Question: a. Explain the relationship between the required return and the coupon interest rate that will cause a bond if the bond is sold: (i) At

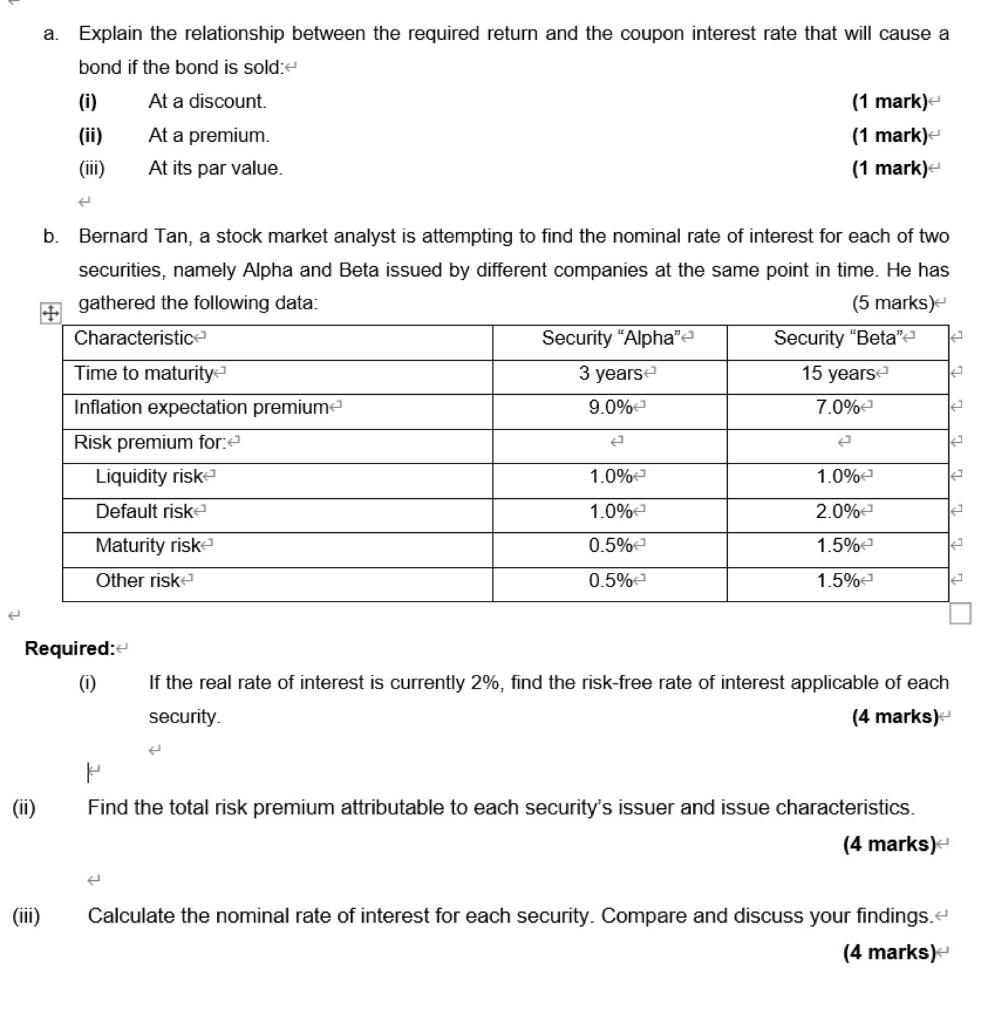

a. Explain the relationship between the required return and the coupon interest rate that will cause a bond if the bond is sold: (i) At a discount (1 mark) (ii) At a premium. (1 mark) (iii) At its par value. (1 mark) + le 12 b. Bernard Tan, a stock market analyst is attempting to find the nominal rate of interest for each of two securities, namely Alpha and Beta issued by different companies at the same point in time. He has gathered the following data: (5 marks) Characteristice Security "Alpha" Security "Beta" Time to maturity 3 years 15 years Inflation expectation premium 9.0% 7.0% Risk premium for: Liquidity riske 1.0% 1.0% Default riske 1.0% 2.0% Maturity riske 0.5% 1.5% Other risk 0.5% 1.5% 1 Required: (0) If the real rate of interest is currently 2%, find the risk-free rate of interest applicable of each security (4 marks) (ii) H Find the total risk premium attributable to each security's issuer and issue characteristics. (4 marks) (iii) Calculate the nominal rate of interest for each security. Compare and discuss your findings. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts