Question: (a) Delta tells us how option value changes when the underlying stock's price increases by a small amountx (b) Gamma is higher when the underlying

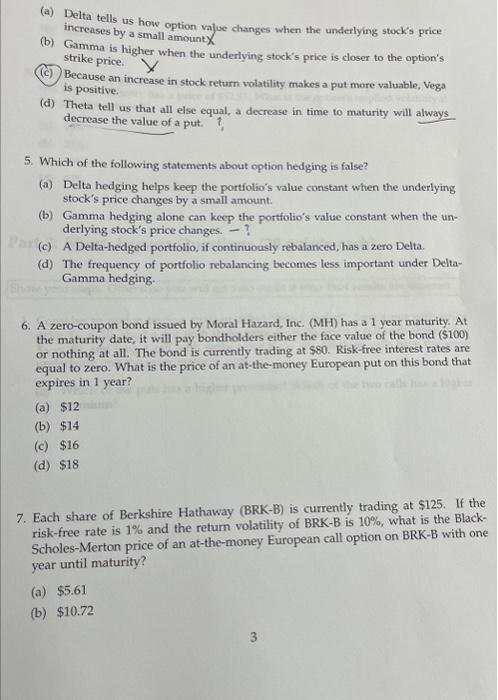

(a) Delta tells us how option value changes when the underlying stock's price increases by a small amountx (b) Gamma is higher when the underlying stock's price is closer to the option's Btrike price. Because an increase in stock return volatility makes a put more valuable, Vega is positive. (d) Theta tell us that all else equal, a decrease in time to maturity will always decrease the value of a put. 5. Which of the following statements about option hedging is false? (a) Delta hedging helps keep the portfolio's value constant when the underlying stock's price changes by a small amount: (b) Gamma hedging alone can keep the portfolio's value constant when the underlying stock's price changes. - ? (c) A Delta-hedged portfolio, if continuously rebalanced, has a zero Delta. (d) The frequency of portfolio rebalancing becomes less important under DeltaGamma hedging. 6. A zero-coupon bond issued by Moral Hazard, Inc. (MH) has a 1 year maturity. At the maturity date, it will pay bondholders either the face value of the bond (\$100) or nothing at all. The bond is currently trading at $0. Risk-free interest rates are equal to zero. What is the price of an at-the-money European put on this bond that expires in 1 year? (a) $12 (b) $14 (c) $16 (d) $18 7. Each share of Berkshire Hathaway (BRK-B) is currently trading at \$125. If the risk-free rate is 1% and the return volatility of BRK-B is 10%, what is the BlackScholes-Merton price of an at-the-money European call option on BRK-B with one year until maturity? (a) 55.61 (b) $10.72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts