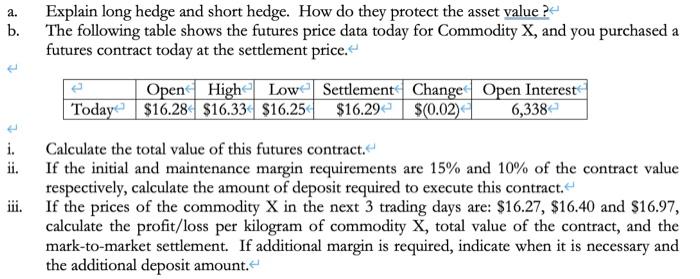

Question: a. Explain long hedge and short hedge. How do they protect the asset value ? b. The following table shows the futures price data today

a. b. Explain long hedge and short hedge. How do they protect the asset value ? The following table shows the futures price data today for Commodity X, and you purchased a futures contract today at the settlement price. Open High Low Settlement Change Open Interest Today $16.28 $16.33 $16.25 $16.29 $(0.02) 6,338 i. Calculate the total value of this futures contract. If the initial and maintenance margin requirements are 15% and 10% of the contract value respectively, calculate the amount of deposit required to execute this contract. iii. If the prices of the commodity X in the next 3 trading days are: $16.27, $16.40 and $16.97, calculate the profit/loss per kilogram of commodity X, total value of the contract, and the mark-to-market settlement. If additional margin is required, indicate when it is necessary and the additional deposit amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts