Question: (a) Explain what is delta for an option? By considering the Black-Scholes formula for a non-dividend-paying stock, write down the formula for delta of a

(a) Explain what is delta for an option? By considering the Black-Scholes formula for a non-dividend-paying stock, write down the formula for delta of a European call.

(b) What is the trader's interpretation of delta?

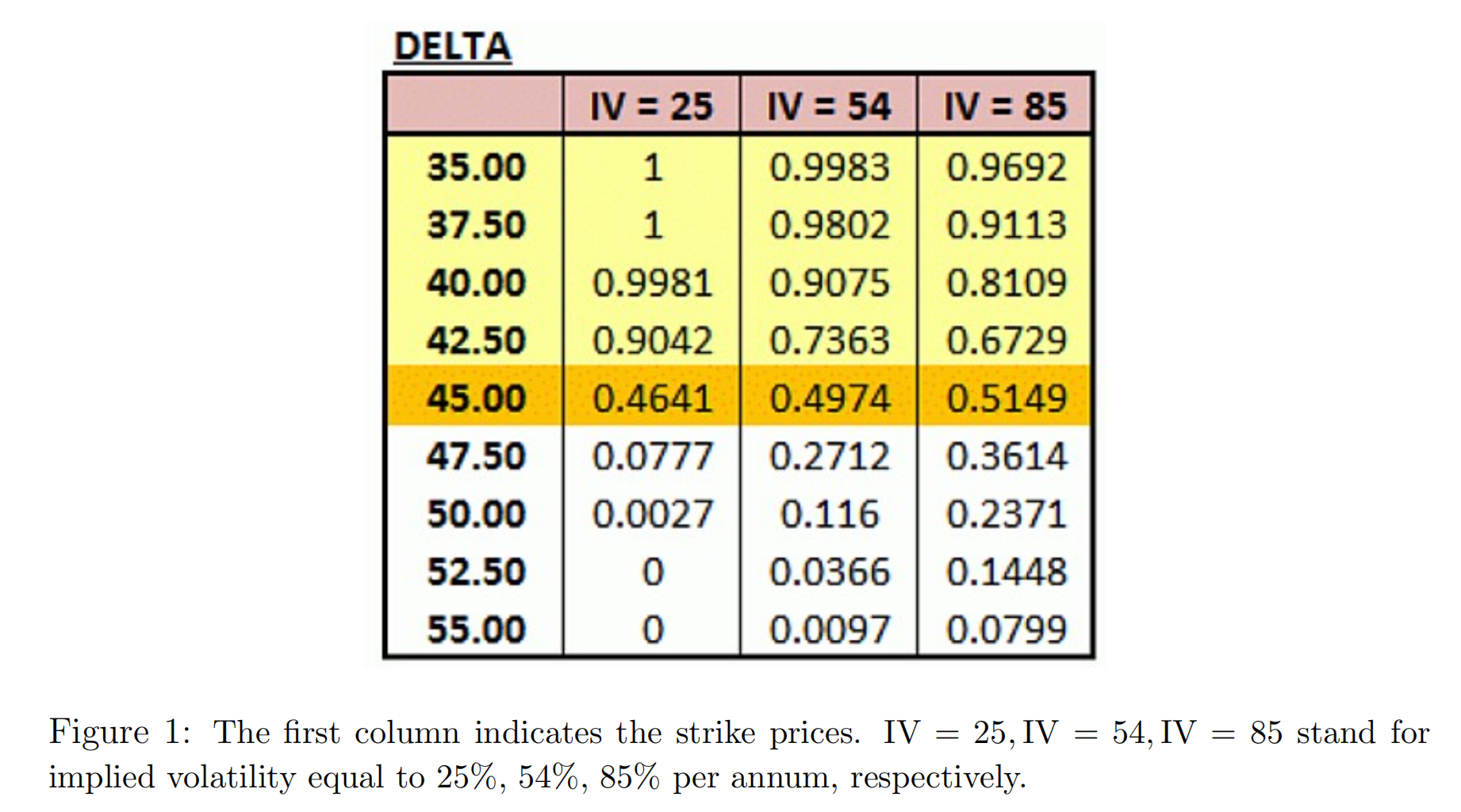

(c) For a stock trading near $45.00, the delta of a European call would look similar to those in Figure 1. What patterns about delta do you see? Explain the intuitions behind the patterns. (Hint: part (b) might be helpful.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts