Question: Case to be discussed : Foreign Exchange Hedging Strategies at General Motors: Transactional and Translational Exposures HBSP Product #: 205095-PDF-ENG Exhibit 9 GM Canada -

Case to be discussed:

Foreign Exchange Hedging Strategies at General Motors: Transactional and Translational Exposures HBSP Product #: 205095-PDF-ENG

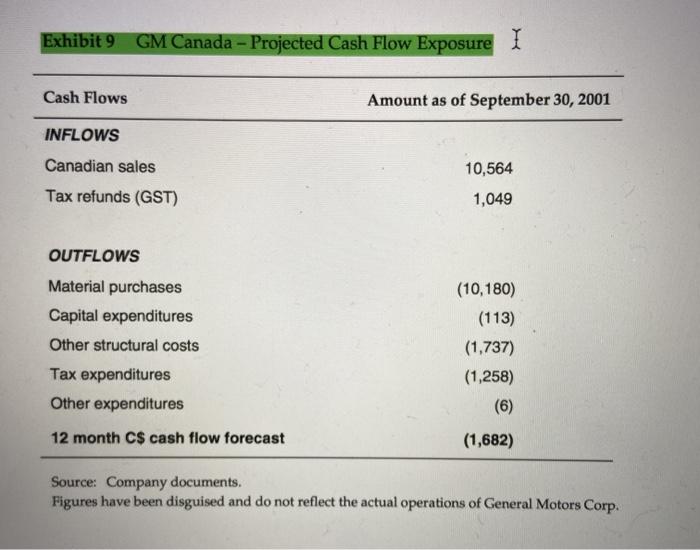

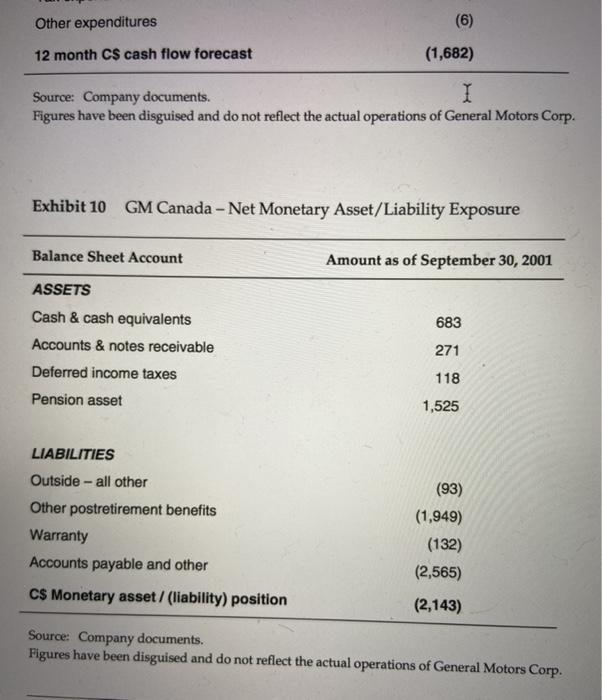

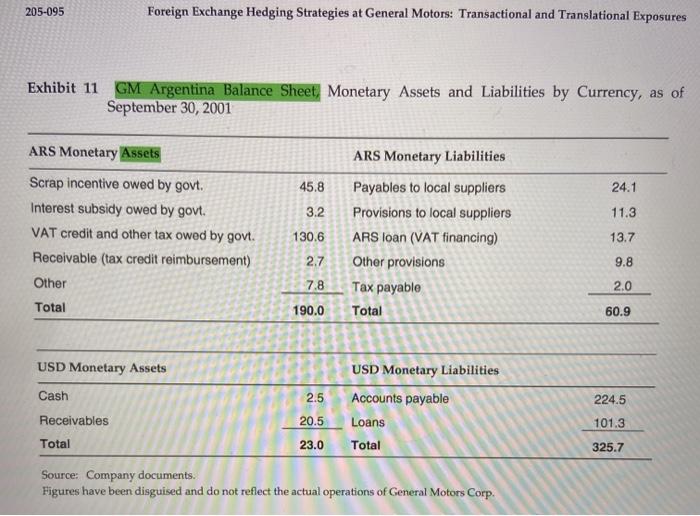

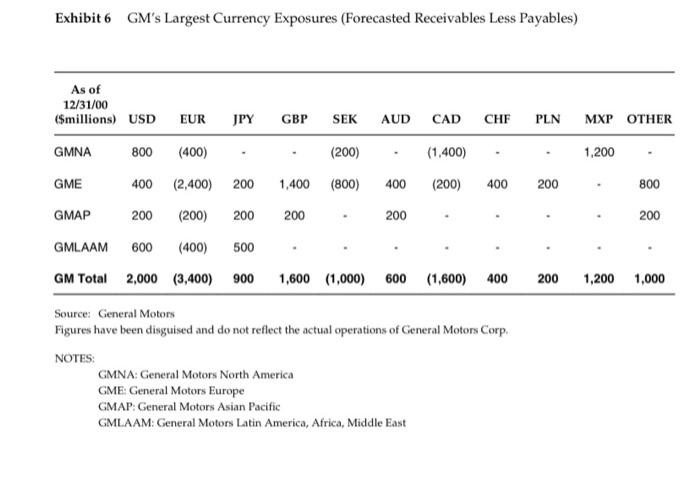

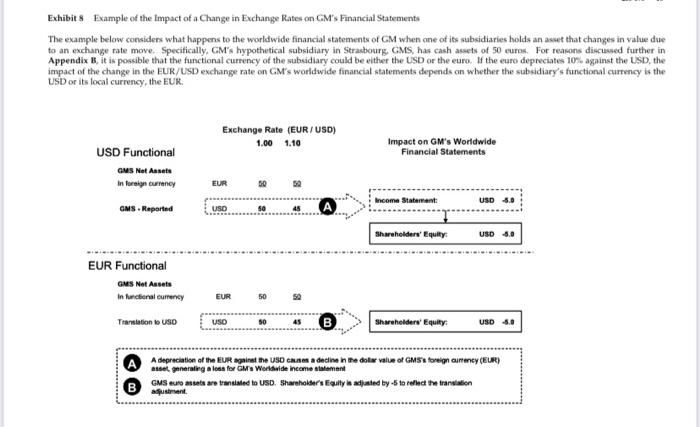

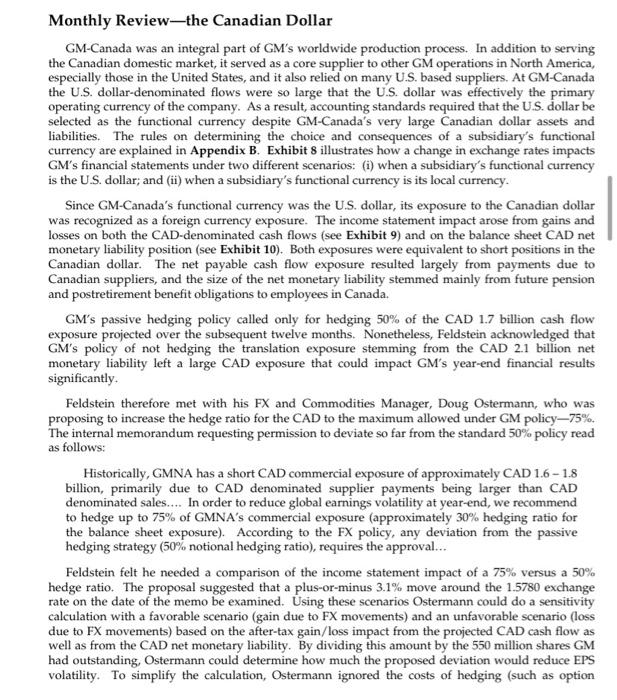

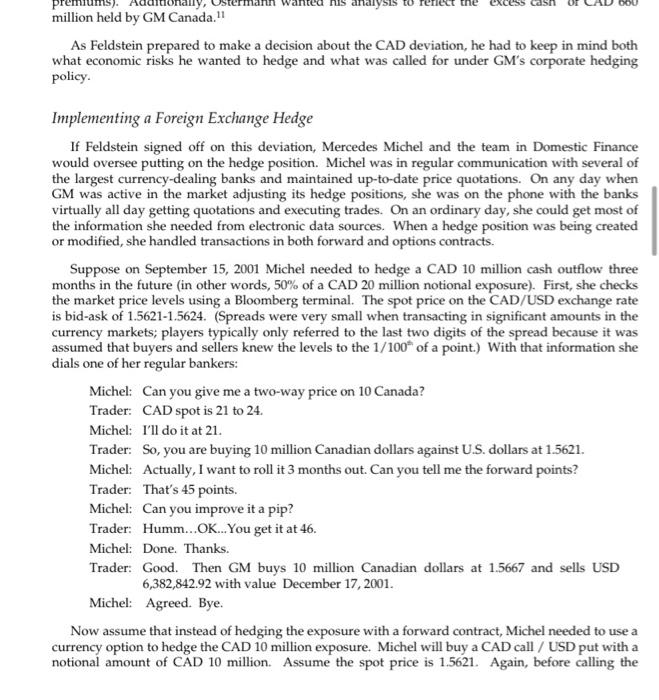

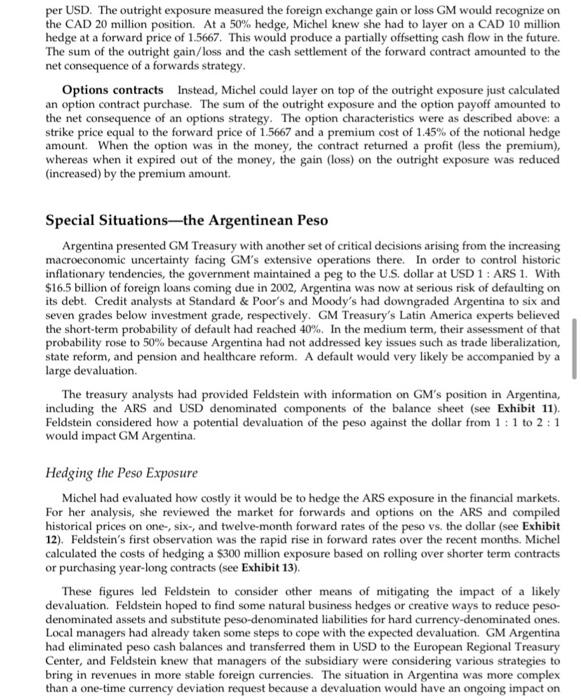

Exhibit 9 GM Canada - Projected Cash Flow Exposure I Cash Flows Amount as of September 30, 2001 INFLOWS Canadian sales 10,564 Tax refunds (GST) 1,049 OUTFLOWS Material purchases Capital expenditures Other structural costs Tax expenditures Other expenditures (10,180) (113) (1,737) (1,258) (6) 12 month C$ cash flow forecast (1,682) Source: Company documents. Figures have been disguised and do not reflect the actual operations of General Motors Corp. Other expenditures (6) 12 month CS cash flow forecast (1,682) Source: Company documents. I Figures have been disguised and do not reflect the actual operations of General Motors Corp. Exhibit 10 GM Canada - Net Monetary Asset/Liability Exposure Balance Sheet Account Amount as of September 30, 2001 683 ASSETS Cash & cash equivalents Accounts & notes receivable Deferred income taxes Pension asset 271 118 1,525 LIABILITIES Outside - all other Other postretirement benefits Warranty Accounts payable and other (93) (1,949) (132) (2,565) C$ Monetary asset/ (liability) position (2,143) Source: Company documents. Figures have been disguised and do not reflect the actual operations of General Motors Corp. 205-095 Foreign Exchange Hedging Strategies at General Motors: Transactional and Translational Exposures Exhibit 11 GM Argentina Balance Sheet, Monetary Assets and Liabilities by Currency, as of September 30, 2001 ARS Monetary Assets 45.8 24.1 3.2 11.3 130.6 Scrap incentive owed by govt. Interest subsidy owed by govt. VAT credit and other tax owed by govt. Receivable (tax credit reimbursement) Other Total ARS Monetary Liabilities Payables to local suppliers Provisions to local suppliers ARS loan (VAT financing) Other provisions Tax payable Total 13.7 2.7 9.8 7.8 2.0 190.0 60.9 USD Monetary Assets Cash 2.5 USD Monetary Liabilities Accounts payable Loans 224.5 Receivables 20.5 101.3 Total 23.0 Total 325.7 Source: Company documents. Figures have been disguised and do not reflect the actual operations of General Motors Corp. Exhibits Example of the impact of a Change in Exchange Rates on GM's Financial Statements The example below considers what happens to the worldwide financial statements of GM when one of its subsidiaries holds an asset that changes in value due to an exchange rate move. Specifically. GM's hypothetical subsidiary in Strasbourg GMS, has cash assets of 50 euros. For reasons discussed further in Appendix B, it is possible that the functional currency of the subsidiary could be either the USD or the euro. If the euro depreciates 10% against the USD, the impact of the change in the EUR/USD exchange rate on GM's worldwide financial statements depends on whether the subsidiary's functional currency is the USD or its local currency, the EUR Exchange Rate (EUR/USD) 1.00 1.10 Impact on GM's Worldwide Financial Statements USD Functional GMS Net Assets in foreign currency EUR Income Statement USD 3.0 GMS. Reported USD Shareholders' Equity USD 4.0 EUR Functional GMS Net Assets In functional currency EUR 50 Se Translation USD USO Shareholder Equy A depreciation of the EUR against the USO Ce a dedine ne dolar value of GMS's foreign currency (EUR) asset generating a loss for GM's Worldwide income statement GMS Euro sets are translated to USD Shareholders Equity in adjusted by -5 to reflect the translation adjustment B word about the balance sheet exposure? What impact could it have on GM? 4. Compare the income statement impact of a 75% versus a 50% hedge ratio. Should GM deviate from Its hedging policy? 5. Compare the use of forward contracts and options for hedging the CAD exposure (On a graph show .. Feldstein. The committee met quarterly to review the performance of GM's financial risk management strategies and to set treasury policy for GM and its subsidiaries. Treasury policy included evaluating the parameters and benchmarks for managing market risks, determining criteria for assessing counterparty credit risk, determining thresholds for property and liability insurance coverage as well as reviewing internal control aspects of operating policies and procedures. GM's formal, company-wide policies contained not only broad principles, but also detailed execution procedures such as, in the case of foreign exchange risk management, the types of instruments to be used and the appropriate time horizons. At its meetings the committee also discussed any special topics that needed to be addressed. Such special topics often included precisely the deviations from usual policy Feldstein was currently considering. Various groups within the Treasurer's Office were involved in the implementation of financial risk management policy. For foreign exchange, all of GM's hedging activities were concentrated in two centers: The Domestic Finance group in New York handled FX hedging for GM entities located in North America, Latin America, Africa and the Middle East The European Regional Treasury Center (ERTC) was GM's largest foreign exchange operation, covering European and Asia Pacific FX exposures FX hedging activities were segregated in this way on the principle that there should be some geographic correspondence between where a business unit was actually managed and where treasury for that business was controlled. At the same time, though, it was considered desirable to reap the benefits of pooling exposures across groups. In a sense, the goal was to match treasury management to the footprint of the business. Having local market knowledge and a trading center in both the European and U.S. time zones was also very helpful, because GM was active in each of the major foreign exchange markets. In managing the FX exposures, both the Domestic Finance group and the ERTC worked closely with other groups within Treasury that had the primary responsibility of providing strategic support to GM entities within that region. These groups were also the global coordinators for intercompany loans, moved cash around the world to finance overseas mergers and acquisitions activities, and managed dividend repatriations. Review of Corporate Hedging Policy General Motors's overall foreign exchange risk management policy was established to meet three primary objectives: (1) reduce cash flow and earnings volatility, (2) minimize the management time and costs dedicated to global FX management, and (3) align FX management in a manner consistent with how GM operates its automotive business. The first constituted a conscious decision to hedge cash flows (transaction exposures) only and ignore balance sheet exposures (translation exposures"). Other members of the Risk Management Committee were the Chief Financial Officer, the General Auditor, the Chief Accounting Officer, the Chief Economist, and a senior executive from General Motors Acceptance Corporation (GMAC), GM's financial services subsidiary. 5 GM policy specified, for example, which risks were to be hedged using forward contracts rather than options contracts. Transaction exposures are the gains and losses that arise when transactions are settled in some currency other than a company's reporting currency. These exposures stem from buying and selling activities as well as financing decisions such as 6 Overview of General Motors and its Treasury Operations General Motors General Motors was the world's largest automaker, with unit sales of 8.5 million vehicles in 200115.1% worldwide market share-and had been the world's sales leader since 1931. Founded in 1908, GM had manufacturing operations in more than 30 countries, and its vehicles were sold in approximately 200 countries. In 2000, it generated earnings of $4.4 billion on sales of $184.6 billion (see Exhibit 1 for GM's consolidated income statement). The labor costs for its 365,000 employees in that year amounted to $19.8 billion, only $8.5 billion of which was for U.S.-based personnel. In addition to vehicles, other major product lines included (i) financial services for automotive, mortgage, and business financing, and insurance services through General Motors Acceptance Corporation (GMAC), (ii) satellite television and commercial satellite services through Hughes Electronics, and (iii) locomotives and heavy duty transmissions through GM Locomotive Group and Allison Transmission Division. GM traded on the New York Stock Exchange and was a component of the Dow Jones Industrial Average. While North America still represented the majority of sales to end customers and the largest concentration of net property, plant, and equipment (see Exhibit 2 and Exhibit 3), the importance of GM's international operations was growing as a percent of the overall business. With globalized production, these figures understated the degree to which intermediate goods in GM's supply chain moved around the world. Its market share in Latin America was 20% and in Europe had reached 10% (20% if Fiat's figures were included) Increasing market share in Asia, which stood at 4%, was a major strategic objective for GM. General Motors Treasurer's Office GM's Treasurer's Office performed a full range of corporate treasury functions from its head office in New York and through additional locations in Brussels, Singapore and Detroit. The organizational structure shown in Exhibit 4 demonstrates the nature and extent of those activities. One of the key functions of the Treasurer's Office was financial risk management. This included management of not only market risk (foreign exchange, interest rate and commodities exposures) but also counterparty, corporate and operational risk. Exhibit 5 outlines the components of this function and demonstrates the high degree of centralization in approach. All of GM's financial risk management activities were subject to oversight by the Risk Management Committee, which was composed of six of GM's most senior executives including Feldstein. The committee met quarterly to review the performance of GM's financial risk management strategies and to set treasury policy for GM and its subsidiaries. Treasury policy included evaluating the parameters and benchmarks for managing market risks, determining criteria for assessing counterparty credit risk, determining thresholds for property and liability insurance coverage, as well as reviewing internal control aspects of operating policies and procedures. GM's formal, company-wide policies contained not only broad principles, but also detailed execution procedures such as, in the case of foreign exchange risk management, the types of instruments to be used and the appropriate time horizons. At its meetings the committee also discussed any special topics that needed to be addressed. Such special topics often included precisely the deviations from usual policy Feldstein was currently considering Various groups within the Treasurer's Office were involved in the implementation of financial risk management policy. For foreign exchange, all of GM's hedging activities were concentrated in two centers: The Domestic Finance group in New York handled FX hedging for GM entities located in North America, Latin America, Africa and the Middle East The European Regional Treasury Center (ERTC) was GM's largest foreign exchange operation, covering European and Asia Pacific FX exposures FX hedging activities were segregated in this way on the principle that there should be some geographic correspondence between where a business unit was actually managed and where treasury for that business was controlled. At the same time, though, it was considered desirable to reap the benefits of pooling exposures across groups. In a sense, the goal was to match treasury management to the footprint of the business. Having local market knowledge and a trading center in both the European and U.S. time zones was also very helpful, because GM was active in each of the major foreign exchange markets. In managing the FX exposures, both the Domestic Finance group and the ERTC worked closely with other groups within Treasury that had the primary responsibility of providing strategic support to GM entities within that region. These groups were also the global coordinators for intercompany loans, moved cash around the world to finance overseas mergers and acquisitions activities, and managed dividend repatriations. Review of Corporate Hedging Policy General Motors's overall foreign exchange risk management policy was established to meet three primary objectives: (1) reduce cash flow and earnings volatility, (2) minimize the management time and costs dedicated to global FX management, and (3) align FX management in a manner consistent with how GM operates its automotive business. The first constituted a conscious decision to hedge cash flows (transaction exposures) only and ignore balance sheet exposures (translation exposures). Other members of the Risk Management Committee were the Chief Financial Officer, the General Auditor, the Chief Accounting Officer, the Chief Economist, and a senior executive from General Motors Acceptance Corporation (GMAC), GM's financial services subsidiary 5 GM policy specified, for example, which risks were to be hedged using forward contracts rather than options contracts 6 Transaction exposures are the gains and losses that arise when transactions are settled in some currency other than a company's reporting currency. These exposures stem from buying and selling activities as well as financing decisions such as risks of $10 million or greater, the regional exposure was required to be hedged. In the case of particularly volatile currencies, exposures were only hedged for the coming six months rather than twelve, and the implied risk threshold was lowered to $5 million. In practice, GM's overseas operations were large enough that all major currencies exceeded this threshold in one or more regions. Net exposures within a region were then hedged to a benchmark hedge ratio of 50%. For example, half, or $200 million, of GMNA's notional euro exposure of S400 million would be hedged. Having calculated the forecasted net exposure to a particular currency for each of the coming twelve months, the regional treasury center was then bound to use particular derivative instruments over specified time horizons: forward contracts to hedge 50% of the exposures for months one through six and options to hedge 50% of the exposures for months seven through twelve. Assuming that GMNA's $400 million euro exposure was distributed evenly over the twelve months of 2001, the $200 million exposure for months one through six would be hedged through forward contracts on $100 million, and the $200 million exposure for months seven through twelve would be hedged through options on $100 million. In general, at least 25% of the combined hedge on a particular currency was to be held in options in order to assure flexibility. The evolution of the rolling forward twelve months naturally became more complicated when the exposures were not evenly spread across time (see Exhibit 7). First, as months rolled closer (cash flow G from month seven to six in Exhibit 7), the Treasury group replaced or supplemented options- based hedge positions with forward contracts, sometimes selling options previously purchased. This meant that the balance of forwards and options used to hedge the year ahead was constantly changing-and according to policy, options had to make up 25% of hedge positions. Second, the forecasts that the Treasury group received from managers in the operating subsidiaries frequently changed from month to month. This created situations where hedging actions from the previous month left the Treasury group either over- or under hedged due to changing expectations. Treasury centers were also expected to monitor the economic performance of their hedges and to readjust cover to levels which matched the levels achieved by a simulated benchmark hedge portfolio. This was done on a delta basis. The delta provided a measure of how effectively a particular instrument covered a risk, taking into account the probability that the instrument would be exercised. Forward contracts therefore had a delta of 100%. In purchasing currency options, GM sought to buy at-the-money-forward options that had an expected delta of 50% upon execution. Given the required mix of forwards and options in hedging an exposure, the hedge ratio of 50% initially corresponded, on a delta basis, to a hedge ratio of 37.5%. Taking again GMNA's euro exposure as an example, the first six months were hedged on a delta basis at the notional hedge ratio (50%) times the forward contract delta (100%) or a delta hedge ratio of 50%. Similarly the last six months were hedged notionally at 50% and using options with a 50% delta, which combined to a 25% delta hedge ratio. The average delta hedge ratio over the entire hedging horizon was therefore 37.5% at the outset. Over time, the delta hedge ratios of both the actual and the benchmark hedge portfolios could be expected to depart from the initial 375%, primarily due to sensitivity of the value of options to movements in spot rates. Experience suggested that the delta hedge ratio of the benchmark portfolio would fluctuate somewhere between 30% and 45%. In addition, the delta hedge ratio of the actual portfolio would often vary from that of the benchmark portfolio because of the practical difficulties in executing exactly in line with the benchmark. A tolerance of +/- 5% was therefore allowed in matching the delta cover of the actual portfolio to the cover of the benchmark portfolio. It was also possible, on an exception basis, to deviate from a passive hedging strategy and take a view on the Commercial exposures (capital expenditures) Because capital expenditures did not exhibit the same month-to-month volatility or changing forecasts, GM adopted a different approach to hedging them. Unlike uncertain cash flows, planned investments (purchases of fixed assets or equipment) that met either of the following two tests were hedged with forward contracts using a 100% hedge ratio to the anticipated payment date: (i) amount in excess of $1 million, or (ii) implied risk equivalent to at least 10% of the unit's net worth. Such exposures were generally treated separately from ordinary commercial exposures. Financial exposures Other known cash flows, including loan repayment schedules and equity injections into affiliates were hedged on a case-by-case basis. Generally they were structured so as to create as little FX risk as possible, and as a rule of thumb they were also 100% hedged using forward contracts. Dividend payments, on the other hand, were only deemed hedgeable once declared, and even then were hedged in the same manner as ordinary commercial exposures, i.e. a 50% hedge ratio. Translation (balance sheet) exposures Translation exposures were not included under GM's corporate hedging policy. Nonetheless, they could on occasion become large enough to warrant the attention of senior finance executives, and Feldstein therefore kept abreast of all such situations. Such exposures were closely related to management's determination of a subsidiary's functional currency, a topic discussed in Appendix B. Accounting treatment One of the goals of GM's hedging policy was to reduce earnings volatility. This goal was challenging given that, under the prevailing accounting standards (FAS 133), the forwards and options GM would use generally had to be marked-to-market and the gains and losses flowed through the income statement. At the same time, the underlying exposure being hedged was, in the case of commercial exposures (forecasts of receivables and payables up to 12 months in advance), often not on the books at all, and therefore changes in its market value did not hit the income statement. This mismatch was a potential source of earnings volatility. FAS 133, however, provided the possibility of hedge accounting treatment for an exposure and associated hedge position. If the requirements for hedge accounting treatment were met, the above described earnings volatility was neutralized by taking gains and losses on the hedges to a shareholder's equity account in the balance sheet pending the realization of gains and losses on the underlying hedged exposures. Ultimately, gains and losses on the hedges would be released through the income statement contemporaneously with the recognition in the income statement of the gains and losses on the underlying exposures. Unfortunately, due to the complexity of compliance with hedge accounting regulations only a few of GM's more significant currency pairs were initially targeted for compliance.10 Reporting Hedging activities were closely tracked and regularly reviewed within the Treasury Group. The information was made available to senior management and to the Risk Management Committee to assist in policy review and creation. It was this internal monitoring that had led, just a few years earlier, to the decision to shift away from active FX risk management to passive management Monthly Reviewthe Canadian Dollar GM-Canada was an integral part of GM's worldwide production process. In addition to serving the Canadian domestic market, it served as a core supplier to other GM operations in North America, especially those in the United States, and it also relied on many U.S. based suppliers. At GM-Canada the U.S. dollar-denominated flows were so large that the U.S. dollar was effectively the primary operating currency of the company. As a result, accounting standards required that the U.S. dollar be selected as the functional currency despite GM-Canada's very large Canadian dollar assets and liabilities. The rules on determining the choice and consequences of a subsidiary's functional currency are explained in Appendix B. Exhibit 8 illustrates how a change in exchange rates impacts GM's financial statements under two different scenarios: (i) when a subsidiary's functional currency is the U.S. dollar; and (ii) when a subsidiary's functional currency is its local currency. Since GM-Canada's functional currency was the U.S. dollar, its exposure to the Canadian dollar was recognized as a foreign currency exposure. The income statement impact arose from gains and losses on both the CAD-denominated cash flows (see Exhibit 9) and on the balance sheet CAD net monetary liability position (see Exhibit 10). Both exposures were equivalent to short positions in the Canadian dollar. The net payable cash flow exposure resulted largely from payments due to Canadian suppliers, and the size of the net monetary liability stemmed mainly from future pension and postretirement benefit obligations to employees in Canada. GM's passive hedging policy called only for hedging 50% of the CAD 1.7 billion cash flow exposure projected over the subsequent twelve months. Nonetheless, Feldstein acknowledged that GM's policy of not hedging the translation exposure stemming from the CAD 2.1 billion net monetary liability left a large CAD exposure that could impact GM's year-end financial results significantly Feldstein therefore met with his FX and Commodities Manager, Doug Ostermann, who was proposing to increase the hedge ratio for the CAD to the maximum allowed under GM policy75%. The internal memorandum requesting permission to deviate so far from the standard 50% policy read as follows: Historically, GMNA has a short CAD commercial exposure of approximately CAD 1.6 - 1.8 billion, primarily due to CAD denominated supplier payments being larger than CAD denominated sales... In order to reduce global earnings volatility at year-end, we recommend to hedge up to 75% of GMNA's commercial exposure (approximately 30% hedging ratio for the balance sheet exposure). According to the FX policy, any deviation from the passive hedging strategy (50% notional hedging ratio), requires the approval... Feldstein felt he needed a comparison of the income statement impact of a 75% versus a 50% hedge ratio. The proposal suggested that a plus-or-minus 3.1% move around the 1.5780 exchange rate on the date of the memo be examined. Using these scenarios Ostermann could do a sensitivity calculation with a favorable scenario (gain due to FX movements) and an unfavorable scenario (loss due to FX movements) based on the after-tax gain/loss impact from the projected CAD cash flow as well as from the CAD net monetary liability. By dividing this amount by the 550 million shares GM had outstanding, Ostermann could determine how much the proposed deviation would reduce EPS volatility. To simplify the calculation, Ostermann ignored the costs of hedging (such as option million held by GM Canada.' As Feldstein prepared to make a decision about the CAD deviation, he had to keep in mind both what economic risks he wanted to hedge and what was called for under GM's corporate hedging policy. Implementing a Foreign Exchange Hedge If Feldstein signed off on this deviation, Mercedes Michel and the team in Domestic Finance would oversee putting on the hedge position. Michel was in regular communication with several of the largest currency-dealing banks and maintained up-to-date price quotations. On any day when GM was active in the market adjusting its hedge positions, she was on the phone with the banks virtually all day getting quotations and executing trades. On an ordinary day, she could get most of the information she needed from electronic data sources. When a hedge position was being created or modified, she handled transactions in both forward and options contracts. Suppose on September 15, 2001 Michel needed to hedge a CAD 10 million cash outflow three months in the future in other words, 50% of a CAD 20 million notional exposure). First, she checks the market price levels using a Bloomberg terminal. The spot price on the CAD/USD exchange rate is bid-ask of 1.5621-1.5624. (Spreads were very small when transacting in significant amounts in the currency markets; players typically only referred to the last two digits of the spread because it was assumed that buyers and sellers knew the levels to the 1/100 of a point.) With that information she dials one of her regular bankers: Michel: Can you give me a two-way price on 10 Canada? Trader: CAD spot is 21 to 24. Michel: I'll do it at 21. Trader: So, you are buying 10 million Canadian dollars against U.S. dollars at 1.5621. Michel: Actually, I want to roll it 3 months out. Can you tell me the forward points? Trader: That's 45 points. Michel: Can you improve it a pip? Trader: Humm...OK... You get it at 46. Michel: Done. Thanks. Trader: Good. Then GM buys 10 million Canadian dollars at 1.5667 and sells USD 6,382,842.92 with value December 17, 2001. Michel: Agreed. Bye. Now assume that instead of hedging the exposure with a forward contract, Michel needed to use a currency option to hedge the CAD 10 million exposure. Michel will buy a CAD call / USD put with a notional amount of CAD 10 million. Assume the spot price is 1.5621. Again, before calling the per USD. The outright exposure measured the foreign exchange gain or loss GM would recognize on the CAD 20 million position. At a 50% hedge, Michel knew she had to layer on a CAD 10 million hedge at a forward price of 1.5667. This would produce a partially offsetting cash flow in the future. The sum of the outright gain/loss and the cash settlement of the forward contract amounted to the net consequence of a forwards strategy. Options contracts Instead, Michel could layer on top of the outright exposure just calculated an option contract purchase. The sum of the outright exposure and the option payoff amounted to the net consequence of an options strategy. The option characteristics were as described above a strike price equal to the forward price of 1.5667 and a premium cost of 1.45% of the notional hedge amount. When the option was in the money, the contract returned a profit (less the premium), whereas when it expired out of the money, the gain (loss) on the outright exposure was reduced (increased) by the premium amount. Special Situations-the Argentinean Peso Argentina presented GM Treasury with another set of critical decisions arising from the increasing macroeconomic uncertainty facing GM's extensive operations there. In order to control historic inflationary tendencies, the government maintained a peg to the U.S. dollar at USD 1: ARS 1. With $16.5 billion of foreign loans coming due in 2002, Argentina was now at serious risk of defaulting on its debt. Credit analysts at Standard & Poor's and Moody's had downgraded Argentina to six and seven grades below investment grade, respectively. GM Treasury's Latin America experts believed the short-term probability of default had reached 40%. In the medium term, their assessment of that probability rose to 50% because Argentina had not addressed key issues such as trade liberalization, state reform, and pension and healthcare reform. A default would very likely be accompanied by a large devaluation The treasury analysts had provided Feldstein with information on GM's position in Argentina, including the ARS and USD denominated components of the balance sheet (see Exhibit 11). Feldstein considered how a potential devaluation of the peso against the dollar from 1 : 1 to 2:1 would impact GM Argentina. Hedging the Peso Exposure Michel had evaluated how costly it would be to hedge the ARS exposure in the financial markets. For her analysis, she reviewed the market for forwards and options on the ARS and compiled historical prices on one-, six-, and twelve-month forward rates of the peso vs. the dollar (see Exhibit 12). Feldstein's first observation was the rapid rise in forward rates over the recent months. Michel calculated the costs of hedging a $300 million exposure based on rolling over shorter term contracts or purchasing year-long contracts (see Exhibit 13). These figures led Feldstein to consider other means of mitigating the impact of a likely devaluation. Feldstein hoped to find some natural business hedges or creative ways to reduce peso- denominated assets and substitute peso-denominated liabilities for hard currency-denominated ones. Local managers had already taken some steps to cope with the expected devaluation. GM Argentina had eliminated peso cash balances and transferred them in USD to the European Regional Treasury Center, and Feldstein knew that managers of the subsidiary were considering various strategies to bring in revenues in more stable foreign currencies. The situation in Argentina was more complex than a one-time currency deviation request because a devaluation would have an ongoing impact on Exhibit 9 GM Canada - Projected Cash Flow Exposure I Cash Flows Amount as of September 30, 2001 INFLOWS Canadian sales 10,564 Tax refunds (GST) 1,049 OUTFLOWS Material purchases Capital expenditures Other structural costs Tax expenditures Other expenditures (10,180) (113) (1,737) (1,258) (6) 12 month C$ cash flow forecast (1,682) Source: Company documents. Figures have been disguised and do not reflect the actual operations of General Motors Corp. Other expenditures (6) 12 month CS cash flow forecast (1,682) Source: Company documents. I Figures have been disguised and do not reflect the actual operations of General Motors Corp. Exhibit 10 GM Canada - Net Monetary Asset/Liability Exposure Balance Sheet Account Amount as of September 30, 2001 683 ASSETS Cash & cash equivalents Accounts & notes receivable Deferred income taxes Pension asset 271 118 1,525 LIABILITIES Outside - all other Other postretirement benefits Warranty Accounts payable and other (93) (1,949) (132) (2,565) C$ Monetary asset/ (liability) position (2,143) Source: Company documents. Figures have been disguised and do not reflect the actual operations of General Motors Corp. 205-095 Foreign Exchange Hedging Strategies at General Motors: Transactional and Translational Exposures Exhibit 11 GM Argentina Balance Sheet, Monetary Assets and Liabilities by Currency, as of September 30, 2001 ARS Monetary Assets 45.8 24.1 3.2 11.3 130.6 Scrap incentive owed by govt. Interest subsidy owed by govt. VAT credit and other tax owed by govt. Receivable (tax credit reimbursement) Other Total ARS Monetary Liabilities Payables to local suppliers Provisions to local suppliers ARS loan (VAT financing) Other provisions Tax payable Total 13.7 2.7 9.8 7.8 2.0 190.0 60.9 USD Monetary Assets Cash 2.5 USD Monetary Liabilities Accounts payable Loans 224.5 Receivables 20.5 101.3 Total 23.0 Total 325.7 Source: Company documents. Figures have been disguised and do not reflect the actual operations of General Motors Corp. Exhibits Example of the impact of a Change in Exchange Rates on GM's Financial Statements The example below considers what happens to the worldwide financial statements of GM when one of its subsidiaries holds an asset that changes in value due to an exchange rate move. Specifically. GM's hypothetical subsidiary in Strasbourg GMS, has cash assets of 50 euros. For reasons discussed further in Appendix B, it is possible that the functional currency of the subsidiary could be either the USD or the euro. If the euro depreciates 10% against the USD, the impact of the change in the EUR/USD exchange rate on GM's worldwide financial statements depends on whether the subsidiary's functional currency is the USD or its local currency, the EUR Exchange Rate (EUR/USD) 1.00 1.10 Impact on GM's Worldwide Financial Statements USD Functional GMS Net Assets in foreign currency EUR Income Statement USD 3.0 GMS. Reported USD Shareholders' Equity USD 4.0 EUR Functional GMS Net Assets In functional currency EUR 50 Se Translation USD USO Shareholder Equy A depreciation of the EUR against the USO Ce a dedine ne dolar value of GMS's foreign currency (EUR) asset generating a loss for GM's Worldwide income statement GMS Euro sets are translated to USD Shareholders Equity in adjusted by -5 to reflect the translation adjustment B word about the balance sheet exposure? What impact could it have on GM? 4. Compare the income statement impact of a 75% versus a 50% hedge ratio. Should GM deviate from Its hedging policy? 5. Compare the use of forward contracts and options for hedging the CAD exposure (On a graph show .. Feldstein. The committee met quarterly to review the performance of GM's financial risk management strategies and to set treasury policy for GM and its subsidiaries. Treasury policy included evaluating the parameters and benchmarks for managing market risks, determining criteria for assessing counterparty credit risk, determining thresholds for property and liability insurance coverage as well as reviewing internal control aspects of operating policies and procedures. GM's formal, company-wide policies contained not only broad principles, but also detailed execution procedures such as, in the case of foreign exchange risk management, the types of instruments to be used and the appropriate time horizons. At its meetings the committee also discussed any special topics that needed to be addressed. Such special topics often included precisely the deviations from usual policy Feldstein was currently considering. Various groups within the Treasurer's Office were involved in the implementation of financial risk management policy. For foreign exchange, all of GM's hedging activities were concentrated in two centers: The Domestic Finance group in New York handled FX hedging for GM entities located in North America, Latin America, Africa and the Middle East The European Regional Treasury Center (ERTC) was GM's largest foreign exchange operation, covering European and Asia Pacific FX exposures FX hedging activities were segregated in this way on the principle that there should be some geographic correspondence between where a business unit was actually managed and where treasury for that business was controlled. At the same time, though, it was considered desirable to reap the benefits of pooling exposures across groups. In a sense, the goal was to match treasury management to the footprint of the business. Having local market knowledge and a trading center in both the European and U.S. time zones was also very helpful, because GM was active in each of the major foreign exchange markets. In managing the FX exposures, both the Domestic Finance group and the ERTC worked closely with other groups within Treasury that had the primary responsibility of providing strategic support to GM entities within that region. These groups were also the global coordinators for intercompany loans, moved cash around the world to finance overseas mergers and acquisitions activities, and managed dividend repatriations. Review of Corporate Hedging Policy General Motors's overall foreign exchange risk management policy was established to meet three primary objectives: (1) reduce cash flow and earnings volatility, (2) minimize the management time and costs dedicated to global FX management, and (3) align FX management in a manner consistent with how GM operates its automotive business. The first constituted a conscious decision to hedge cash flows (transaction exposures) only and ignore balance sheet exposures (translation exposures"). Other members of the Risk Management Committee were the Chief Financial Officer, the General Auditor, the Chief Accounting Officer, the Chief Economist, and a senior executive from General Motors Acceptance Corporation (GMAC), GM's financial services subsidiary. 5 GM policy specified, for example, which risks were to be hedged using forward contracts rather than options contracts. Transaction exposures are the gains and losses that arise when transactions are settled in some currency other than a company's reporting currency. These exposures stem from buying and selling activities as well as financing decisions such as 6 Overview of General Motors and its Treasury Operations General Motors General Motors was the world's largest automaker, with unit sales of 8.5 million vehicles in 200115.1% worldwide market share-and had been the world's sales leader since 1931. Founded in 1908, GM had manufacturing operations in more than 30 countries, and its vehicles were sold in approximately 200 countries. In 2000, it generated earnings of $4.4 billion on sales of $184.6 billion (see Exhibit 1 for GM's consolidated income statement). The labor costs for its 365,000 employees in that year amounted to $19.8 billion, only $8.5 billion of which was for U.S.-based personnel. In addition to vehicles, other major product lines included (i) financial services for automotive, mortgage, and business financing, and insurance services through General Motors Acceptance Corporation (GMAC), (ii) satellite television and commercial satellite services through Hughes Electronics, and (iii) locomotives and heavy duty transmissions through GM Locomotive Group and Allison Transmission Division. GM traded on the New York Stock Exchange and was a component of the Dow Jones Industrial Average. While North America still represented the majority of sales to end customers and the largest concentration of net property, plant, and equipment (see Exhibit 2 and Exhibit 3), the importance of GM's international operations was growing as a percent of the overall business. With globalized production, these figures understated the degree to which intermediate goods in GM's supply chain moved around the world. Its market share in Latin America was 20% and in Europe had reached 10% (20% if Fiat's figures were included) Increasing market share in Asia, which stood at 4%, was a major strategic objective for GM. General Motors Treasurer's Office GM's Treasurer's Office performed a full range of corporate treasury functions from its head office in New York and through additional locations in Brussels, Singapore and Detroit. The organizational structure shown in Exhibit 4 demonstrates the nature and extent of those activities. One of the key functions of the Treasurer's Office was financial risk management. This included management of not only market risk (foreign exchange, interest rate and commodities exposures) but also counterparty, corporate and operational risk. Exhibit 5 outlines the components of this function and demonstrates the high degree of centralization in approach. All of GM's financial risk management activities were subject to oversight by the Risk Management Committee, which was composed of six of GM's most senior executives including Feldstein. The committee met quarterly to review the performance of GM's financial risk management strategies and to set treasury policy for GM and its subsidiaries. Treasury policy included evaluating the parameters and benchmarks for managing market risks, determining criteria for assessing counterparty credit risk, determining thresholds for property and liability insurance coverage, as well as reviewing internal control aspects of operating policies and procedures. GM's formal, company-wide policies contained not only broad principles, but also detailed execution procedures such as, in the case of foreign exchange risk management, the types of instruments to be used and the appropriate time horizons. At its meetings the committee also discussed any special topics that needed to be addressed. Such special topics often included precisely the deviations from usual policy Feldstein was currently considering Various groups within the Treasurer's Office were involved in the implementation of financial risk management policy. For foreign exchange, all of GM's hedging activities were concentrated in two centers: The Domestic Finance group in New York handled FX hedging for GM entities located in North America, Latin America, Africa and the Middle East The European Regional Treasury Center (ERTC) was GM's largest foreign exchange operation, covering European and Asia Pacific FX exposures FX hedging activities were segregated in this way on the principle that there should be some geographic correspondence between where a business unit was actually managed and where treasury for that business was controlled. At the same time, though, it was considered desirable to reap the benefits of pooling exposures across groups. In a sense, the goal was to match treasury management to the footprint of the business. Having local market knowledge and a trading center in both the European and U.S. time zones was also very helpful, because GM was active in each of the major foreign exchange markets. In managing the FX exposures, both the Domestic Finance group and the ERTC worked closely with other groups within Treasury that had the primary responsibility of providing strategic support to GM entities within that region. These groups were also the global coordinators for intercompany loans, moved cash around the world to finance overseas mergers and acquisitions activities, and managed dividend repatriations. Review of Corporate Hedging Policy General Motors's overall foreign exchange risk management policy was established to meet three primary objectives: (1) reduce cash flow and earnings volatility, (2) minimize the management time and costs dedicated to global FX management, and (3) align FX management in a manner consistent with how GM operates its automotive business. The first constituted a conscious decision to hedge cash flows (transaction exposures) only and ignore balance sheet exposures (translation exposures). Other members of the Risk Management Committee were the Chief Financial Officer, the General Auditor, the Chief Accounting Officer, the Chief Economist, and a senior executive from General Motors Acceptance Corporation (GMAC), GM's financial services subsidiary 5 GM policy specified, for example, which risks were to be hedged using forward contracts rather than options contracts 6 Transaction exposures are the gains and losses that arise when transactions are settled in some currency other than a company's reporting currency. These exposures stem from buying and selling activities as well as financing decisions such as risks of $10 million or greater, the regional exposure was required to be hedged. In the case of particularly volatile currencies, exposures were only hedged for the coming six months rather than twelve, and the implied risk threshold was lowered to $5 million. In practice, GM's overseas operations were large enough that all major currencies exceeded this threshold in one or more regions. Net exposures within a region were then hedged to a benchmark hedge ratio of 50%. For example, half, or $200 million, of GMNA's notional euro exposure of S400 million would be hedged. Having calculated the forecasted net exposure to a particular currency for each of the coming twelve months, the regional treasury center was then bound to use particular derivative instruments over specified time horizons: forward contracts to hedge 50% of the exposures for months one through six and options to hedge 50% of the exposures for months seven through twelve. Assuming that GMNA's $400 million euro exposure was distributed evenly over the twelve months of 2001, the $200 million exposure for months one through six would be hedged through forward contracts on $100 million, and the $200 million exposure for months seven through twelve would be hedged through options on $100 million. In general, at least 25% of the combined hedge on a particular currency was to be held in options in order to assure flexibility. The evolution of the rolling forward twelve months naturally became more complicated when the exposures were not evenly spread across time (see Exhibit 7). First, as months rolled closer (cash flow G from month seven to six in Exhibit 7), the Treasury group replaced or supplemented options- based hedge positions with forward contracts, sometimes selling options previously purchased. This meant that the balance of forwards and options used to hedge the year ahead was constantly changing-and according to policy, options had to make up 25% of hedge positions. Second, the forecasts that the Treasury group received from managers in the operating subsidiaries frequently changed from month to month. This created situations where hedging actions from the previous month left the Treasury group either over- or under hedged due to changing expectations. Treasury centers were also expected to monitor the economic performance of their hedges and to readjust cover to levels which matched the levels achieved by a simulated benchmark hedge portfolio. This was done on a delta basis. The delta provided a measure of how effectively a particular instrument covered a risk, taking into account the probability that the instrument would be exercised. Forward contracts therefore had a delta of 100%. In purchasing currency options, GM sought to buy at-the-money-forward options that had an expected delta of 50% upon execution. Given the required mix of forwards and options in hedging an exposure, the hedge ratio of 50% initially corresponded, on a delta basis, to a hedge ratio of 37.5%. Taking again GMNA's euro exposure as an example, the first six months were hedged on a delta basis at the notional hedge ratio (50%) times the forward contract delta (100%) or a delta hedge ratio of 50%. Similarly the last six months were hedged notionally at 50% and using options with a 50% delta, which combined to a 25% delta hedge ratio. The average delta hedge ratio over the entire hedging horizon was therefore 37.5% at the outset. Over time, the delta hedge ratios of both the actual and the benchmark hedge portfolios could be expected to depart from the initial 375%, primarily due to sensitivity of the value of options to movements in spot rates. Experience suggested that the delta hedge ratio of the benchmark portfolio would fluctuate somewhere between 30% and 45%. In addition, the delta hedge ratio of the actual portfolio would often vary from that of the benchmark portfolio because of the practical difficulties in executing exactly in line with the benchmark. A tolerance of +/- 5% was therefore allowed in matching the delta cover of the actual portfolio to the cover of the benchmark portfolio. It was also possible, on an exception basis, to deviate from a passive hedging strategy and take a view on the Commercial exposures (capital expenditures) Because capital expenditures did not exhibit the same month-to-month volatility or changing forecasts, GM adopted a different approach to hedging them. Unlike uncertain cash flows, planned investments (purchases of fixed assets or equipment) that met either of the following two tests were hedged with forward contracts using a 100% hedge ratio to the anticipated payment date: (i) amount in excess of $1 million, or (ii) implied risk equivalent to at least 10% of the unit's net worth. Such exposures were generally treated separately from ordinary commercial exposures. Financial exposures Other known cash flows, including loan repayment schedules and equity injections into affiliates were hedged on a case-by-case basis. Generally they were structured so as to create as little FX risk as possible, and as a rule of thumb they were also 100% hedged using forward contracts. Dividend payments, on the other hand, were only deemed hedgeable once declared, and even then were hedged in the same manner as ordinary commercial exposures, i.e. a 50% hedge ratio. Translation (balance sheet) exposures Translation exposures were not included under GM's corporate hedging policy. Nonetheless, they could on occasion become large enough to warrant the attention of senior finance executives, and Feldstein therefore kept abreast of all such situations. Such exposures were closely related to management's determination of a subsidiary's functional currency, a topic discussed in Appendix B. Accounting treatment One of the goals of GM's hedging policy was to reduce earnings volatility. This goal was challenging given that, under the prevailing accounting standards (FAS 133), the forwards and options GM would use generally had to be marked-to-market and the gains and losses flowed through the income statement. At the same time, the underlying exposure being hedged was, in the case of commercial exposures (forecasts of receivables and payables up to 12 months in advance), often not on the books at all, and therefore changes in its market value did not hit the income statement. This mismatch was a potential source of earnings volatility. FAS 133, however, provided the possibility of hedge accounting treatment for an exposure and associated hedge position. If the requirements for hedge accounting treatment were met, the above described earnings volatility was neutralized by taking gains and losses on the hedges to a shareholder's equity account in the balance sheet pending the realization of gains and losses on the underlying hedged exposures. Ultimately, gains and losses on the hedges would be released through the income statement contemporaneously with the recognition in the income statement of the gains and losses on the underlying exposures. Unfortunately, due to the complexity of compliance with hedge accounting regulations only a few of GM's more significant currency pairs were initially targeted for compliance.10 Reporting Hedging activities were closely tracked and regularly reviewed within the Treasury Group. The information was made available to senior management and to the Risk Management Committee to assist in policy review and creation. It was this internal monitoring that had led, just a few years earlier, to the decision to shift away from active FX risk management to passive management Monthly Reviewthe Canadian Dollar GM-Canada was an integral part of GM's worldwide production process. In addition to serving the Canadian domestic market, it served as a core supplier to other GM operations in North America, especially those in the United States, and it also relied on many U.S. based suppliers. At GM-Canada the U.S. dollar-denominated flows were so large that the U.S. dollar was effectively the primary operating currency of the company. As a result, accounting standards required that the U.S. dollar be selected as the functional currency despite GM-Canada's very large Canadian dollar assets and liabilities. The rules on determining the choice and consequences of a subsidiary's functional currency are explained in Appendix B. Exhibit 8 illustrates how a change in exchange rates impacts GM's financial statements under two different scenarios: (i) when a subsidiary's functional currency is the U.S. dollar; and (ii) when a subsidiary's functional currency is its local currency. Since GM-Canada's functional currency was the U.S. dollar, its exposure to the Canadian dollar was recognized as a foreign currency exposure. The income statement impact arose from gains and losses on both the CAD-denominated cash flows (see Exhibit 9) and on the balance sheet CAD net monetary liability position (see Exhibit 10). Both exposures were equivalent to short positions in the Canadian dollar. The net payable cash flow exposure resulted largely from payments due to Canadian suppliers, and the size of the net monetary liability stemmed mainly from future pension and postretirement benefit obligations to employees in Canada. GM's passive hedging policy called only for hedging 50% of the CAD 1.7 billion cash flow exposure projected over the subsequent twelve months. Nonetheless, Feldstein acknowledged that GM's policy of not hedging the translation exposure stemming from the CAD 2.1 billion net monetary liability left a large CAD exposure that could impact GM's year-end financial results significantly Feldstein therefore met with his FX and Commodities Manager, Doug Ostermann, who was proposing to increase the hedge ratio for the CAD to the maximum allowed under GM policy75%. The internal memorandum requesting permission to deviate so far from the standard 50% policy read as follows: Historically, GMNA has a short CAD commercial exposure of approximately CAD 1.6 - 1.8 billion, primarily due to CAD denominated supplier payments being larger than CAD denominated sales... In order to reduce global earnings volatility at year-end, we recommend to hedge up to 75% of GMNA's commercial exposure (approximately 30% hedging ratio for the balance sheet exposure). According to the FX policy, any deviation from the passive hedging strategy (50% notional hedging ratio), requires the approval... Feldstein felt he needed a comparison of the income statement impact of a 75% versus a 50% hedge ratio. The proposal suggested that a plus-or-minus 3.1% move around the 1.5780 exchange rate on the date of the memo be examined. Using these scenarios Ostermann could do a sensitivity calculation with a favorable scenario (gain due to FX movements) and an unfavorable scenario (loss due to FX movements) based on the after-tax gain/loss impact from the projected CAD cash flow as well as from the CAD net monetary liability. By dividing this amount by the 550 million shares GM had outstanding, Ostermann could determine how much the proposed deviation would reduce EPS volatility. To simplify the calculation, Ostermann ignored the costs of hedging (such as option million held by GM Canada.' As Feldstein prepared to make a decision about the CAD deviation, he had to keep in mind both what economic risks he wanted to hedge and what was called for under GM's corporate hedging policy. Implementing a Foreign Exchange Hedge If Feldstein signed off on this deviation, Mercedes Michel and the team in Domestic Finance would oversee putting on the hedge position. Michel was in regular communication with several of the largest currency-dealing banks and maintained up-to-date price quotations. On any day when GM was active in the market adjusting its hedge positions, she was on the phone with the banks virtually all day getting quotations and executing trades. On an ordinary day, she could get most of the information she needed from electronic data sources. When a hedge position was being created or modified, she handled transactions in both forward and options contracts. Suppose on September 15, 2001 Michel needed to hedge a CAD 10 million cash outflow three months in the future in other words, 50% of a CAD 20 million notional exposure). First, she checks the market price levels using a Bloomberg terminal. The spot price on the CAD/USD exchange rate is bid-ask of 1.5621-1.5624. (Spreads were very small when transacting in significant amounts in the currency markets; players typically only referred to the last two digits of the spread because it was assumed that buyers and sellers knew the levels to the 1/100 of a point.) With that information she dials one of her regular bankers: Michel: Can you give me a two-way price on 10 Canada? Trader: CAD spot is 21 to 24. Michel: I'll do it at 21. Trader: So, you are buying 10 million Canadian dollars against U.S. dollars at 1.5621. Michel: Actually, I want to roll it 3 months out. Can you tell me the forward points? Trader: That's 45 points. Michel: Can you improve it a pip? Trader: Humm...OK... You get it at 46. Michel: Done. Thanks. Trader: Good. Then GM buys 10 million Canadian dollars at 1.5667 and sells USD 6,382,842.92 with value December 17, 2001. Michel: Agreed. Bye. Now assume that instead of hedging the exposure with a forward contract, Michel needed to use a currency option to hedge the CAD 10 million exposure. Michel will buy a CAD call / USD put with a notional amount of CAD 10 million. Assume the spot price is 1.5621. Again, before calling the per USD. The outright exposure measured the foreign exchange gain or loss GM would recognize on the CAD 20 million position. At a 50% hedge, Michel knew she had to layer on a CAD 10 million hedge at a forward price of 1.5667. This would produce a partially offsetting cash flow in the future. The sum of the outright gain/loss and the cash settlement of the forward contract amounted to the net consequence of a forwards strategy. Options contracts Instead, Michel could layer on top of the outright exposure just calculated an option contract purchase. The sum of the outright exposure and the option payoff amounted to the net consequence of an options strategy. The option characteristics were as described above a strike price equal to the forward price of 1.5667 and a premium cost of 1.45% of the notional hedge amount. When the option was in the money, the contract returned a profit (less the premium), whereas when it expired out of the money, the gain (loss) on the outright exposure was reduced (increased) by the premium amount. Special Situations-the Argentinean Peso Argentina presented GM Treasury with another set of critical decisions arising from the increasing macroeconomic uncertainty facing GM's extensive operations there. In order to control historic inflationary tendencies, the government maintained a peg to the U.S. dollar at USD 1: ARS 1. With $16.5 billion of foreign loans coming due in 2002, Argentina was now at serious risk of defaulting on its debt. Credit analysts at Standard & Poor's and Moody's had downgraded Argentina to six and seven grades below investment grade, respectively. GM Treasury's Latin America experts believed the short-term probability of default had reached 40%. In the medium term, their assessment of that probability rose to 50% because Argentina had not addressed key issues such as trade liberalization, state reform, and pension and healthcare reform. A default would very likely be accompanied by a large devaluation The treasury analysts had provided Feldstein with information on GM's position in Argentina, including the ARS and USD denominated components of the balance sheet (see Exhibit 11). Feldstein considered how a potential devaluation of the peso against the dollar from 1 : 1 to 2:1 would impact GM Argentina. Hedging the Peso Exposure Michel had evaluated how costly it would be to hedge the ARS exposure in the financial markets. For her analysis, she reviewed the market for forwards and options on the ARS and compiled historical prices on one-, six-, and twelve-month forward rates of the peso vs. the dollar (see Exhibit 12). Feldstein's first observation was the rapid rise in forward rates over the recent months. Michel calculated the costs of hedging a $300 million exposure based on rolling over shorter term contracts or purchasing year-long contracts (see Exhibit 13). These figures led Feldstein to consider other means of mitigating the impact of a likely devaluation. Feldstein hoped to find some natural business hedges or creative ways to reduce peso- denominated assets and substitute peso-denominated liabilities for hard currency-denominated ones. Local managers had already taken some steps to cope with the expected devaluation. GM Argentina had eliminated peso cash balances and transferred them in USD to the European Regional Treasury Center, and Feldstein knew that managers of the subsidiary were considering various strategies to bring in revenues in more stable foreign currencies. The situation in Argentina was more complex than a one-time currency deviation request because a devaluation would have an ongoing impact on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts