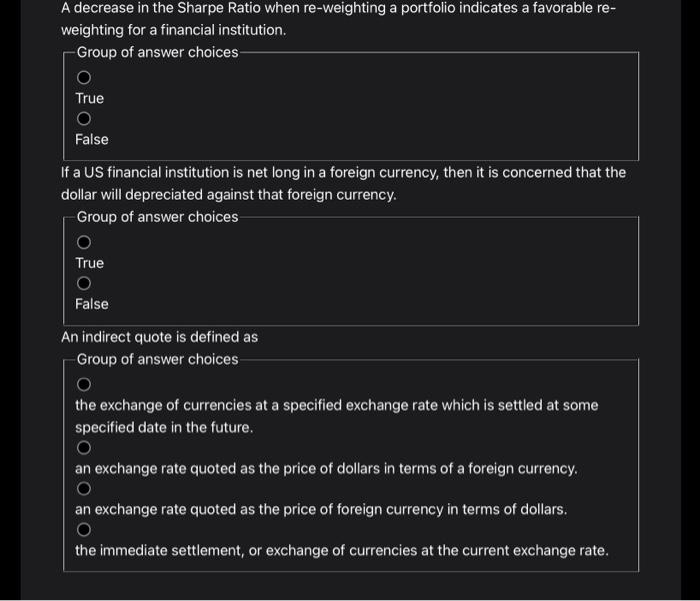

Question: A decrease in the Sharpe Ratio when re-weighting a portfolio indicates a favorable re- weighting for a financial institution. Group of answer choices True O

A decrease in the Sharpe Ratio when re-weighting a portfolio indicates a favorable re- weighting for a financial institution. Group of answer choices True O False If a US financial institution is net long in a foreign currency, then it is concerned that the dollar will depreciated against that foreign currency. Group of answer choices o True o False An indirect quote is defined as Group of answer choices o the exchange of currencies at a specified exchange rate which is settled at some specified date in the future. an exchange rate quoted as the price of dollars in terms of a foreign currency. o an exchange rate quoted as the price of foreign currency in terms of dollars. o the immediate settlement, or exchange of currencies at the current exchange rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts