Question: a. Explain how accounting standards may influence valuation multiples. b. Why is the standard deviation of a firm's stock return not necessarily a good measure

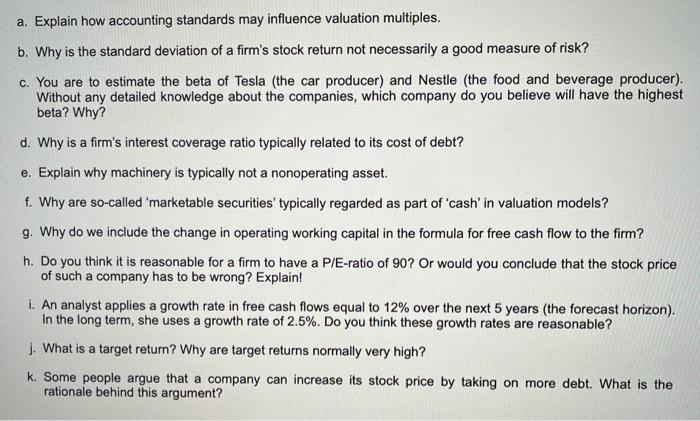

a. Explain how accounting standards may influence valuation multiples. b. Why is the standard deviation of a firm's stock return not necessarily a good measure of risk? c. You are to estimate the beta of Tesla (the car producer) and Nestle (the food and beverage producer). Without any detailed knowledge about the companies, which company do you believe will have the highest beta? Why? d. Why is a firm's interest coverage ratio typically related to its cost of debt? e. Explain why machinery is typically not a nonoperating asset. f. Why are so-called 'marketable securities' typically regarded as part of cash' in valuation models? g. Why do we include the change in operating working capital in the formula for free cash flow to the firm? h. Do you think it is reasonable for a firm to have a P/E-ratio of 90? Or would you conclude that the stock price of such a company has to be wrong? Explain! 1. An analyst applies a growth rate in free cash flows equal to 12% over the next 5 years (the forecast horizon). In the long term, she uses a growth rate of 2.5%. Do you think these growth rates are reasonable? j. What is a target return? Why are target returns normally very high? k. Some people argue that a company can increase its stock price by taking on more debt. What is the rationale behind this argument

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts