Question: a) Differentiate between perfect negative correlation and perfect positive correlation. (5 marks) b) Explain the concept of diversification in investment portfolio. (5 marks) c) A

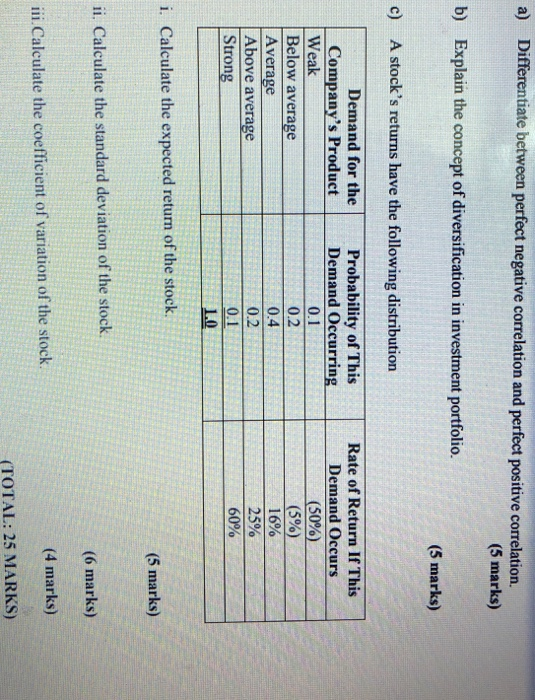

a) Differentiate between perfect negative correlation and perfect positive correlation. (5 marks) b) Explain the concept of diversification in investment portfolio. (5 marks) c) A stock's returns have the following distribution Demand for the Company's Product Weak Below average Average Above average Strong Probability of this Demand Occurring 0.1 0.2 0.4 0.2 0.1 1.0 Rate of Return If This Demand Occurs (50%) (5%) 16% 25% 60% i. Calculate the expected return of the stock. (5 marks) ii. Calculate the standard deviation of the stock. (6 marks) (4 marks) iii. Calculate the coefficient of variation of the stock (TOTAL: 25 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts