Question: A desk was purchased for $ 1 , 3 1 2 . 5 5 on July 6 , 2 0 2 0 . Depreciation entries

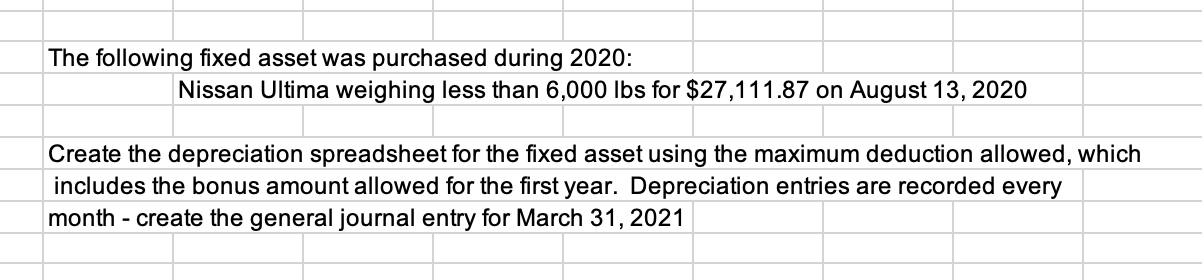

A desk was purchased for $ on July Depreciation entries are recorded every month using MACRS A computer was purchased for $ on December Depreciation entries are recorded every month using MACRS Create the general journal entries for July August September October November and December The following fixed asset was purchased during :

Nissan Ultima weighing less than lbs for $ on August

Create the depreciation spreadsheet for the fixed asset using the maximum deduction allowed, which includes the bonus amount allowed for the first year. Depreciation entries are recorded every month create the general journal entry for March

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock