Question: a) Explain why you would agree or disagree with this statement: Buying a put is just like short selling the underlying asset. You gain the

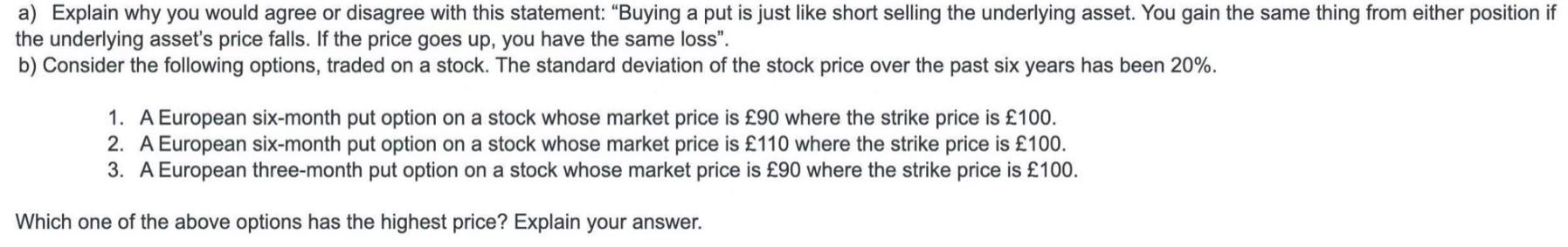

a) Explain why you would agree or disagree with this statement: "Buying a put is just like short selling the underlying asset. You gain the same thing from either position if the underlying asset's price falls. If the price goes up, you have the same loss". b) Consider the following options, traded on a stock. The standard deviation of the stock price over the past six years has been 20%. 1. A European six-month put option on a stock whose market price is 90 where the strike price is 100. 2. A European six-month put option on a stock whose market price is 110 where the strike price is 100. 3. A European three-month put option on a stock whose market price is 90 where the strike price is 100. Which one of the above options has the highest price? Explain your answer. a) Explain why you would agree or disagree with this statement: "Buying a put is just like short selling the underlying asset. You gain the same thing from either position if the underlying asset's price falls. If the price goes up, you have the same loss". b) Consider the following options, traded on a stock. The standard deviation of the stock price over the past six years has been 20%. 1. A European six-month put option on a stock whose market price is 90 where the strike price is 100. 2. A European six-month put option on a stock whose market price is 110 where the strike price is 100. 3. A European three-month put option on a stock whose market price is 90 where the strike price is 100. Which one of the above options has the highest price? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts