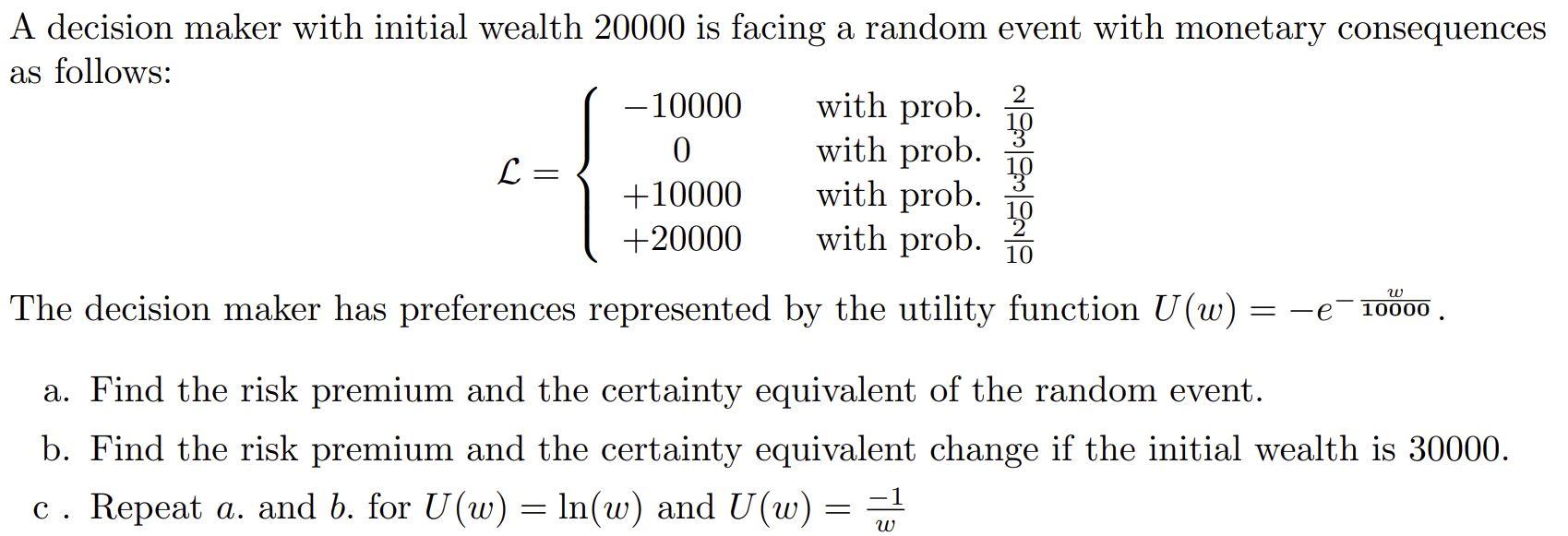

Question: A decision maker with initial wealth 20000 is facing a random event with monetary consequences as follows: -10000 with prob. 0 with prob. L= +10000

A decision maker with initial wealth 20000 is facing a random event with monetary consequences as follows: -10000 with prob. 0 with prob. L= +10000 with prob. +20000 with prob.io ONS Globo The decision maker has preferences represented by the utility function U(w) = -e 10000 = a. Find the risk premium and the certainty equivalent of the random event. b. Find the risk premium and the certainty equivalent change if the initial wealth is 30000. c. Repeat a. and b. for U(W) = ln(w) and U(W) = = - = w A decision maker with initial wealth 20000 is facing a random event with monetary consequences as follows: -10000 with prob. 0 with prob. L= +10000 with prob. +20000 with prob.io ONS Globo The decision maker has preferences represented by the utility function U(w) = -e 10000 = a. Find the risk premium and the certainty equivalent of the random event. b. Find the risk premium and the certainty equivalent change if the initial wealth is 30000. c. Repeat a. and b. for U(W) = ln(w) and U(W) = = - = w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts