Question: A. Explain what is delta for an option? By considering the Black-Scholes formula for a non-dividend-paying stock, write down the formula for delta of a

A. Explain what is delta for an option? By considering the Black-Scholes formula for a non-dividend-paying stock, write down the formula for delta of a European call.

(b) What is the trader's interpretation of delta?

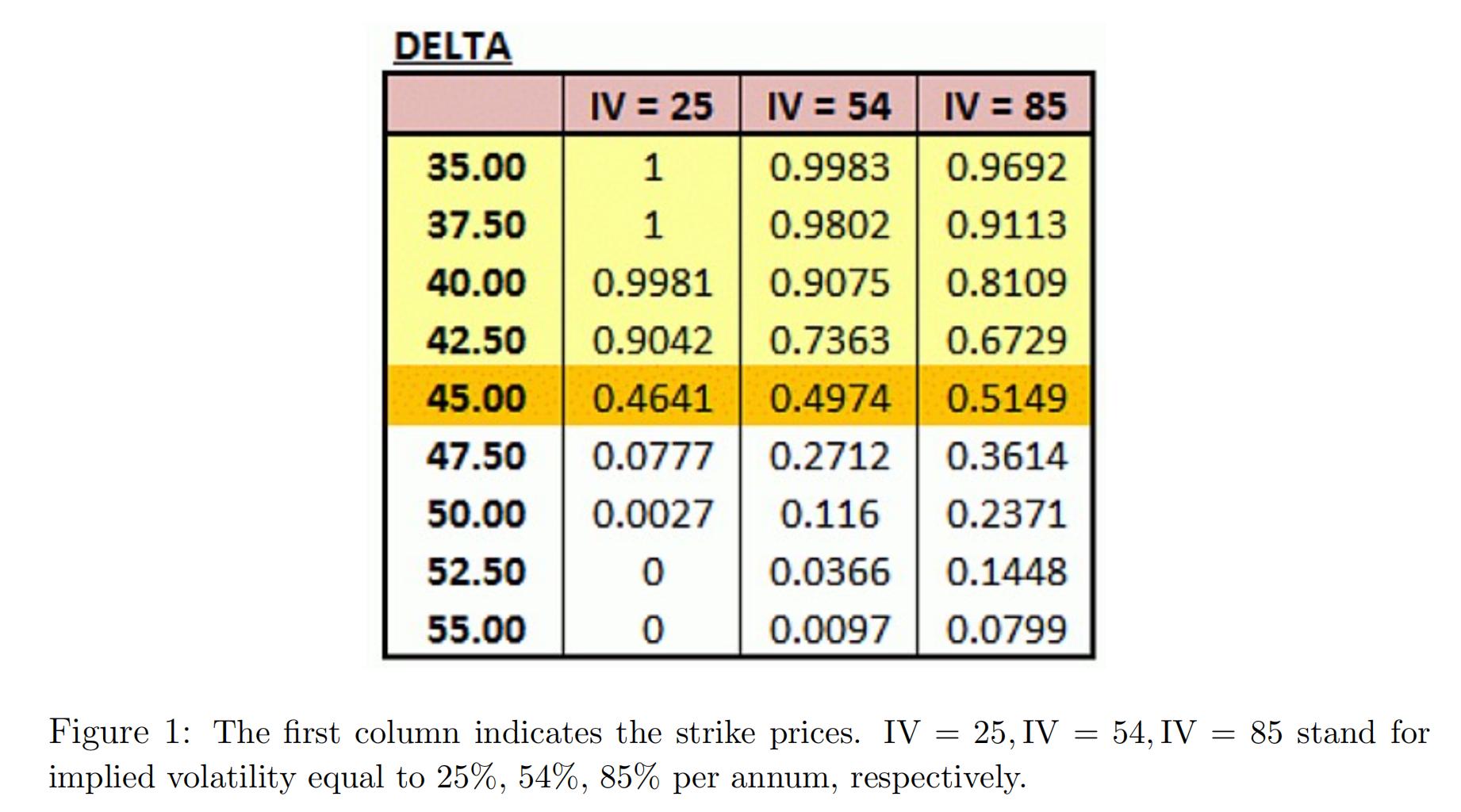

(c) For a stock trading near $45.00, the delta of a European call would look similar to those in Figure 1.

What patterns about delta do you see? Explain the intuitions behind the patterns.

DELTA IV = 25 IV = 54 IV = 85 35.00 1 0.9983 0.9692 37.50 1 0.9802 0.9113 40.00 0.9981 0.9075 0.8109 42.50 0.9042 0.7363 0.6729 45.00 0.4641 0.4974 0.5149 47.50 0.0777 0.2712 0.3614 50.00 0.0027 0.116 0.2371 52.50 0 0.0366 0.1448 55.00 0 0.0097 0.0799 Figure 1: The first column indicates the strike prices. IV = 25, IV = 54, IV = 85 stand for implied volatility equal to 25%, 54%, 85% per annum, respectively.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

a Delta is a measure of how much an options price will change in response to a change in the underly... View full answer

Get step-by-step solutions from verified subject matter experts