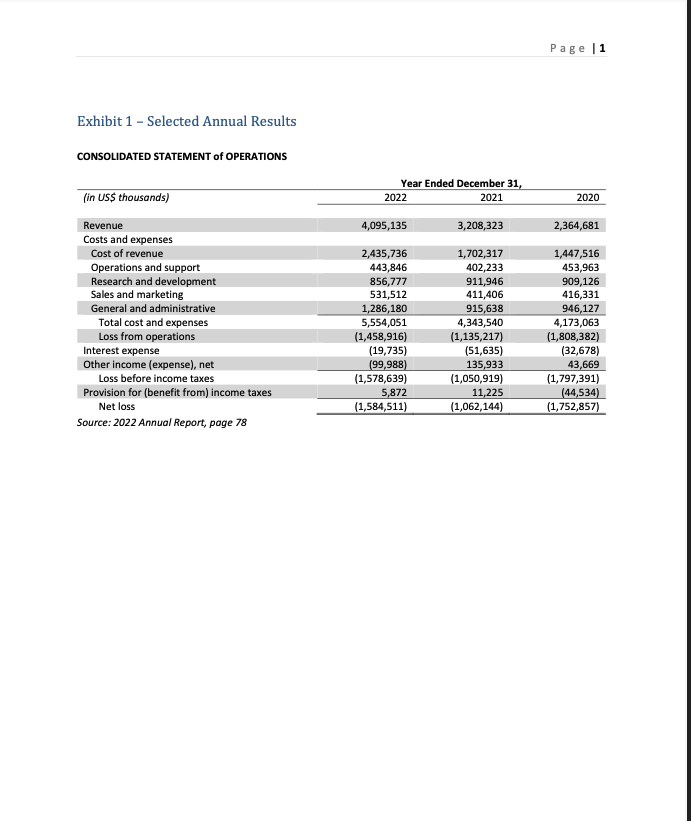

Question: Page |1 Lyft: More than a mustache markets, they differ in size, physically Lyft has been going through a rough patch (employees, locations, customers) and

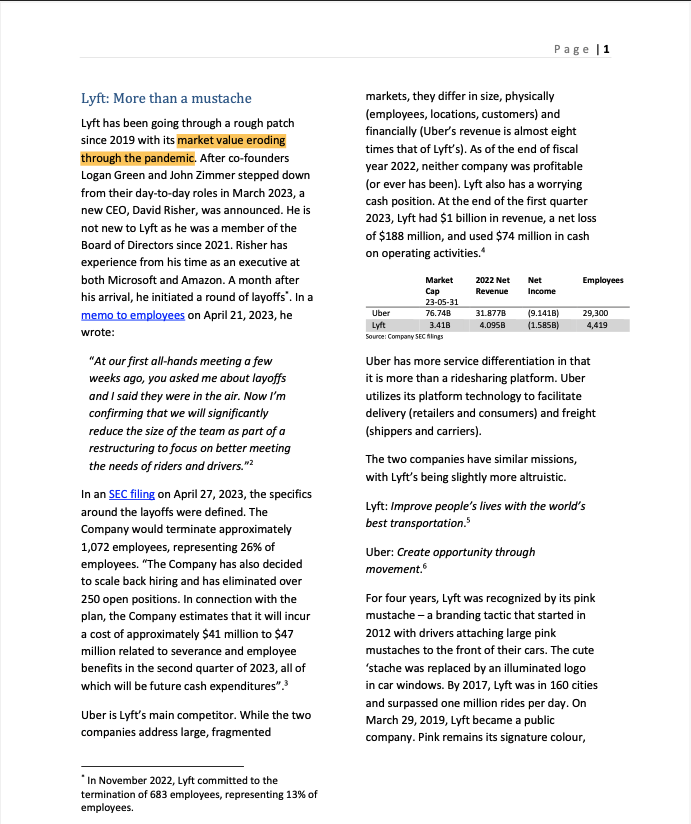

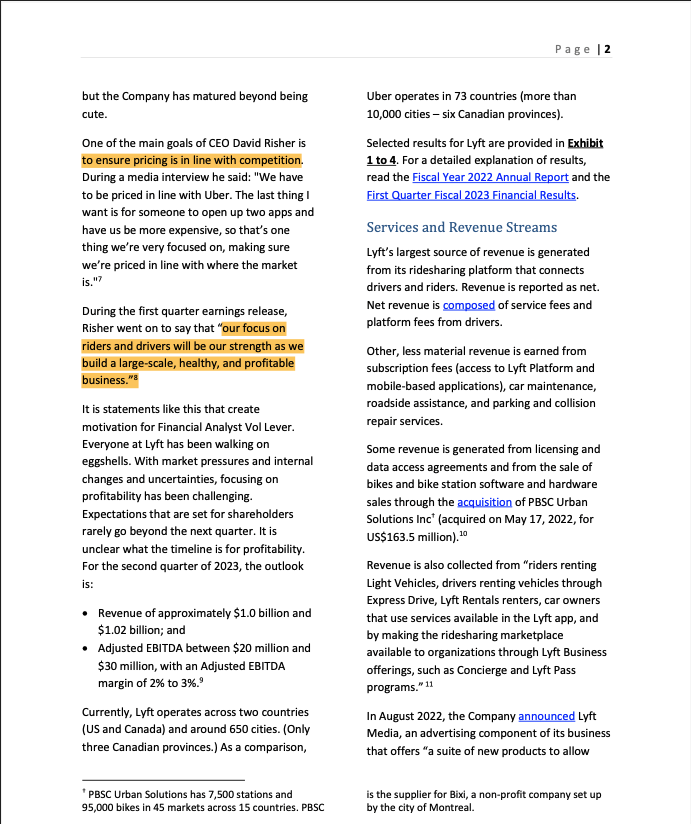

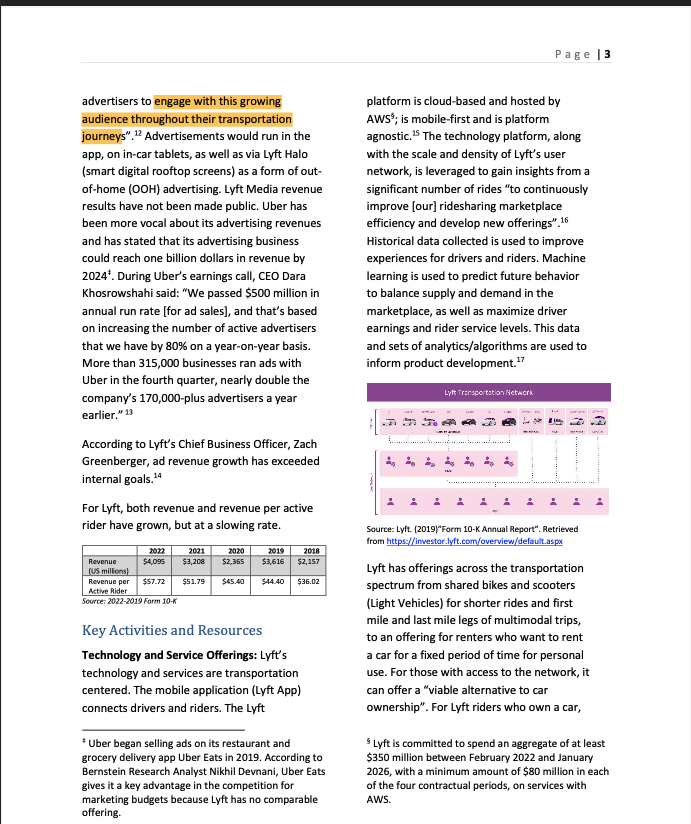

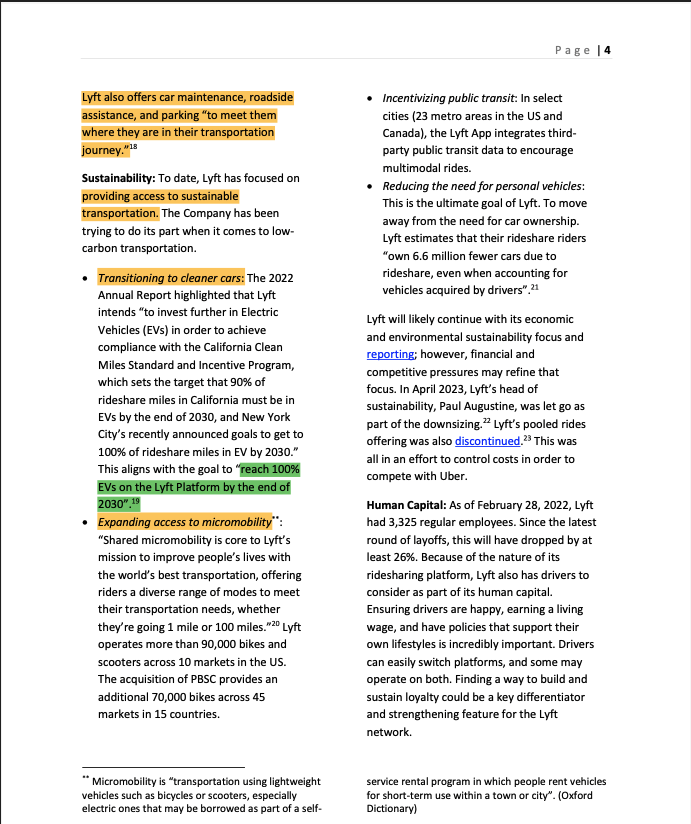

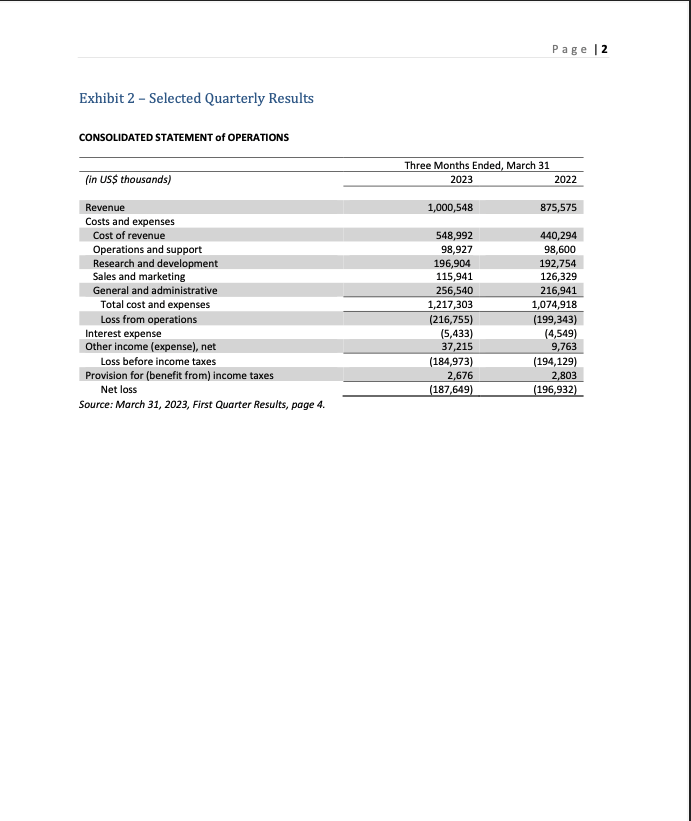

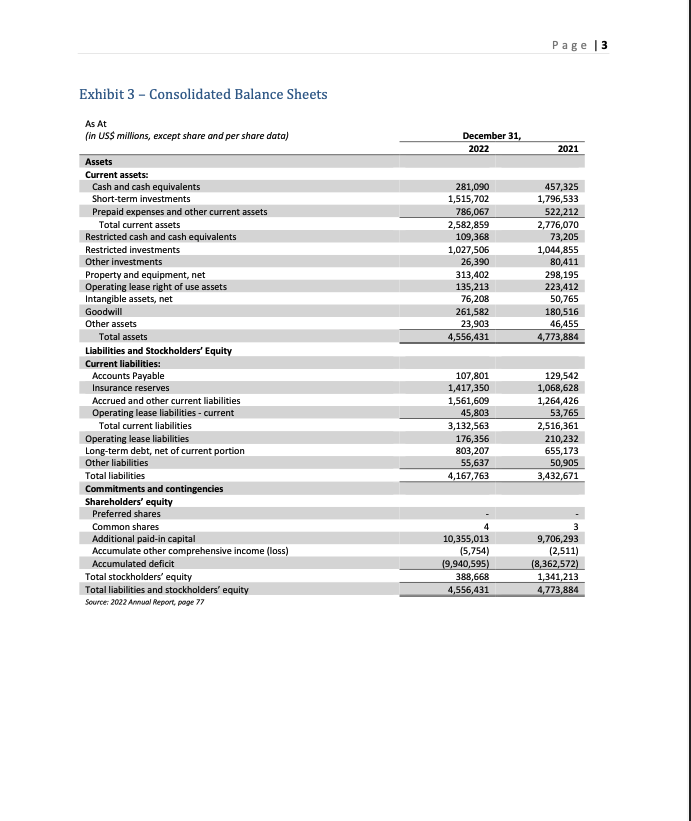

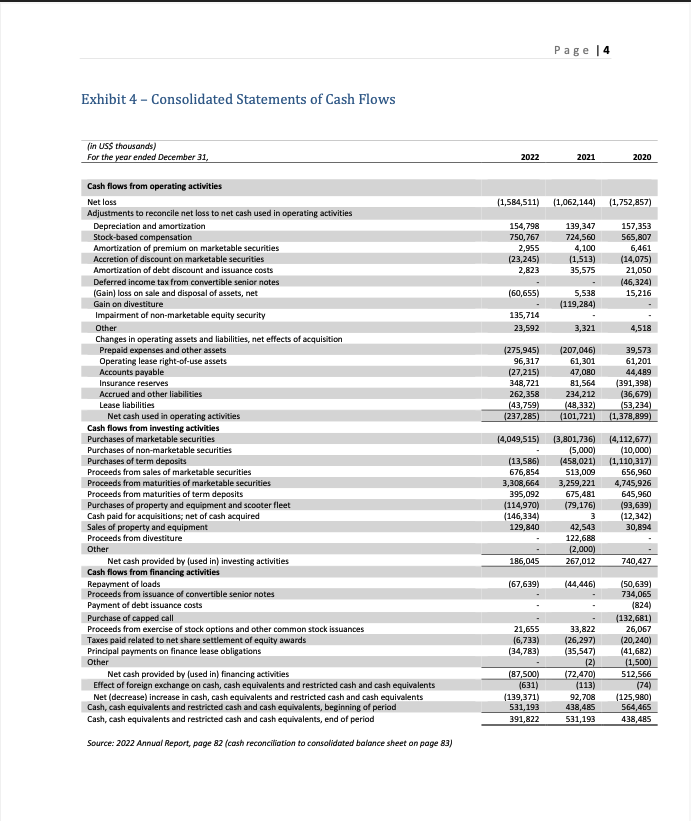

Page |1 Lyft: More than a mustache markets, they differ in size, physically Lyft has been going through a rough patch (employees, locations, customers) and financially (Uber's revenue is almost eight since 2019 with its market value eroding times that of Lyft's). As of the end of fiscal through the pandemic. After co-founders Logan Green and John Zimmer stepped down year 2022, neither company was profitable from their day-to-day roles in March 2023, a (or ever has been). Lyft also has a worrying new CEO, David Risher, was announced. He is cash position. At the end of the first quarter 2023, Lyft had $1 billion in revenue, a net loss not new to Lyft as he was a member of the of $188 million, and used $74 million in cash Board of Directors since 2021. Risher has on operating activities.* experience from his time as an executive at both Microsoft and Amazon. A month after Market 2022 Net Net Employees his arrival, he initiated a round of layoffs'. In a Cap Revenue Income 23-05-3 memo to employees on April 21, 2023, he Uber 76.740 31 8770 9.1418) 29,300 Lyft 3.41B 4.095E (1.5856) 4,419 wrote: Source: Company SEC filings "At our first all-hands meeting a few Uber has more service differentiation in that weeks ago, you asked me about layoffs it is more than a ridesharing platform. Uber and I said they were in the air. Now I'm utilizes its platform technology to facilitate confirming that we will significantly delivery (retailers and consumers) and freight reduce the size of the team as part of a (shippers and carriers). restructuring to focus on better meeting the needs of riders and drivers." The two companies have similar missions, with Lyft's being slightly more altruistic. In an SEC filing on April 27, 2023, the specifics around the layoffs were defined. The Lyft: Improve people's lives with the world's Company would terminate approximately best transportation. 1,072 employees, representing 26% of Uber: Create opportunity through employees. "The Company has also decided movement." to scale back hiring and has eliminated over 250 open positions. In connection with the For four years, Lyft was recognized by its pink plan, the Company estimates that it will incur mustache - a branding tactic that started in a cost of approximately $41 million to $47 2012 with drivers attaching large pink million related to severance and employee mustaches to the front of their cars. The cute benefits in the second quarter of 2023, all of stache was replaced by an illuminated logo which will be future cash expenditures". in car windows. By 2017, Lyft was in 160 cities and surpassed one million rides per day. On Uber is Lyft's main competitor. While the two March 29, 2019, Lyft became a public companies address large, fragmented company. Pink remains its signature colour, In November 2022, Lyft committed to the termination of 683 employees, representing 13% of employees.Page |2 but the Company has matured beyond being Uber operates in 73 countries (more than cute 10,000 cities - six Canadian provinces). One of the main goals of CEO David Risher is Selected results for Lyft are provided in Exhibit to ensure pricing is in line with competition. 1 to 4. For a detailed explanation of results, During a media interview he said: "We have read the Fiscal Year 2022 Annual Report and the to be priced in line with Uber. The last thing I First Quarter Fiscal 2023 Financial Results. want is for someone to open up two apps and have us be more expensive, so that's one Services and Revenue Streams thing we're very focused on, making sure Lyft's largest source of revenue is generated we're priced in line with where the market from its ridesharing platform that connects is. "7 drivers and riders. Revenue is reported as net. During the first quarter earnings release, Net revenue is composed of service fees and Risher went on to say that "our focus on platform fees from drivers. riders and drivers will be our strength as we Other, less material revenue is earned from build a large-scale, healthy, and profitable subscription fees (access to Lyft Platform and business."2 mobile-based applications), car maintenance, It is statements like this that create roadside assistance, and parking and collision motivation for Financial Analyst Vol Lever. repair services Everyone at Lyft has been walking on Some revenue is generated from licensing and eggshells. With market pressures and internal data access agreements and from the sale of changes and uncertainties, focusing on bikes and bike station software and hardware profitability has been challenging. sales through the acquisition of PBSC Urban Expectations that are set for shareholders Solutions Inc (acquired on May 17, 2022, for rarely go beyond the next quarter. It is US$163.5 million). 10 unclear what the timeline is for profitability. For the second quarter of 2023, the outlook Revenue is also collected from "riders renting is: Light Vehicles, drivers renting vehicles through Express Drive, Lyft Rentals renters, car owners Revenue of approximately $1.0 billion and that use services available in the Lyft app, and $1.02 billion; and by making the ridesharing marketplace Adjusted EBITDA between $20 million and available to organizations through Lyft Business $30 million, with an Adjusted EBITDA offerings, such as Concierge and Lyft Pass margin of 2% to 3%." programs." 11 Currently, Lyft operates across two countries In August 2022, the Company announced Lyft (US and Canada) and around 650 cities. (Only Media, an advertising component of its business three Canadian provinces.) As a comparison, that offers "a suite of new products to allow *PBSC Urban Solutions has 7,500 stations and is the supplier for Bixi, a non-profit company set up 95,000 bikes in 45 markets across 15 countries. PBSC by the city of Montreal.Page |3 advertisers to engage with this growing platform is cloud-based and hosted by audience throughout their transportation AWS'; is mobile-first and is platform journeys"."? Advertisements would run in the agnostic." The technology platform, along app, on in-car tablets, as well as via Lyft Halo with the scale and density of Lyft's user (smart digital rooftop screens) as a form of out- network, is leveraged to gain insights from a of-home (OOH) advertising. Lyft Media revenue significant number of rides "to continuously results have not been made public. Uber has improve [our] ridesharing marketplace been more vocal about its advertising revenues efficiency and develop new offerings".16 and has stated that its advertising business Historical data collected is used to improve could reach one billion dollars in revenue by experiences for drivers and riders. Machine 2024*. During Uber's earnings call, CEO Dara learning is used to predict future behavior Khosrowshahi said: "We passed $500 million in to balance supply and demand in the annual run rate [for ad sales], and that's based marketplace, as well as maximize driver on increasing the number of active advertisers earnings and rider service levels. This data that we have by 80% on a year-on-year basis. and sets of analytics/algorithms are used to More than 315,000 businesses ran ads with inform product development. 17 Uber in the fourth quarter, nearly double the company's 170,000-plus advertisers a year Lyft Transportation Network earlier." 13 According to Lyft's Chief Business Officer, Zach Greenberger, ad revenue growth has exceeded internal goals. 14 For Lyft, both revenue and revenue per active rider have grown, but at a slowing rate. Source: Lyft (2019)"Form 10-K Annual Report". Retrieved from https://investor.lyft.com/overview/default.aspx 2021 2020 2019 2018 Revenue $4,095 $3,208 52.355 $3,616 $2,157 Us millions Lyft has offerings across the transportation Revenue per $57-72 $51.79 $45.40 $44.40 $36.02 Active Rider spectrum from shared bikes and scooters Source, 2022-2019 Form 10-K (Light Vehicles) for shorter rides and first mile and last mile legs of multimodal trips, Key Activities and Resources to an offering for renters who want to rent Technology and Service Offerings: Lyft's a car for a fixed period of time for personal technology and services are transportation use. For those with access to the network, it centered. The mobile application (Lyft App) can offer a "viable alternative to car connects drivers and riders. The Lyft ownership". For Lyft riders who own a car, *Uber began selling ads on its restaurant and Lyft is committed to spend an aggregate of at least grocery delivery app Uber Eats in 2019. According to $350 million between February 2022 and January Bernstein Research Analyst Nikhil Devnani, Uber Eats 2026, with a minimum amount of $80 million in each gives it a key advantage in the competition for of the four contractual periods, on services with marketing budgets because Lyft has no comparable AWS offering.Page | 4 Lyft also offers car maintenance, roadside . Incentivizing public transit: In select assistance, and parking "to meet them cities (23 metro areas in the US and where they are in their transportation Canada), the Lyft App integrates third- journey."18 party public transit data to encourage multimodal rides. Sustainability: To date, Lyft has focused on Reducing the need for personal vehicles: providing access to sustainable This is the ultimate goal of Lyft. To move transportation. The Company has been trying to do its part when it comes to low- away from the need for car ownership. Lyft estimates that their rideshare riders carbon transportation. "own 6.6 million fewer cars due to Transitioning to cleaner cars: The 2022 rideshare, even when accounting for Annual Report highlighted that Lyft vehicles acquired by drivers".21 intends "to invest further in Electric Lyft will likely continue with its economic Vehicles (EVs) in order to achieve and environmental sustainability focus and compliance with the California Clean reporting; however, financial and Miles Standard and Incentive Program, competitive pressures may refine that which sets the target that 90% of focus. In April 2023, Lyft's head of rideshare miles in California must be in sustainability, Paul Augustine, was let go as EVs by the end of 2030, and New York part of the downsizing." Lyft's pooled rides City's recently announced goals to get to offering was also discontinued." This was 100% of rideshare miles in EV by 2030." This aligns with the goal to "reach 100% all in an effort to control costs in order to compete with Uber. EVs on the Lyft Platform by the end of 2030.19 Human Capital: As of February 28, 2022, Lyft Expanding access to micromobility": had 3,325 regular employees. Since the latest "Shared micromobility is core to Lyft's round of layoffs, this will have dropped by at mission to improve people's lives with least 26%. Because of the nature of its the world's best transportation, offering ridesharing platform, Lyft also has drivers to riders a diverse range of modes to meet consider as part of its human capital. their transportation needs, whether Ensuring drivers are happy, earning a living they're going 1 mile or 100 miles."20 Lyft wage, and have policies that support their operates more than 90,000 bikes and own lifestyles is incredibly important. Drivers scooters across 10 markets in the US. can easily switch platforms, and some may The acquisition of PBSC provides an operate on both. Finding a way to build and additional 70,000 bikes across 45 sustain loyalty could be a key differentiator markets in 15 countries. and strengthening feature for the Lyft network. "Micromobility is "transportation using lightweight service rental program in which people rent vehicles vehicles such as bicycles or scooters, especially for short-term use within a town or city". (Oxford electric ones that may be borrowed as part of a self- Dictionary)Page 5 The Industry Lyft refers to the shift from car ownership to Transportation as a Service (TaaS) in its 2022 According to Mckinsey & Company, the shared- annual report. The concept refers to the use of mobility market accounted for approximately $130 billion to $140 billion in global consumer transportation services, such as ridesharing, bikesharing, and carsharing, as a replacement spending in 2019. Ridesharing (e-hailing) accounted for the largest share, $120 billion to for traditional personal vehicle ownership. The $130 billion (90% of the total market).24 benefits of Taas include: being a more affordable option to owning a vehicle; being a more convenient means of getting around; being more environmentally friendly (reduces traffic congestion which reduces carbon emissions); and improving mobility. A wide range of companies are involved in Taas Source: Heineke, Kersten. Kloss, Benedikt. Maller, Tima. including Lyft and Uber. Large car Wiemuth, Charlotte. (April 11, 2021). "shared mobility: Where it manufacturers GM, Ford, and Telsa would be stands, where it's headed", Mckinsey & Company. Retrieved from https://www.mckinsey.com/industries/automotive-and- included in the Taas industry and so would the assemblyfour-insights/shared-mobility-where-it-stands-where its- major rental agencies Avis/Budget and Hertz. headed Outside of North America, companies like DiDi, Micromobility is a powerful component of the Ola Cabs, and Gojek and heavily involved. Big shared-mobility mix. In the US, approximately technology companies are also involved. 60% of all trips are less than five miles. Alphabet Inc. (Google) is the parent company of "Americans lose an average of 99 hours a year Waymo, a self-driving technology company. due to traffic congestion, according to the 2019 Intel is involved in developing autonomous INRIX National Traffic Scorecard, and in 2019, driving technology as is Nvidia; both significant traffic cost Americans roughly $88B, or an companies in terms of market presence and average of almost $1,400 per driver.#25 financial strength."7 As the number one competitor of Lyft, Uber is DISRUPTING THE CAR focused on more than transportation. The company intents to build a marketplace that connects beyond transportation and the BIES.HEILIES technology platform that supports that has dott I Opin Grob val different design implications. 60% clappin En 15 Uber generates the majority of its revenue from fees paid by drivers and merchants to use its Source: CBInsights. (October 13, 2021). Retrieved from https://www.cbinsights.com/research/report/micromobility- platform. "We act as an agent in these revolution/ transactions by connecting consumers to Drivers and Merchants to facilitate a trip, meal According to Mckinsey, by 2030, the shared- or grocery delivery service.*2: micromobility market could reach $50 billion to $90 billion.2 (Up by 40% each year from 2019.) Uber tracks revenue across three segments:Page |6 . Mobility - connecting customers across the authors identify five fundamental ridesharing, carsharing, micromobility, properties of networks". This is a worthwhile rentals, public transit, and taxis; read as part of the process of identifying Lyft's Delivery - helping customers search for and options. According to the authors, "Network discover the best of restaurants, grocery, properties are trumping platform scale" alcohol, convenience, and other retailers to Unfortunately, almost all the downsides of order a meal or other items and have it platforms identified by the authors apply to picked up or delivered; and ridesharing. Freight - connecting shippers and carriers using a proprietary on-demand platform to . Network clustering - fragmented into local automate logistics transactions.? clusters or cities. . Disintermediation - riders and drivers Revenue connecting outside of the platform. fin millions USD, FY 2022 Q1 2023 Mobility 14,029 4,330 Multi-homing - using both the Uber and Lyft Delivery 10,90 3,093 Freight 6.947 1,400 apps (and others if they exist in a market] Total 31,877 8,821 and selecting the best price (there is no cost ource: Uber. 2022 10-K. March 31, 2023 10 0. to using both). While Uber does not directly report revenue per rider, it does report Monthly Active Platform For Lyft in particular, these effects make Consumers (MAPC), gross bookings, and becoming profitable very challenging. Consider revenue. Revenue as a percentage of gross three questions when identifying Lyft's strategic bookings is referred to as "take rate" and is 28% options. for fiscal year 2022. Revenue per MAPC is 1) Can market share be secured with a $20.23 (gross bookings per MAPC is $73.41). ridesharing platform alone? Lyft's revenue per active rider for the fiscal year 2022 was $52.28 ($51.17 for Q1 2023). Lyft has Being number two in a duopoly is not a bad strong revenue per active rider, but Uber has thing as long as growth is possible, and more than 20 times the number of active riders profitability is achievable. Often market (assuming MAPC is a close comparison). Like all leadership and profitability go hand-in-hand, platform models, volume matters. but in the case of ridesharing, this has not shown to be true. Focusing on gaining share in Strategic Considerations one space (like ridesharing) is not a bad thing either, however, it can prove to be difficult Lyft is facing some seriously strong headwinds when it is easy for someone with a good and is burning through cash at an alarming rate. application to enter the space (low barriers of Ridesharing is a difficult business where price entry). Uber has chosen to build cross-network competition is intense and switching costs for effects by diversifying in delivery and shipping. drivers and riders are low. Harvard Business Both Lyft and Uber are trying to strengthen Review published an article in 2019 entitled their rider sharing network effects by learning "Why Some Platforms Thrive.and Others from the data collected on riders and drivers. Don't". Through discussions about platforms (Similar to Amazon's recommendations which like Facebook and Airbnb versus Uber and Didi, increased barriers to entry.) Lyft has investedPage |7 heavily in micromobility, but not in cross- models and loyalty programs. This may be a platforms like delivery and freight. The majority way to lessen the negative network effect of of shared mobility revenue will continue to be multi-homing. Partnering with financial services driven by ridesharing into the foreseeable companies, airlines, and vacation home future. Partnerships with other successful platforms could lessen the negative effect of platforms could be a way to secure riders along network clustering. To reiterate Lyft's mission - the transportation value chain. "Improve people's lives with the world's best transportation". Apple figured out how to 2) Can Lyft be the autonomous vehicle of choice embed itself in every aspect of how we live - it when the time comes? has become its own market at almost three The drivers of today will be replaced by trillion dollars. Maybe this is what needs to be autonomous vehicles (AVs) in the future, so the considered for Lyft. technology supporting those vehicles will be the golden ticket. While a lot of energy goes into The Strategy Report and Board securing and keeping drivers happy today Presentation (policies, wages, legal fees), in the AV future, Lyft has taken steps to reduce costs and that money can be utilized to offer even more focus on competing with Uber. It has not affordable transportation. It will be important chosen to expand through cities to match to have access to AVs (obviously), have tried Uber, but rather through transportation and tested self-driving software, and a options. Bolstering the strength of its ridesharing network. Maybe Uber and Tesla will network will require ongoing innovation, be the sweet match, but there is opportunity agility (responding to drivers and riders), for Lyft. The Company already has a relationship and cash. with Waymo, the autonomous driving technology company (subsidiary of At a recent meeting, Vol Lever was asked by Alphabet..the parent of Google..deep, deep, the Senior Director of Strategy to provide deep pockets). While EV's do not address short the requirements outlined below for a term profitability, partnerships with successful meeting with the Executive Management platforms could as well as help secure longer team and a subsequent Board Presentation. term success "I really need a concise response for the 3) What do riders really want? Executive Management team that outlines your team's analysis," added the Director. Like most services, understanding the problem "You will also need to spend time on a 10- that needs to be solved and coming up with a minute Board Presentation which solution is the path to success. It is well summarizes your recommendation and researched that the top reason customers use rationale". ridesharing services is because it is easy. In Lever and the rest of the corporate strategy some cases it might be cheaper, more reliable, and cleaner than a taxi or bus. Making life even team have met for a working lunch to outline and assign tasks. The team is still easier may be an opportunity for Lyft. Both Uber and Lyft are flirting with subscription working in an uncertain environment asPage |8 market and internal pressures persist. An e-mail received from the Senior Director External talks of being acquired have not of Strategy stressed the time frame and done much to boost internal moral either. explained: "with a little more than a month, While it can be a strategy (good companies we really need to focus on three strategic get bought), for public companies with poor possibilities. The Board members will not analyst ratings and struggling share price expect to see a detailed action plan yet; it trends, it can be defeatist. Urbanization is would be premature to develop one until real. Climate change is real. Riders need to we have Board approval of a new strategic complete their transportation journeys. plan. However, they will expect an Finding ways to create value along the assessment of the implementation transportation chain will help reverse the considerations of your recommendation negative network effects surrounding including an assessment of the key risks ridesharing. By the end of lunch, the team together with at least five (5) other had summarized a set of requirements on implementation considerations. One last the white board: thing - the Board will require a clear view of the financial impacts of your Assess the current strategy of Lyft and recommendation." their source of advantage, including: An overview of the status quo business strategy and a value proposition map; a current financial size-up; a Simplified Business Model Canvas and an assessment of the strategic and financial linkages; and o a clear statement of Lyft's source of competitive advantage and the trigger for strategic change. Identify three (3) strategic possibilities; . Prepare an Executive Report and a 10- minute board presentation, including: Perform an analysis of the external and internal environments assembling a picture of what we believe the future will look like; and Choose the best strategic possibility, clearly communicating the recommendation, rationale, and implications.Page |1 Exhibit 1 - Selected Annual Results CONSOLIDATED STATEMENT of OPERATIONS Year Ended December 31, (in USS thousands) 2022 2021 2020 Revenue 4,095,135 3,208,323 2,364,681 Costs and expenses Cost of revenue 2,435,736 1,702,317 1,447,516 Operations and support 443,846 402,233 453.963 Research and development 856,777 911,946 909,126 Sales and marketing 531,512 411,406 416,331 General and administrative 1,286,180 915,638 946,127 Total cost and expenses 5,554,051 4,343,540 4,173,063 Loss from operations (1,458,916) (1,135,217) (1, 808,382) Interest expense (19,735) (51,635) (32,678) Other income (expense), net (99,988) 135,933 43,669 Loss before income taxes [1,578,639 (1,050,919) (1,797,391) Provision for (benefit from) income taxes 5,872 11,225 (44,534) Net loss (1,584,511) (1,062,144) (1,752,857) Source: 2022 Annual Report, page 78Page |2 Exhibit 2 - Selected Quarterly Results CONSOLIDATED STATEMENT of OPERATIONS Three Months Ended, March 31 (in USS thousands) 2023 2022 Revenue 1,000,548 875,575 Costs and expenses Cost of revenue 548,992 440,294 Operations and support 98,927 98,600 Research and development 196,904 192,754 Sales and marketing 115,941 126,329 General and administrative 256,540 216,941 Total cost and expenses 1,217,303 1,074,918 Loss from operations (216,755) (199,343) Interest expense (5,433) (4,549) Other income (expense), net 37,215 9,763 Loss before income taxes (184,973) (194,129) Provision for (benefit from) income taxes 2,676 2,803 Net loss (187,649 (196,932) Source: March 31, 2023, First Quarter Results, page 4.Page | 3 Exhibit 3 - Consolidated Balance Sheets As At fin USS millions, except share and per share data) December 31, 2022 2021 Assets Current assets: Cash and cash equivalents 281,090 457,325 Short-term investments 1,515,702 ,796,533 Prepaid expenses and other current assets 786,067 522,212 Total current asset 2,582,859 2,776,070 Restricted cash and cash equivalents 109,368 73,205 Restricted investments 1,027,506 1,044,855 Other investments 26,390 80,411 Property and equipment, net 313,402 298,195 Operating lease right of use assets 135,213 223,412 Intangible assets, ne 76,208 50,765 Goodwill 261,582 180,516 Other assets 23,90 46,455 Total assets 4,556,431 4,773,884 Liabilities and Stockholders' Equity Current liabilities: Accounts Payable 107,801 129,542 Insurance reserves 1,417,350 1,068,628 Accrued and other current liabilities 1,561,609 1,264,426 Operating lease liabilities - current 45,803 53,765 Total current liabilities 3,132,563 2.516,361 Operating lease liabilities 176,356 210,232 Long-term debt, net of current portion 803,207 655,173 Other liabilities 55,637 50,905 Total liabilities 4,167,763 3,432,671 Commitments and contingencies Shareholders' Preferred shares Common shares Additional paid-in capital 10,355,013 9,706,293 Accumulate other comprehensive income (loss) (5,754) (2,511 Accumulated deficit (9,940,595) [8,362,572) Total stockholders' equity 388,668 1,341,213 Total liabilities and stockholders' equity 4,556,431 4,773,884 Source: 2012 Annual Report, page 77Page | 4 Exhibit 4 - Consolidated Statements of Cash Flows (in USS thousands) For the year ended December 31, 2022 2021 2020 Cash flows from operating activities Net loss (1,584,511) (1,062,144) (1,752,857) Adjustments to reconcile net loss to net cash used in operating activities Depreciation and amortization 154,798 139,347 157,353 Stock-based compensation 750,767 724,560 565,807 Amortization of premium on marketable securities 2,955 4,100 6,461 Accretion of discount on marketable securities (23,245) [1,513) (14,075) Amortization of debt discount and issuance costs 2,823 35,575 21,050 Deferred income tax from convertible senior notes (46,324) (Gain] loss on sale and disposal of assets, net (60,655) 5,538 15,216 Gain on divestiture (119,284) Impairment of non-marketable equity security 135,714 Other 23,592 3,321 4,518 Changes in operating assets and liabilities, net effects of acquisition Prepaid expenses and other assets (275,945) (207,046) 39,573 Operating lease right-of-use assets 96,317 61,301 61,201 Accounts payable 27,215) 47,080 14,489 Insurance reserves 348,721 81,564 (391,398) Accrued and other liabilities 262,358 234,212 (36,679) Lease liabilities 43,759) 48,332) (53,234) Net cash used in operating activities 237,285) 101,721) [1,378,899) Cash flows from investing activities Purchases of marketable securities (4,049,515) (3,301,736) [4,112,677) Purchases of non-marketable securities 15,000 (10,000) Purchases of term deposit (13,586) 458,021) [1,110,317) Proceeds from sales of marketable securities 676,854 513,009 656,960 Proceeds from maturities of marketable securities 1,308,664 3,259,221 4,745,926 Proceeds from maturities of term deposits 395,092 675,481 645,960 Purchases of property and equipment and scooter fleet (114,970) (79,176) (93,639) Cash paid for acquisitions; net of cash acquired (146,334 (12,342) Sales of property and equipment 129,840 42,543 30,894 Proceeds from divestiture 122,683 Other 12,000 Net cash provided by [used in) investing activities 186,045 267,012 740,427 Cash flows from financing activities Repayment of loads (67,639) (44,446) (50,639) Proceeds from issuance of convertible senior notes 734,065 Payment of debt issuance costs (824) Purchase of capped call (132,681) Proceeds from exercise of stock options and other common stock issuances 21,655 33,822 26,067 Taxes paid related to net share settlement of equity awards (6,733 26,297) (20,240) Principal payments on finance lease obligations 34,783) (35,547) 41,682) Other 12 [1,500) Net cash provided by (used in) financing activities 87,500) (72,470) 512,566 Effect of foreign exchange on cash, cash equivalents and restricted cash and cash equivalents (631) (113) (74) Net (decrease) increase in cash, cash equivalents and restricted cash and cash equivalents 139,371) 92,70 (125,980) Cash, cash equivalents and restricted cash and cash equivalents, beginning of period 531,193 438,485 564,465 Cash, cash equivalents and restricted cash and cash equivalents, end of period 391,82 531,193 438,485 Source: 2022 Annual Report, page 82 (cash reconciliation to consolidated balance sheet on page 83)

Step by Step Solution

There are 3 Steps involved in it

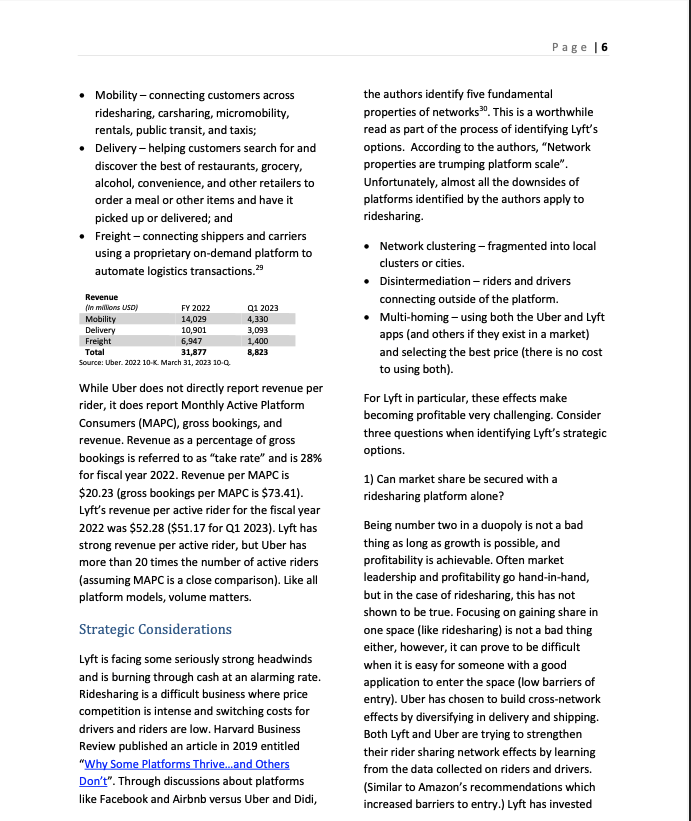

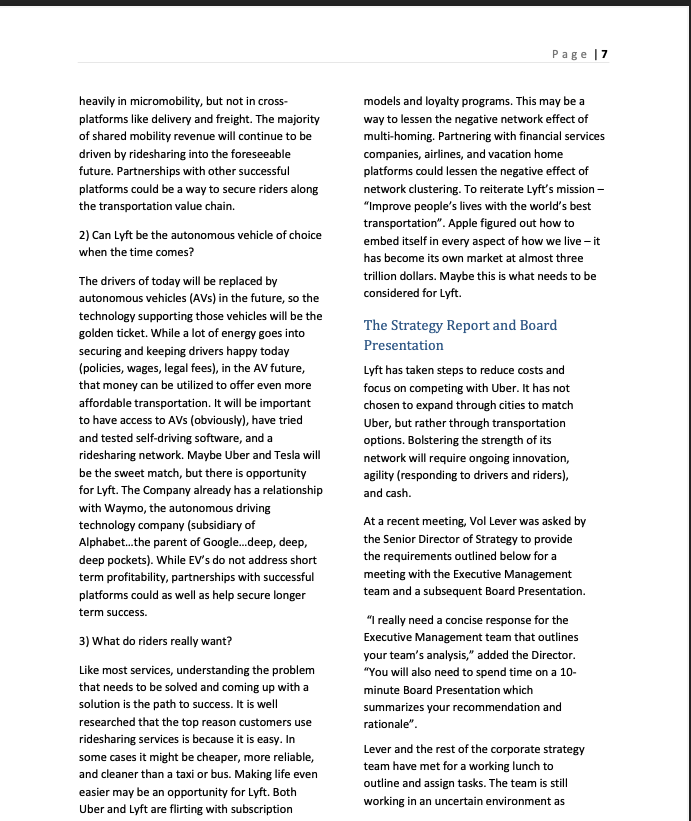

Get step-by-step solutions from verified subject matter experts