A decision maker is faced with a choice between two projects, both of which have start-up costs in the first year of $150m and project

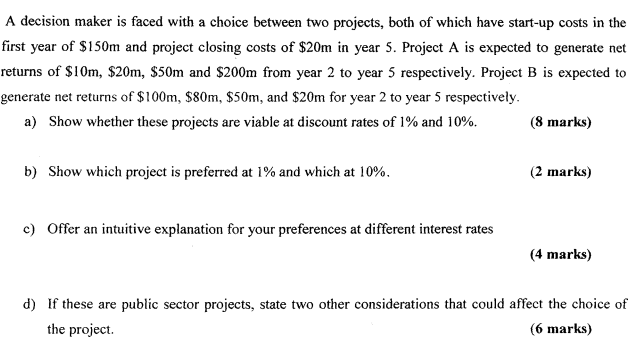

A decision maker is faced with a choice between two projects, both of which have start-up costs in the first year of $150m and project closing costs of $20m in year 5. Project A is expected to generate net returns of $10m, $20m, $50m and $200m from year 2 to year 5 respectively. Project B is expected to generate net returns of $100m, $80m. $50m, and $20m for year 2 to year 5 respectively. a) Show whether these projects are viable at discount rates of 1% and 10%. (8 marks) b) Show which project is preferred at 1% and which at 10%. (2 marks) c) Offer an intuitive explanation for your preferences at different interest rates (4 marks) d) If these are public sector projects, state two other considerations that could affect the choice of the project. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts