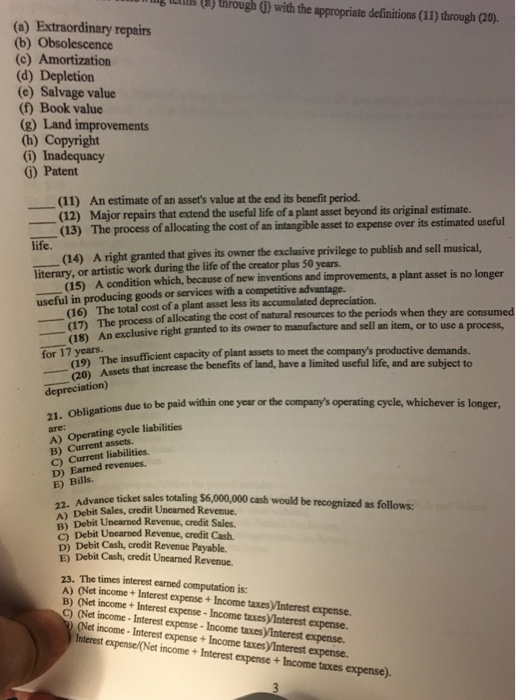

Question: (a) Extraordinary repairs (b) Obsolescence (c) Amortization (d) Depletion (e) Salvage value (f) Book value (g) Land improvements (h) Copyright (i) Inadequacy (j) Patent _____

(a) Extraordinary repairs (b) Obsolescence (c) Amortization (d) Depletion (e) Salvage value (f) Book value (g) Land improvements (h) Copyright (i) Inadequacy (j) Patent _____ An estimate of an asset's value at the end its benefit period. _____ Major repairs that extend the useful life of a plant asset beyond its original estimate. _____ The process of allocating the cost of an intangible asset to expense over its estimated useful life. _____ A right granted that gives its owner the exclusive privilege to publish and sell musical, literary, or artistic work during the life of the creator plus 50 years. _____ A condition which, because of new inventions and improvements, a plant asset is no longer useful in producing goods or services with a competitive advantage. _____ The total cost of a plant asset less its accumulated depreciation. _____ The process of allocating the cost of natural resources to the periods when they are consumed _____ An exclusive right granted to its owner to manufacture and sell an item, or to use a process, for 17 years. _____ The insufficient capacity of plant assets to meet the company's productive demands. _____ Assets that increase the benefits of land, have a limited useful life, and are subject to depreciation) Obligations due to be paid within one year or the company's operating cycle, whichever is longer, are: A) Operating cycle liabilities B) Current assets. C) Current liabilities. D) Earned revenues. E) Bills. Advance ticket sales totaling exist6,000,000 cash would be recognized as follows: A) Debit Sales, credit Unearned Revenue. B) Debit Unearned Revenue, credit Sales. C) Debit Unearned Revenue, credit Cash. D) Debit Cash, credit Revenue Payable. E) Debit Cash, credit Unearned Revenue. The times interest earned computation is: A) (Net income + Interest expense + Income taxes)/Interest expense. B) (Net income + Interest expense - Income taxes)/Interest expense. C) (Net income - Interest expense - Income taxes)/Interest expense D) (Net income - Interest expense + Income taxes)/Interest expense. E) Interest expense/(Net income + Interest expense + Income taxes expense)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts