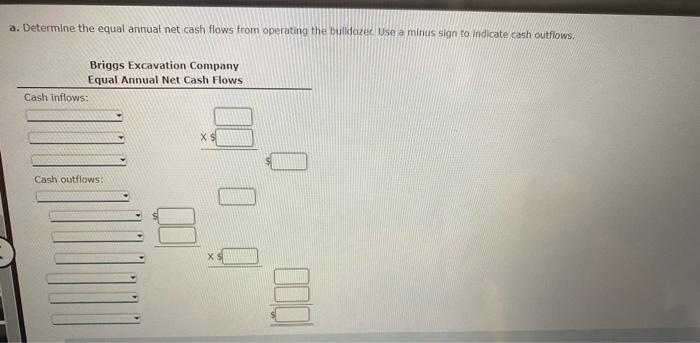

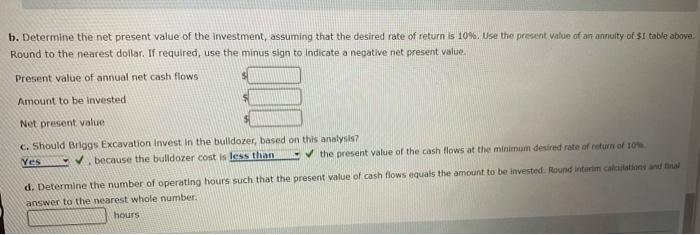

Question: a. Determine the equal annual net cash flows from operating the bulldozer. Use a minus sign to indicate cash outflows. b. Determine the net present

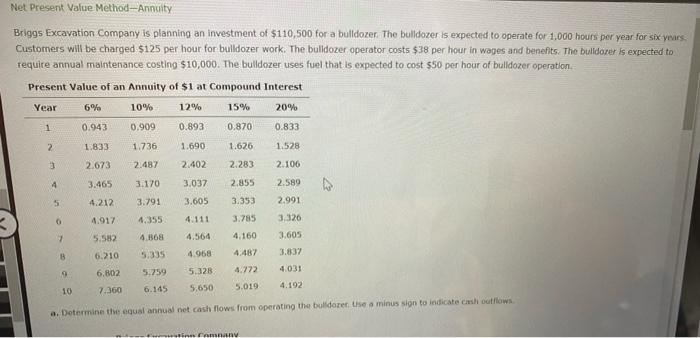

Brigg5 Excavation Company is planning an investment of $110,500 for a bulldozer. The bulldozer is expected to operate for 1,000 hours per year for six ymars. Customers will be charged $125 per hour for bulldozer work. The bullidozer operator costs $38 per hour in wages and benefits. The bulidozer is expected to require annual maintenance costing $10,000. The bulldozer uses fuel that is expected to cost $50 per hour of bulidozer operation. Present Value of an Annuitv of $1 at Compound Interest. a. Doterinine the equal annual net cash flows from operating the buld dorer the a minus slign to iedicate cath outhiows Determine the equal annual net cash flows from operating the buldazec Use a minids sign to indicate cash outflows. b. Determine the net present value of the investment, assuming that the desired rate of return is 109 . Use the present value of an annuity of $1 table abave Round to the nearest dollar. If required, use the minus sign to indicate a nepative net present value. c. Should Biggs Excavation invest in the bulidozer, based on this analysie? 2 bocause the bulldozer cost is the present value of the cash flows at the minimum decired rate of neturn of tora anewon to the nearest whole number: heurs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts