Question: a) Explain how a straddle and strangle spread (use OTM options) can be created to speculate on low volatility. b) Construct a table showing the

a) Explain how a straddle and strangle spread (use OTM options) can be created to speculate on low volatility.

b) Construct a table showing the profit of strangle.

c) Construct a table showing the profit of straddle.

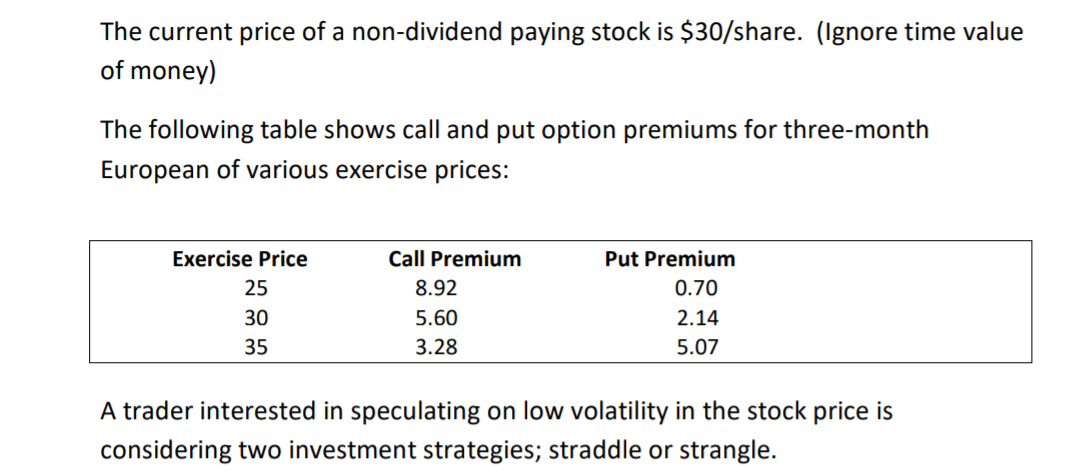

The current price of a non-dividend paying stock is $30/share. (Ignore time value of money) The following table shows call and put option premiums for three-month European of various exercise prices: Exercise Price 25 30 35 Call Premium 8.92 5.60 3.28 Put Premium 0.70 2.14 5.07 A trader interested in speculating on low volatility in the stock price is considering two investment strategies; straddle or strangle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts