Question: a. Explain how to find the Units-of-production (13,000,000) (14,000,000) b. Explain how to find the Double-declining-balance (16.625.000) (12,467.750) On January 1, 2018, Logan Service purchased

a. Explain how to find the Units-of-production (13,000,000) (14,000,000)

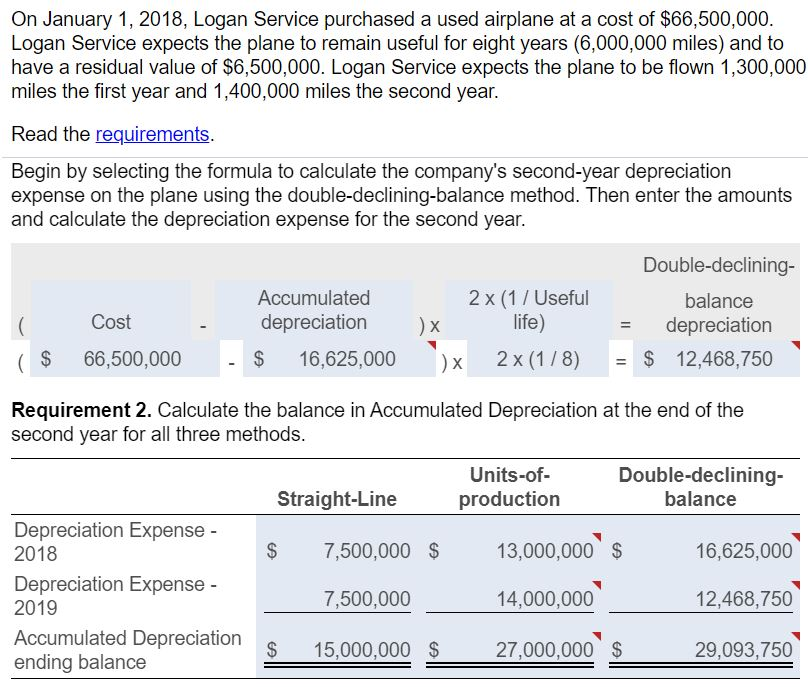

b. Explain how to find the Double-declining-balance (16.625.000) (12,467.750)

On January 1, 2018, Logan Service purchased a used airplane at a cost of $66,500,000. Logan Service expects the plane to remain useful for eight years (6,000,000 miles) and to have a residual value of $6,500,000. Logan Service expects the plane to be flown 1,300,000 miles the first year and 1,400,000 miles the second year. Read the requirements. Begin by selecting the formula to calculate the company's second-year depreciation expense on the plane using the double-declining-balance method. Then enter the amounts and calculate the depreciation expense for the second year. Cost Accumulated depreciation $ 16,625,000 2 x (1 / Useful ) x life) ) x 2 x (1/8) Double-declining- balance depreciation $ 12,468,750 ( $ 66,500,000 Requirement 2. Calculate the balance in Accumulated Depreciation at the end of the second year for all three methods. Units-of Double-declining- Straight-Line production balance Depreciation Expense - 2018 $ 7,500,000 $ 13,000,000 $ 16,625,000 Depreciation Expense - 7,500,000 2019 14,000,000 12,468,750 Accumulated Depreciation $ 15,000,000 $ 27,000,000 $ 29,093,750 ending balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts