Question: A developer owns a vacant site for which he recently paid $1,000,000. He intends to develop a 15,000 sq. ft. building which will cost

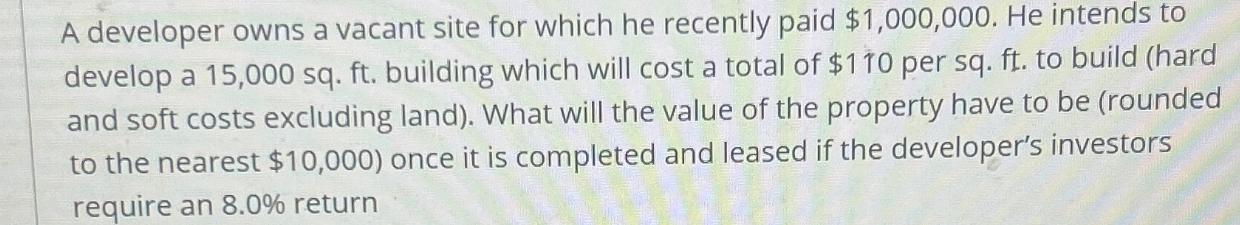

A developer owns a vacant site for which he recently paid $1,000,000. He intends to develop a 15,000 sq. ft. building which will cost a total of $110 per sq. ft. to build (hard and soft costs excluding land). What will the value of the property have to be (rounded to the nearest $10,000) once it is completed and leased if the developer's investors require an 8.0% return

Step by Step Solution

3.55 Rating (152 Votes )

There are 3 Steps involved in it

To calculate the value of the property once it is completed and leased we need to determine the total cost of development and then calculate the value based on the required return rate of the investor... View full answer

Get step-by-step solutions from verified subject matter experts