Question: a. Explain long hedge and short hedge. How do they protect the asset value? b. The following table shows the futures price data today for

a. Explain long hedge and short hedge. How do they protect the asset value?

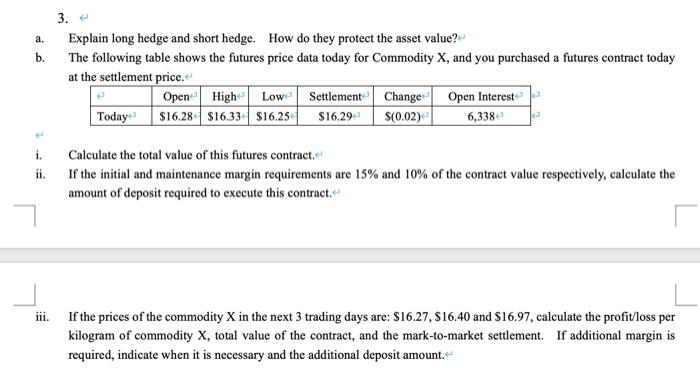

b. The following table shows the futures price data today for Commodity X, and you purchased a futures contract today at the settlement price.

| Open | High | Low | Settlement | Change | Open Interest |

Today | $16.28 | $16.33 | $16.25 | $16.29 | $(0.02) | 6,338 |

i. Calculate the total value of this futures contract.

ii. If the initial and maintenance margin requirements are 15% and 10% of the contract value respectively, calculate the amount of deposit required to execute this contract.

iii. If the prices of the commodity X in the next 3 trading days are: $16.27, $16.40 and $16.97, calculate the profit/loss per kilogram of commodity X, total value of the contract, and the mark-to-market settlement. If additional margin is required, indicate when it is necessary and the additional deposit amount.

a. b. 3. Explain long hedge and short hedge. How do they protect the asset value? The following table shows the futures price data today for Commodity X, and you purchased a futures contract today at the settlement price. Open High Low Settlement Change Open Interest Today $16.28 $16.33 $16.25 $16.29 S(0.02) 6,338 i. Calculate the total value of this futures contract. ii. If the initial and maintenance margin requirements are 15% and 10% of the contract value respectively, calculate the amount of deposit required to execute this contract. iii. If the prices of the commodity X in the next 3 trading days are: $16.27, 516.40 and $16.97, calculate the profit loss per kilogram of commodity X, total value of the contract, and the mark-to-market settlement. If additional margin is required, indicate when it is necessary and the additional deposit amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts