Question: A developer puts in 5% equity and a fund puts in 95% of the equity for a development deal. The pref rate is 10%, the

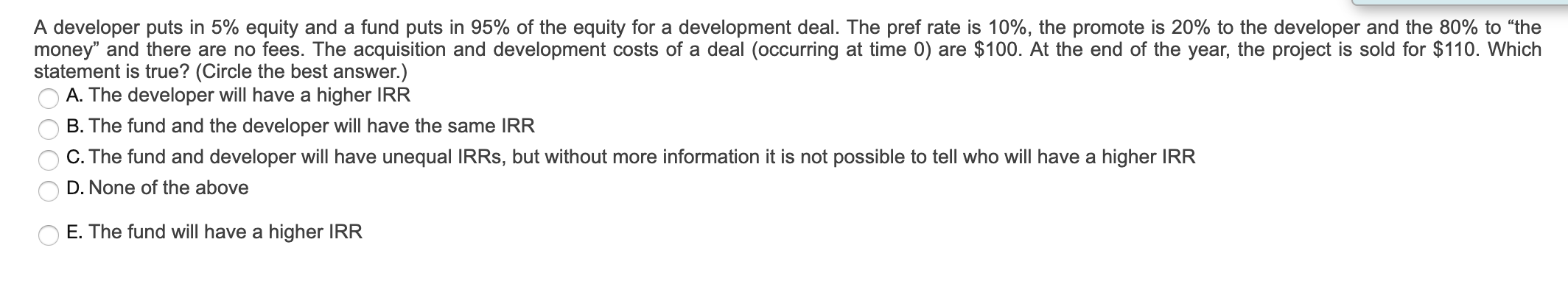

A developer puts in 5% equity and a fund puts in 95% of the equity for a development deal. The pref rate is 10%, the promote is 20% to the developer and the 80% to "the money" and there are no fees. The acquisition and development costs of a deal (occurring at time 0) are $100. At the end of the year, the project is sold for $110. Which statement is true? (Circle the best answer.) A. The developer will have a higher IRR B. The fund and the developer will have the same IRR C. The fund and developer will have unequal IRRs, but without more information it is not possible to tell who will have a higher IRR D. None of the above E. The fund will have a higher IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts