Question: A European gap call option with strike K, trigger K2 and maturity T on a stock S is an option of call type presenting

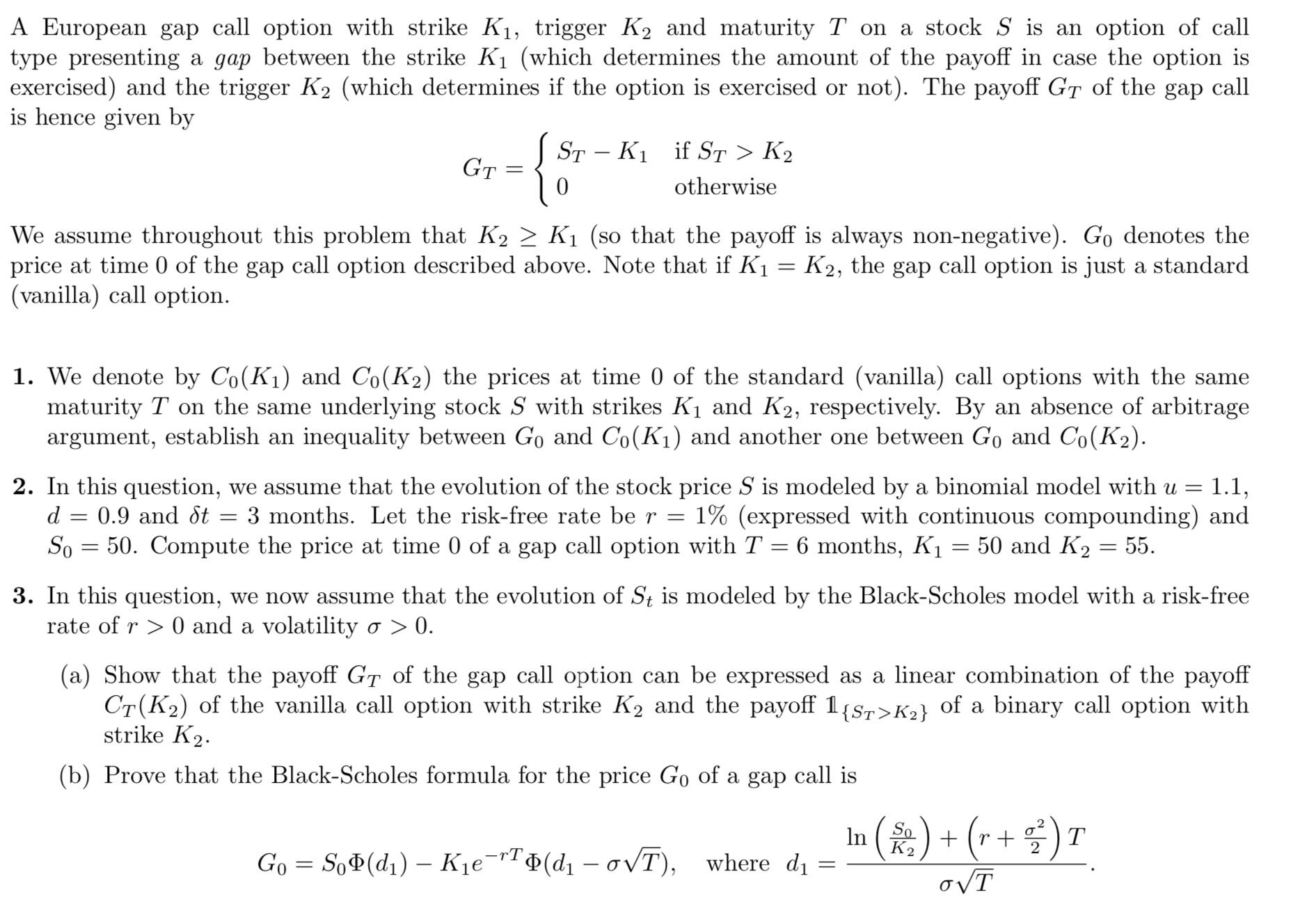

A European gap call option with strike K, trigger K2 and maturity T on a stock S is an option of call type presenting a gap between the strike K (which determines the amount of the payoff in case the option is exercised) and the trigger K2 (which determines if the option is exercised or not). The payoff GT of the gap call is hence given by GT = S K if ST > K 0 otherwise We assume throughout this problem that K K (so that the payoff is always non-negative). Go denotes the price at time 0 of the gap call option described above. Note that if K K2, the gap call option is just a standard (vanilla) call option. = 1. We denote by Co (K) and Co (K2) the prices at time 0 of the standard (vanilla) call options with the same maturity T on the same underlying stock S with strikes K and K2, respectively. By an absence of arbitrage argument, establish an inequality between Go and Co (K) and another one between Go and Co (K2). d 1.1, 2. In this question, we assume that the evolution of the stock price S is modeled by a binomial model with u = = 0.9 and St = 3 months. Let the risk-free rate be r 1% (expressed with continuous compounding) and with T = 6 months, K = 50 and K = 55. = = So 50. Compute the price at time 0 of a gap call option 3. In this question, we now assume that the evolution of St is modeled by the Black-Scholes model with a risk-free rate of r > 0 and a volatility > 0. (a) Show that the payoff G of the gap call option can be expressed as a linear combination of the payoff CT (K2) of the vanilla call option with strike K2 and the payoff 1{ST>K2} of a binary call option with strike K2. (b) Prove that the Black-Scholes formula for the price Go of a gap call is So K2 r Go = So(d) KeT (d T), where d In (1/2) + (1 + 2/) T = rT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts