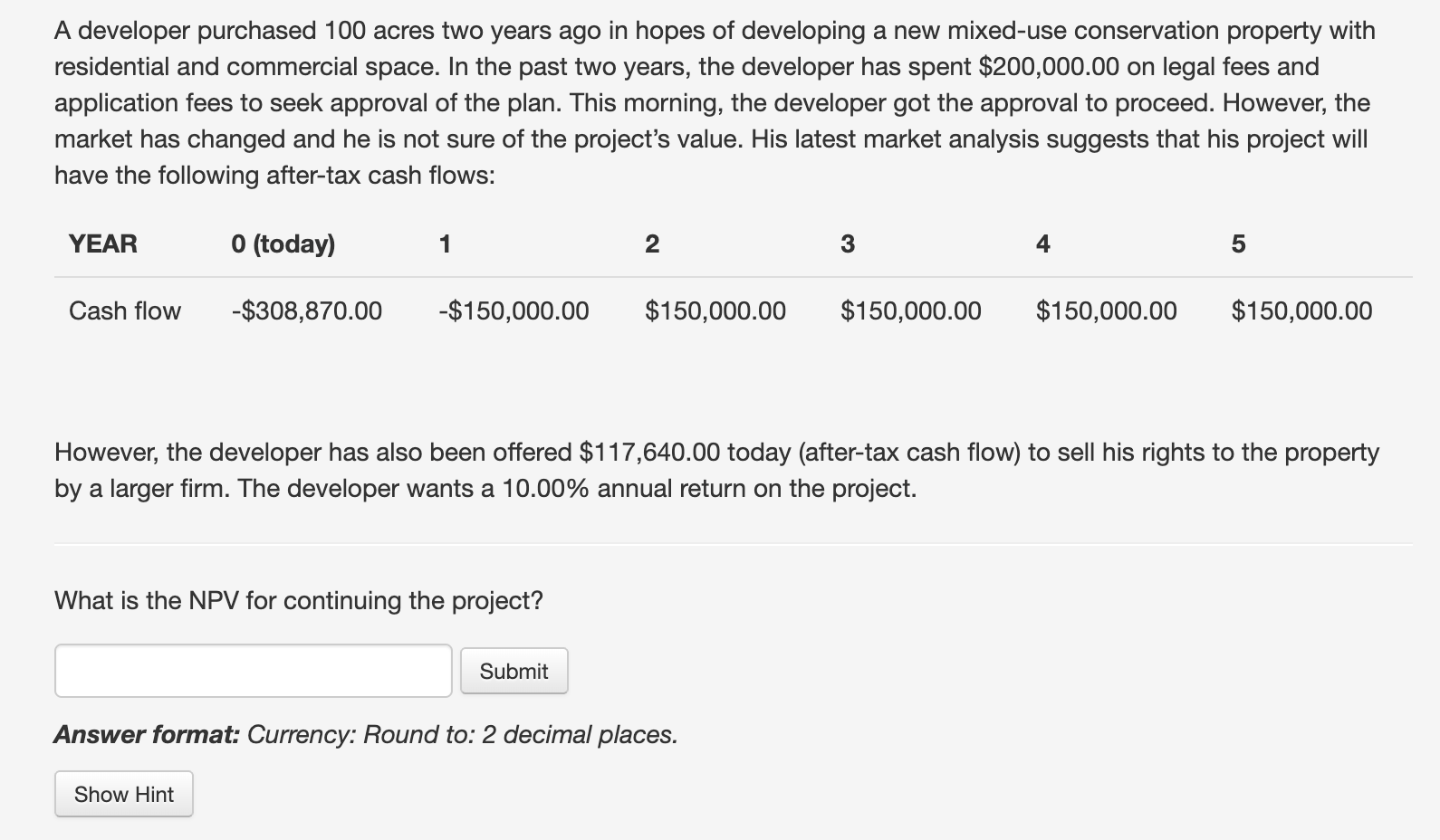

Question: A developer purchased 1 0 0 acres two years ago in hopes of developing a new mixed - use conservation property with residential and commercial

A developer purchased acres two years ago in hopes of developing a new mixeduse conservation property with residential and commercial space. In the past two years, the developer has spent $ on legal fees and application fees to seek approval of the plan. This morning, the developer got the approval to proceed. However, the market has changed and he is not sure of the project's value. His latest market analysis suggests that his project will have the following aftertax cash flows: However, the developer has also been offered $ today aftertax cash flow to sell his rights to the property by a larger firm. The developer wants a annual return on the project. What is the NPV for continuing the project? Answer format: Currency: Round to: decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock