Question: a) Determine the additional financing needed for next year. b) Recommend which financing source is the best for the company and explain its implication on

a) Determine the additional financing needed for next year.

b) Recommend which financing source is the best for the company and explain its implication on the companys net income.

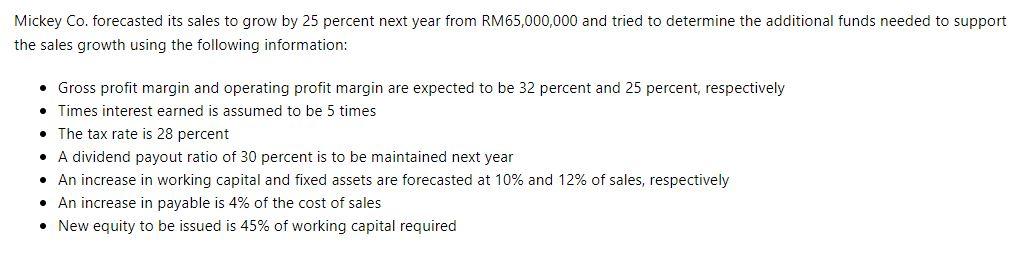

Mickey Co. forecasted its sales to grow by 25 percent next year from RM65,000,000 and tried to determine the additional funds needed to support the sales growth using the following information: Gross profit margin and operating profit margin are expected to be 32 percent and 25 percent, respectively Times interest earned is assumed to be 5 times The tax rate is 28 percent A dividend payout ratio of 30 percent is to be maintained next year An increase in working capital and fixed assets are forecasted at 10% and 12% of sales, respectively 1 An increase in payable is 4% of the cost of sales New equity to be issued is 45% of working capital required Mickey Co. forecasted its sales to grow by 25 percent next year from RM65,000,000 and tried to determine the additional funds needed to support the sales growth using the following information: Gross profit margin and operating profit margin are expected to be 32 percent and 25 percent, respectively Times interest earned is assumed to be 5 times The tax rate is 28 percent A dividend payout ratio of 30 percent is to be maintained next year An increase in working capital and fixed assets are forecasted at 10% and 12% of sales, respectively 1 An increase in payable is 4% of the cost of sales New equity to be issued is 45% of working capital required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts