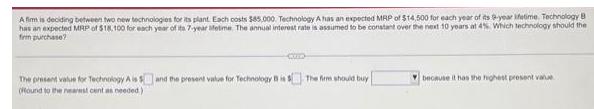

Question: A fimm is deciding between two new technologies for its plant. Each costs $85,000. Technology A has an expected MRP of $14,500 for each

A fimm is deciding between two new technologies for its plant. Each costs $85,000. Technology A has an expected MRP of $14,500 for each year of its 9-year ifetime. Technology B has an expected MRP of $18,100 for each year of its 7-year Metime. The annual interest rate is assumed to be constant over the next 10 years at 4% Which technology should the fr purchase? -COD- The present value for Technology A is and the present value for Technology B is The firm should buy offound to the nearest cent as needed) because it has the highest present value

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

For Technology A MRP per year 14500 Lifetime 9 years Annual interest rate 4 Step 1 Calcula... View full answer

Get step-by-step solutions from verified subject matter experts