Question: A) drop down optionns: 1,2,3,4 C) drop down options: Yes or No Your firm is considerning a project that will cost $4.529 million up front,

A) drop down optionns: 1,2,3,4

C) drop down options: Yes or No

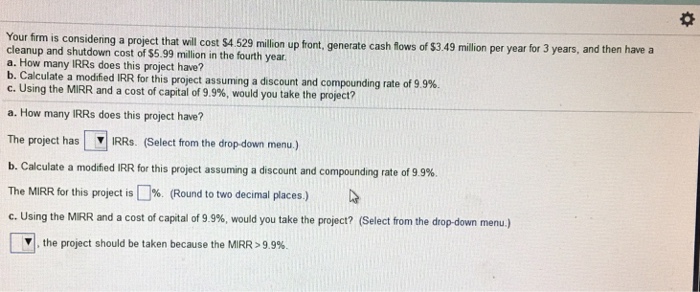

Your firm is considerning a project that will cost $4.529 million up front, generate cash lows of $3.49 million cleanup and shutdown cost of $5.99 million in the fourth year a. How many IRRs does this project have? b Calculate a modified IRR for this project assuming a discount and compounding rate of 9.9%. c. Using the MIRR and a cost of capital of 9.9%, would you take the project? a. How many IRRs does this project have? The project has IRRs. (Select from the drop-down menu.) b. Calculate a modified IRR for this project assuming a discount and compounding rate of 9 9% The MIRR for this project is % (Round to two decimal places.) t> c, using the MRR and a cost of capital of 9.9%, would you take the project? (Select from the drop-down menu ) ., the project should be taken because the MIRR> 9.9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts