Question: A) Explain how a straddle and strangle spread (use OTM options) can be created to speculate on low volatility. B) Construct a table showing the

A) Explain how a straddle and strangle spread (use OTM options) can be created to speculate on low volatility.

B) Construct a table showing the profit of strangle.

C) Construct a table showing the profit of straddle

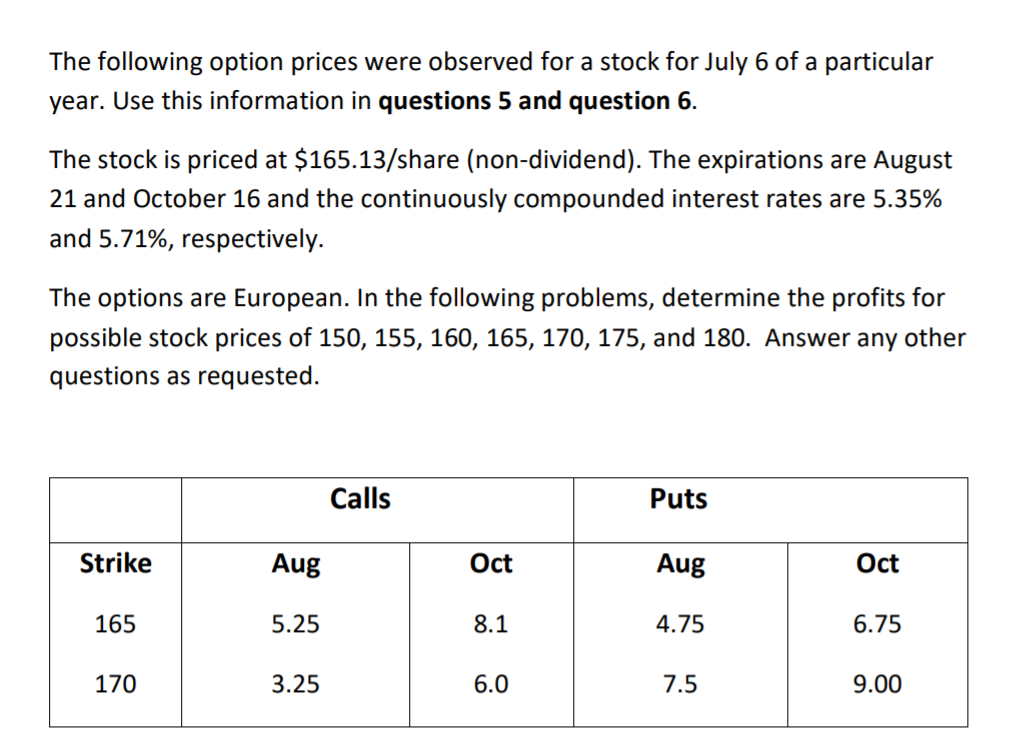

The following option prices were observed for a stock for July 6 of a particular year. Use this information in questions 5 and question 6. The stock is priced at $165.13/share (non-dividend). The expirations are August 21 and October 16 and the continuously compounded interest rates are 5.35% and 5.71%, respectively. The options are European. In the following problems, determine the profits for possible stock prices of 150, 155, 160, 165, 170, 175, and 180. Answer any other questions as requested. Calls Puts Strike Aug Oct Aug Oct 165 5.25 8.1 4.75 6.75 170 3.25 6.0 7.5 9.00 The following option prices were observed for a stock for July 6 of a particular year. Use this information in questions 5 and question 6. The stock is priced at $165.13/share (non-dividend). The expirations are August 21 and October 16 and the continuously compounded interest rates are 5.35% and 5.71%, respectively. The options are European. In the following problems, determine the profits for possible stock prices of 150, 155, 160, 165, 170, 175, and 180. Answer any other questions as requested. Calls Puts Strike Aug Oct Aug Oct 165 5.25 8.1 4.75 6.75 170 3.25 6.0 7.5 9.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts