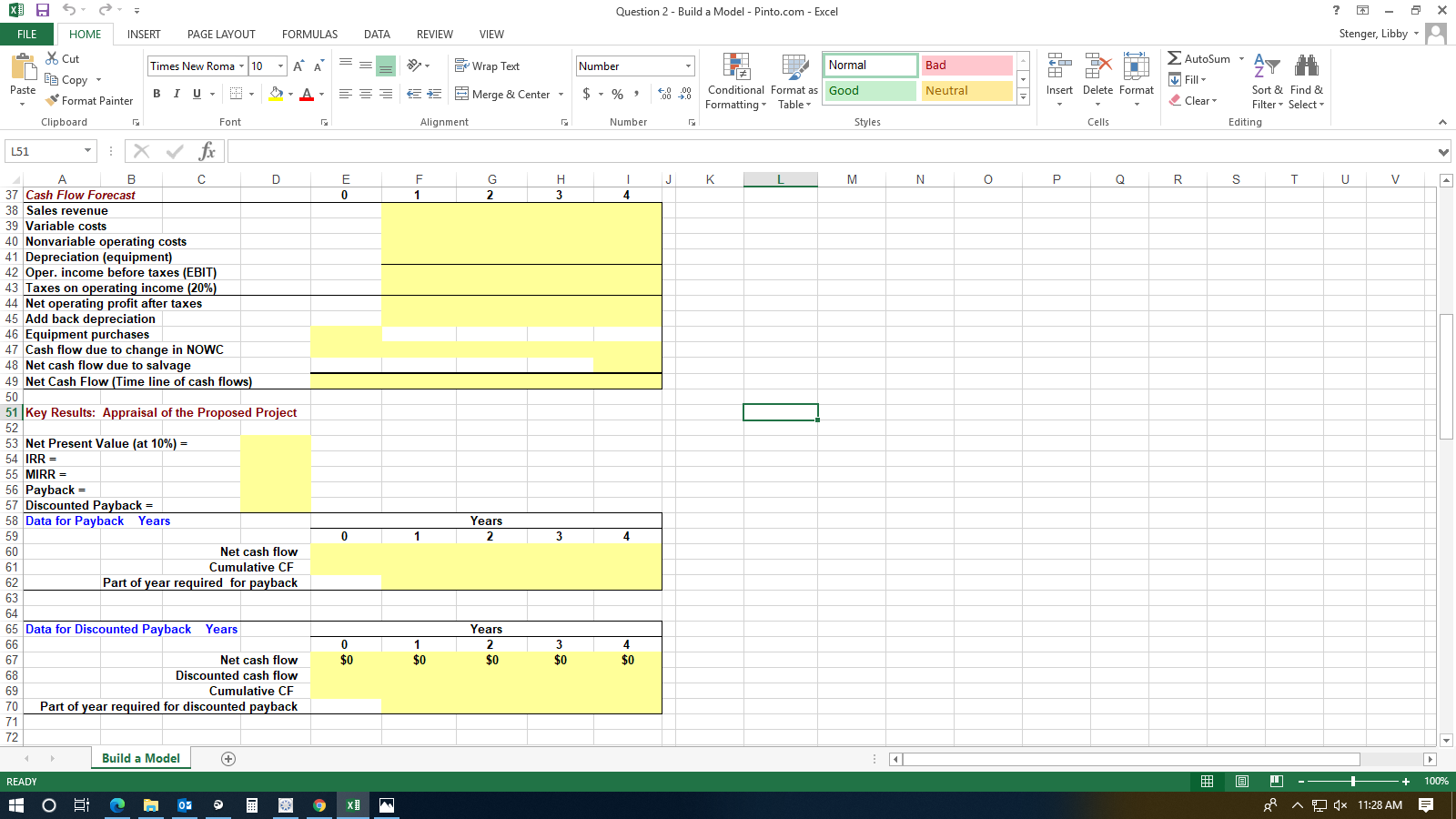

Question: a. Develop a spreadsheet model, and use it to find the projects NPV, IRR, and payback. Scenario name Base Case Note: the items in red

| a. Develop a spreadsheet model, and use it to find the projects NPV, IRR, and payback. |

| Scenario name | Base Case | Note: the items in red will be used in a scenario analysis. | ||||

| Probability of scenario | 50% | |||||

| Equipment cost | $25,000 | |||||

| Net operating working capital/Sales | 12% | Key Results: | ||||

| First year sales (in units) | 2,000 | NPV = | ||||

| Sales price per unit | $21.00 | IRR = | ||||

| Variable cost per unit (excl. depr.) | $15.00 | Payback = | ||||

| Nonvariable costs (excl. depr.) | $1,500 | |||||

| Inflation in prices and costs | 2.5% | |||||

| Estimated salvage value at year 4 | $1,000 | |||||

| Depreciation years | Year 1 | Year 2 | Year 3 | Year 4 | ||

| Depreciation rates | 20.00% | 32.00% | 19.20% | 11.52% | ||

| Tax rate | 20% | |||||

| WACC for average-risk projects | 10% | |||||

XUS Question 2 - Build a Model - Pinto.com - Excel ? x FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Stenger, Libby AutoSum - Times New Roma - 10 AA Wrap Text Number Bad * Cut Be Copy Format Painter AY # > OX FA LO Insert Delete Format Fill- Paste BIU, A 6 3 Merge & Center - $ - % Normal Conditional Format as Good Formatting Table Styles +8.00 Neutral Clear Sort & Find & Filter Select- Editing Clipboard Font Alignment Number [5 Cells J K 1 M N 0 Q R S T U V E 0 F 1 G 2 . 3 1 4 L51 : x fc A B C D 37 Cash Flow Forecast 38 Sales revenue 39 Variable costs 40 Nonvariable operating costs 41 Depreciation (equipment) 42 Oper. income before taxes (EBIT) 43 Taxes on operating income (20%) 44 Net operating profit after taxes 45 Add back depreciation 46 Equipment purchases 47 Cash flow due to change in NOWC 48 Net cash flow due to salvage 49 Net Cash Flow (Time line of cash flows) 50 51 Key Results: Appraisal of the Proposed Project 52 53 Net Present Value (at 10%) = 54 IRR = 55 MIRR = 56 Payback 57 Discounted Payback = 58 Data for Payback Years 59 60 Net cash flow 61 Cumulative CF 62 Part of year required for payback 63 64 65 Data for Discounted Payback Years 66 67 Net cash flow 68 Discounted cash flow 69 Cumulative CF 70 Part of year required for discounted payback 71 72 Years 2 0 1 3 4 0 $0 1 $0 Years 2 $0 3 $0 4 $0 Build a Model + READY + 100% H OP 07 8 A 9 x 11:28 AM = XUS Question 2 - Build a Model - Pinto.com - Excel ? x FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Stenger, Libby AutoSum - Times New Roma - 10 AA Wrap Text Number Bad * Cut Be Copy Format Painter AY # > OX FA LO Insert Delete Format Fill- Paste BIU, A 6 3 Merge & Center - $ - % Normal Conditional Format as Good Formatting Table Styles +8.00 Neutral Clear Sort & Find & Filter Select- Editing Clipboard Font Alignment Number [5 Cells J K 1 M N 0 Q R S T U V E 0 F 1 G 2 . 3 1 4 L51 : x fc A B C D 37 Cash Flow Forecast 38 Sales revenue 39 Variable costs 40 Nonvariable operating costs 41 Depreciation (equipment) 42 Oper. income before taxes (EBIT) 43 Taxes on operating income (20%) 44 Net operating profit after taxes 45 Add back depreciation 46 Equipment purchases 47 Cash flow due to change in NOWC 48 Net cash flow due to salvage 49 Net Cash Flow (Time line of cash flows) 50 51 Key Results: Appraisal of the Proposed Project 52 53 Net Present Value (at 10%) = 54 IRR = 55 MIRR = 56 Payback 57 Discounted Payback = 58 Data for Payback Years 59 60 Net cash flow 61 Cumulative CF 62 Part of year required for payback 63 64 65 Data for Discounted Payback Years 66 67 Net cash flow 68 Discounted cash flow 69 Cumulative CF 70 Part of year required for discounted payback 71 72 Years 2 0 1 3 4 0 $0 1 $0 Years 2 $0 3 $0 4 $0 Build a Model + READY + 100% H OP 07 8 A 9 x 11:28 AM =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts