Question: A FI manager receives information from an economic forecasting unit that interest rates are expected to rise from 10 percent to 11 percent over the

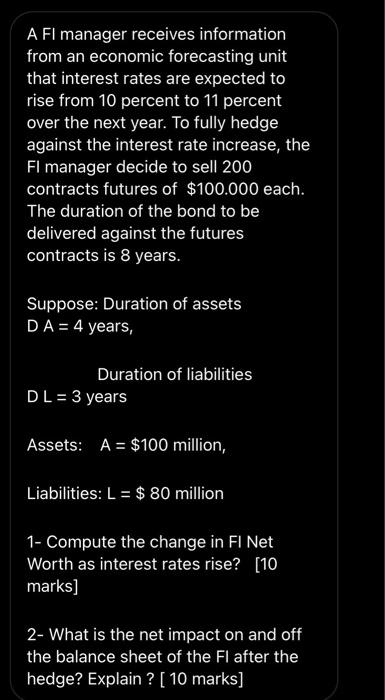

A FI manager receives information from an economic forecasting unit that interest rates are expected to rise from 10 percent to 11 percent over the next year. To fully hedge against the interest rate increase, the FI manager decide to sell 200 contracts futures of $100.000 each. The duration of the bond to be delivered against the futures contracts is 8 years. Suppose: Duration of assets DA = 4 years, Duration of liabilities DL = 3 years Assets: A = $100 million, Liabilities: L = $ 80 million 1- Compute the change in FI Net Worth as interest rates rise? [10 marks] 2- What is the net impact on and off the balance sheet of the FI after the hedge? Explain? [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts