Question: A docs.google.com u Small Group Final - Google Docs Take Te prove the responsiveness of your Mac, ons Help Last edit was made seconds ago

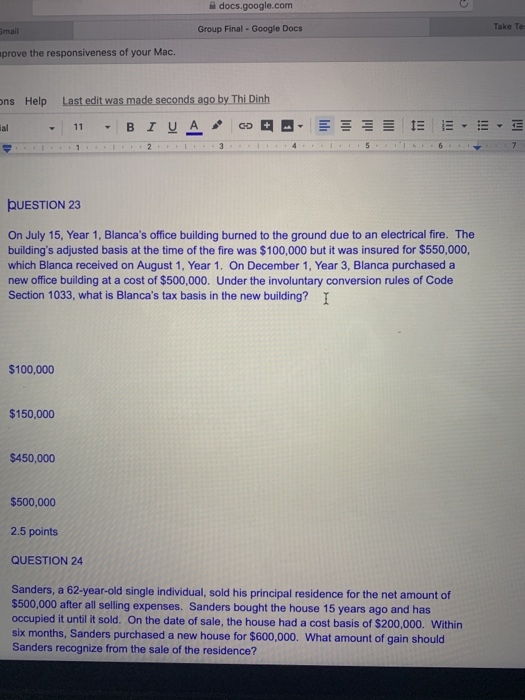

A docs.google.com u Small Group Final - Google Docs Take Te prove the responsiveness of your Mac, ons Help Last edit was made seconds ago by Thi Dinh lal 11 GD 15 iii lil 2 5 6 7 QUESTION 23 On July 15, Year 1, Blanca's office building burned to the ground due to an electrical fire. The building's adjusted basis at the time of the fire was $100,000 but it was insured for $550,000, which Blanca received on August 1, Year 1. On December 1, Year 3, Blanca purchased a new office building at a cost of $500,000. Under the involuntary conversion rules of Code Section 1033, what is Blanca's tax basis in the new building? I $100,000 $150,000 $450,000 $500,000 2.5 points QUESTION 24 Sanders, a 62-year-old single individual, sold his principal residence for the net amount of $500,000 after all selling expenses. Sanders bought the house 15 years ago and has occupied it until it sold. On the date of sale, the house had a cost basis of $200,000. Within six months, Sanders purchased a new house for $600,000. What amount of gain should Sanders recognize from the sale of the residence

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts