Question: A developer has put together a business plan to construct a retail structure with the following Pro Forma information: Adjusted Gross Income, Annual: $540,000 Estimated

A developer has put together a business plan to construct a retail structure with the following Pro Forma information:

Adjusted Gross Income, Annual: $540,000

Estimated Expenses, Annual: $172,000

Planned Rate of Return: 13%

The developer is looking to obtain a long-term loan from a bank to cover the construction of the retail structure. After assessing the developers credit worthiness, the bank assigns the developer an interest rate of 8.0%. The bank will limit the loan at a ratio 75%, Loan Value to Economic Value.

Please build a spreadsheet (similar to the model on page 202) and answer the following questions:

- What is the computed Cap Rate that will be used in computations of the Economic (Capitalization) Value?

- What is the Economic (Capitalization) Value of the Project?

- What is the maximum loan value the bank will be willing to lend based on all of these factors?

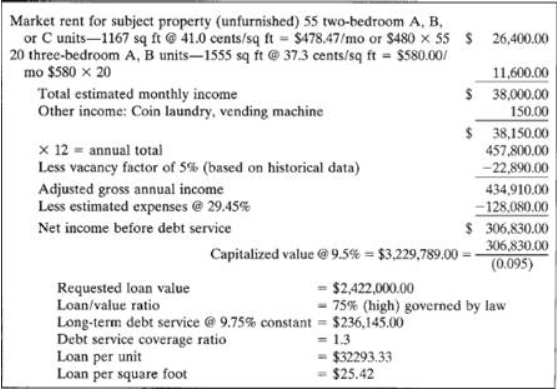

Market rent for subject property (unfurnished) 55 two-bedroom A, B, or C units-1167 sq ft @41.0 cents/sq ft - $478.47/mo or $480 x 55 $ 26,400.00 20 three-bedroom A, B units-1555 sq ft @ 37.3 cents/sq ft = $580.001 mo $580 x 20 11,600.00 Total estimated monthly income $ 38,000.00 Other income: Coin laundry, vending machine 150.00 $ 38,150.00 x 12 = annual total 457.800.00 Less Vacancy factor of 5% (based on historical data) -22.890.00 Adjusted gross annual income 434.910.00 Less estimated expenses @ 29.45% -128,080.00 Net income before debt service $ 306.830.00 306,830.00 Capitalized value @ 9.5% = $3.229,789.00 = - (0.095) Requested loan value - $2,422,000.00 Loan/value ratio -75% (high) governed by law Long-term debt service @ 9.75% constant = $236,145.00 Debt service coverage ratio = 1.3 Loan per unit - $32293.33 Loan per square foot - $25.42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts