Question: Questions: please help! 25 / 32 75% + Example: Your first job is CFO of Gump Restaurants Co., which is considering opening fifteen (15) new

Questions: please help!

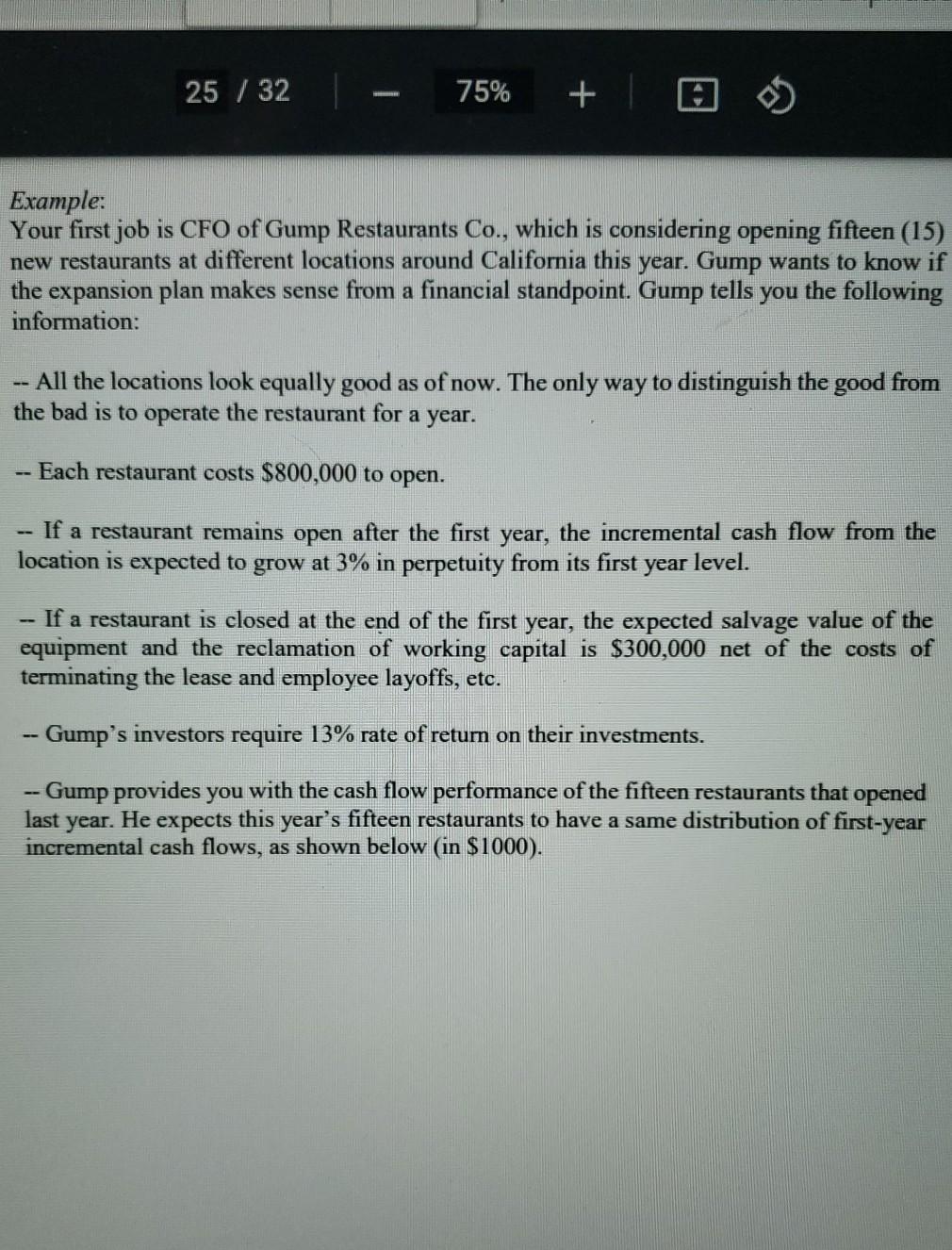

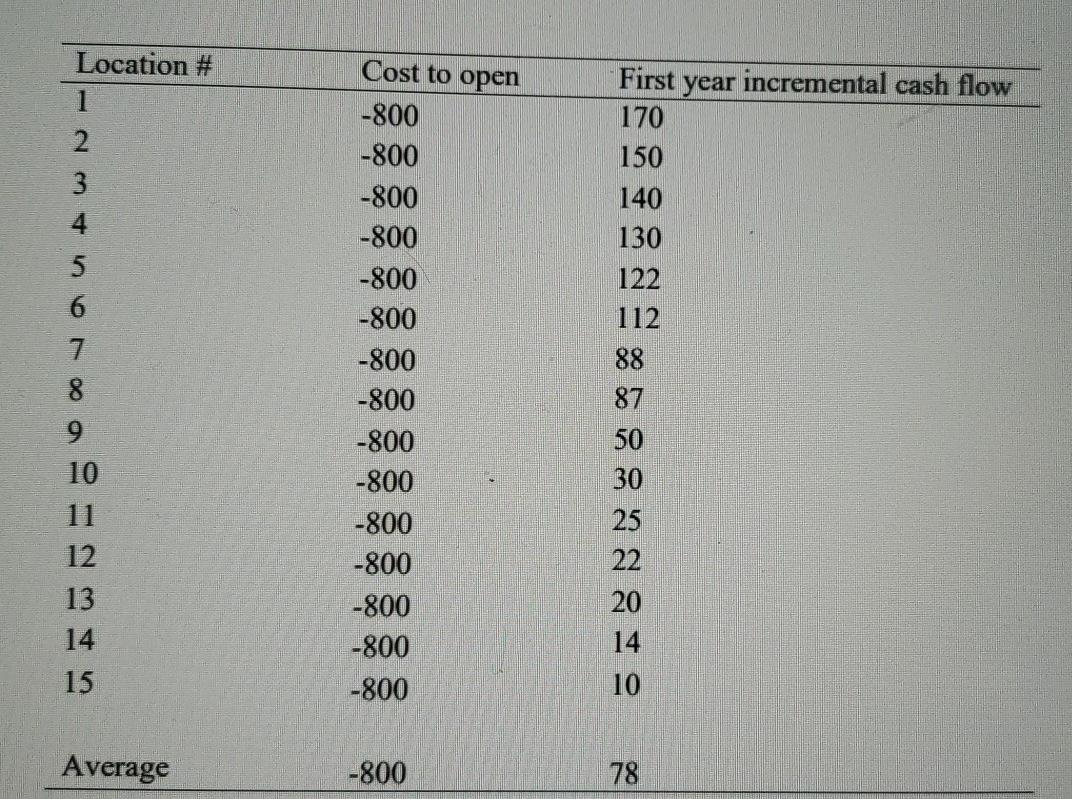

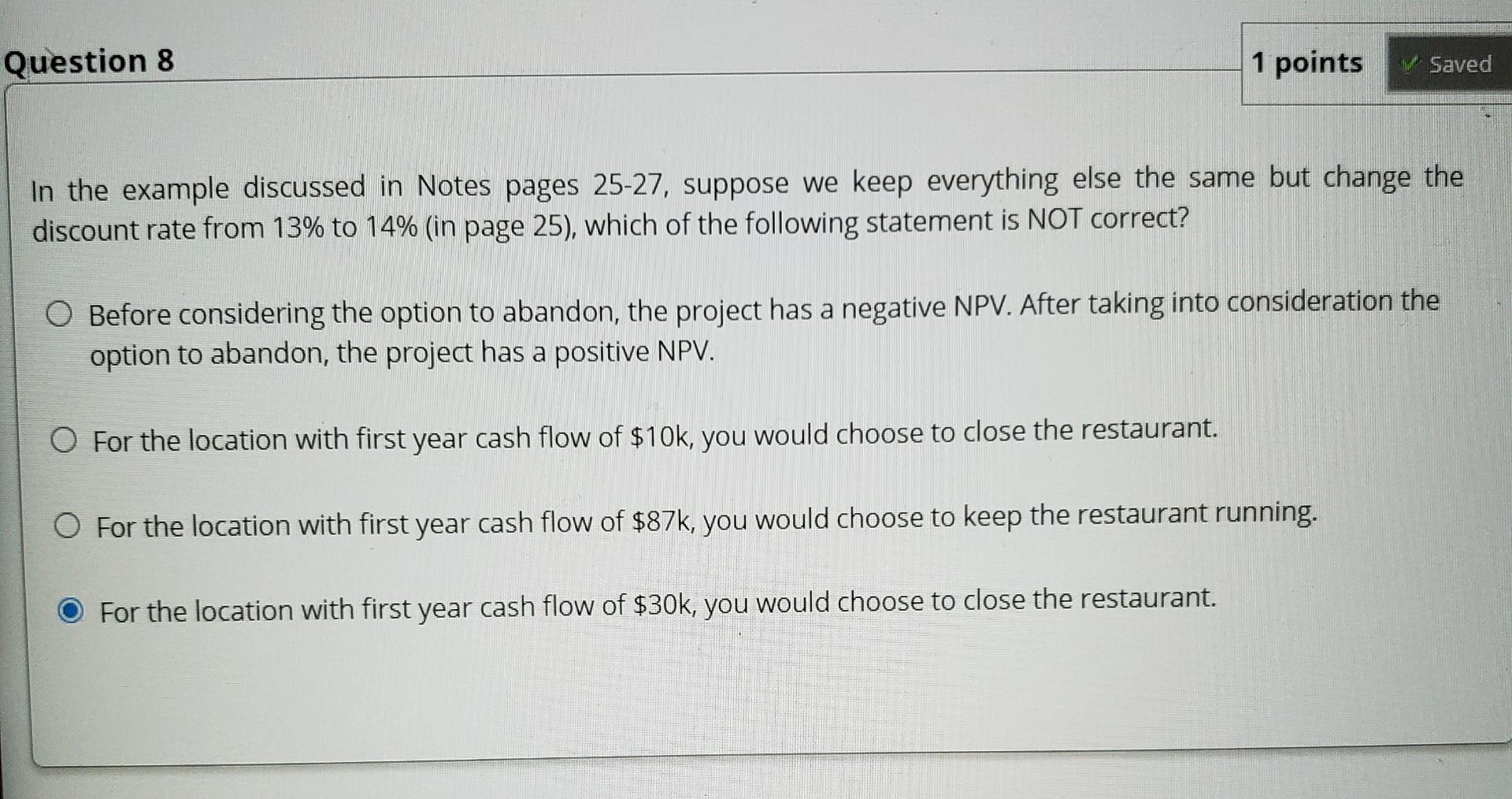

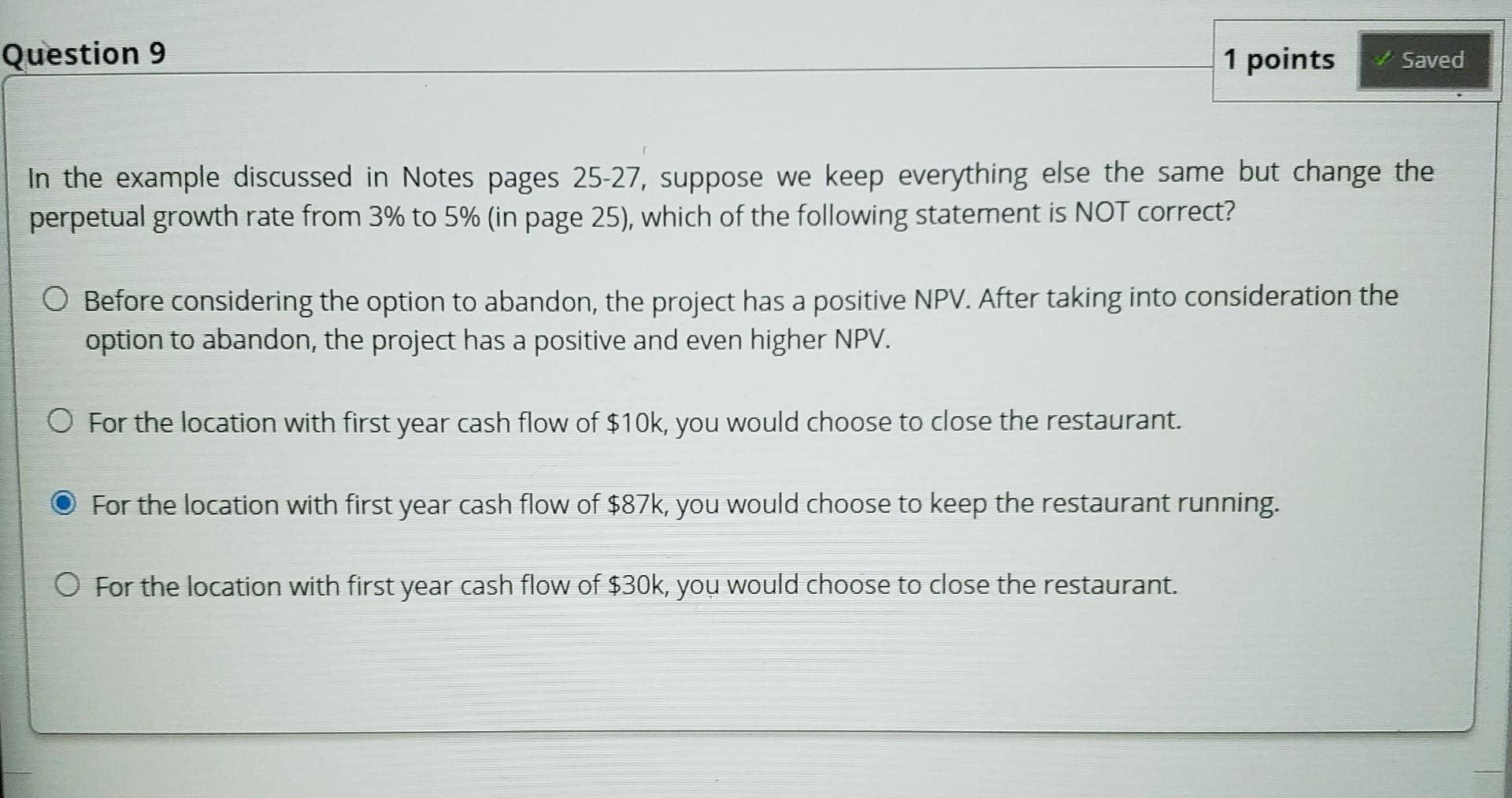

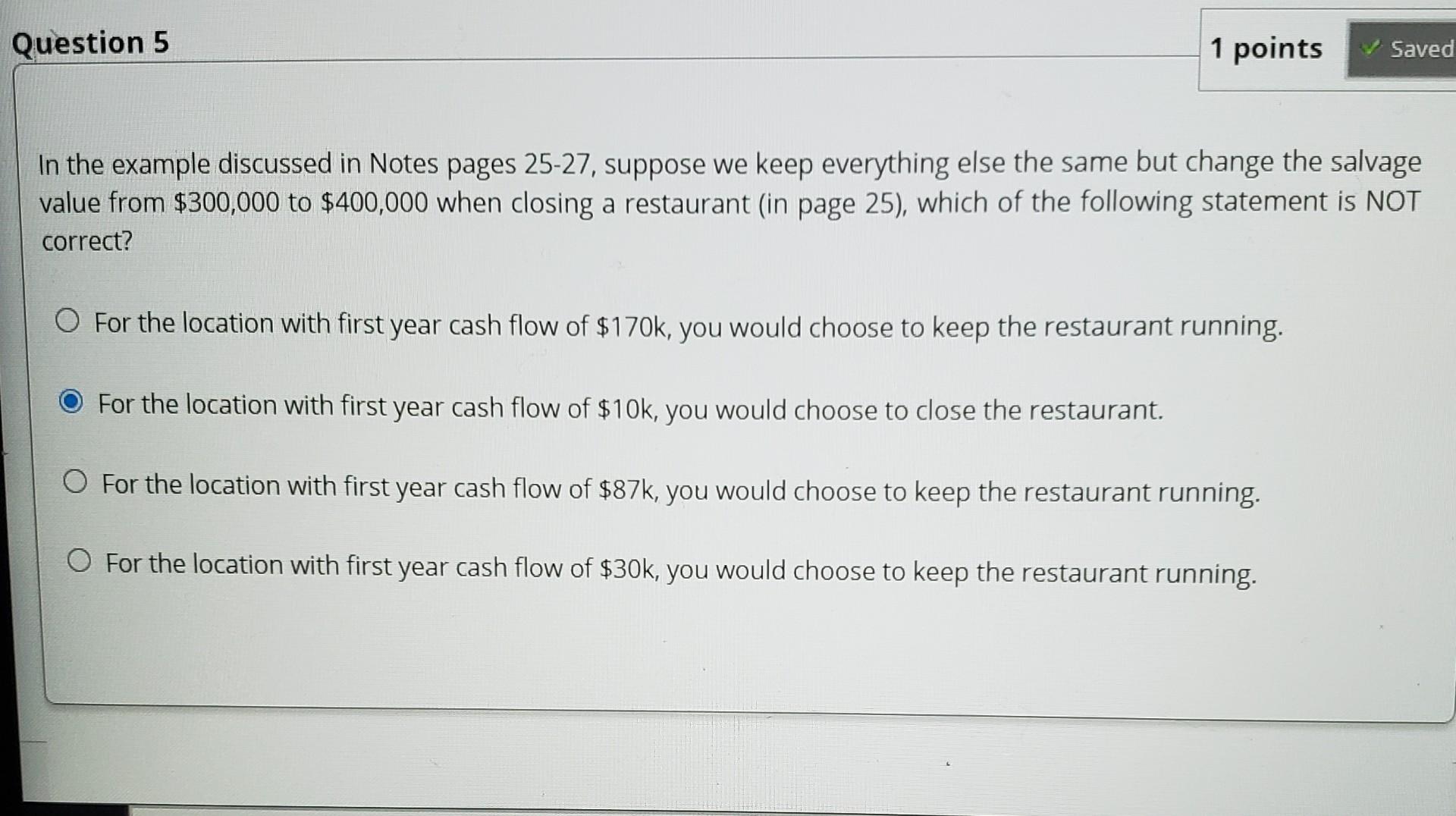

25 / 32 75% + Example: Your first job is CFO of Gump Restaurants Co., which is considering opening fifteen (15) new restaurants at different locations around California this year. Gump wants to know if the expansion plan makes sense from a financial standpoint. Gump tells you the following information: -- All the locations look equally good as of now. The only way to distinguish the good from the bad is to operate the restaurant for a year. - Each restaurant costs $800,000 to open. -- If a restaurant remains open after the first year, the incremental cash flow from the location is expected to grow at 3% in perpetuity from its first year level. -- If a restaurant is closed at the end of the first year, the expected salvage value of the equipment and the reclamation of working capital is $300,000 net of the costs of terminating the lease and employee layoffs, etc. -- Gump's investors require 13% rate of retum on their investments. -- Gump provides you with the cash flow performance of the fifteen restaurants that opened last year. He expects this year's fifteen restaurants to have a same distribution of first-year incremental cash flows, as shown below (in $1000). Cost to open Location # 1 2 5 6 7 8 9 10 11 12 13 14 15 -800 -800 -800 -800 -800 -800 -800 -800 -800 -800 -800 -800 -800 -800 -800 First year incremental cash flow 170 150 140 130 122 112 88 87 50 30 25 22 20 14 10 Average -800 78 Location # 1 PV if keep PV If abandon Optimal decision Optimal PV Optimal NPV Ist year CF 170 150 140 130 122 112 88 87 50 30 25 22 20 14 10 1500 1400 1300 1220 1120 880 870 500 398 389 381 373 365 343 342 310 Keep Keep Keep Keep Keep Keep Keep Keep 1500 1400 1300 1220 1120 880 870 500 700 600 500 420 320 80 70 -300 7 10 12 13 220 200 140 285 283 278 Abandon Abandon Abandon 285 283 278 -515 -517 -522 14 15 Average 78 780 335 13 Question 8 1 points Saved In the example discussed in Notes pages 25-27, suppose we keep everything else the same but change the discount rate from 13% to 14% (in page 25), which of the following statement is NOT correct? O Before considering the option to abandon, the project has a negative NPV. After taking into consideration the option to abandon, the project has a positive NPV. O For the location with first year cash flow of $10k, you would choose to close the restaurant. For the location with first year cash flow of $87k, you would choose to keep the restaurant running. For the location with first year cash flow of $30k, you would choose to close the restaurant. Question 9 1 points Saved In the example discussed in Notes pages 25-27, suppose we keep everything else the same but change the perpetual growth rate from 3% to 5% (in page 25), which of the following statement is NOT correct? Before considering the option to abandon, the project has a positive NPV. After taking into consideration the option to abandon, the project has a positive and even higher NPV. O For the location with first year cash flow of $10k, you would choose to close the restaurant. For the location with first year cash flow of $87k, you would choose to keep the restaurant running. O For the location with first year cash flow of $30k, you would choose to close the restaurant. Question 5 1 points Saved In the example discussed in Notes pages 25-27, suppose we keep everything else the same but change the salvage value from $300,000 to $400,000 when closing a restaurant (in page 25), which of the following statement is NOT correct? For the location with first year cash flow of $170k, you would choose to keep the restaurant running. For the location with first year cash flow of $10k, you would choose to close the restaurant. O For the location with first year cash flow of $87k, you would choose to keep the restaurant running. For the location with first year cash flow of $30k, you would choose to keep the restaurant running

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts