Question: A final question from Anne Marie. I see these things called current assets and current liabilities. What are they? Why show them? I have current

A final question from Anne Marie.

- I see these things called current assets and current liabilities. What are they? Why show them? I have current assets of $47,797.50 and current liabilities of $5,200. Is that good or bad?

| Anne's Beauty Salon, Inc | ||

| Income Statement | ||

| For the Year 20XX | ||

| Sales (Revenue) | $125,000.00 |

|

| Cost of Goods Sold | 25,000.00 |

|

| Gross Profit | 100,000.00 |

|

|

|

| |

| Payroll Expense | 67,500.00 |

|

| Sales, General, Administrative Expense | 5,000.00 |

|

| Rent Expense | 1,400.00 |

|

| Utilities Expense | 1,670.00 |

|

| Insurance Expense | 500.00 |

|

| Depreciation Expense | 2,500.00 |

|

| Total Operating Expense | 78,570.00 |

|

| Total Operating Income | 21,430.00 |

|

| Income Taxes | 6,430.00 |

|

| Net Income | $15,000.00 |

|

|

|

|

|

|

|

|

|

| Anne's Beauty Salon, Inc | ||

| Statement of Retained Earnings | ||

| For the Month Ending December 31, 20XX | ||

|

|

| |

| Retained Earnings, December 1 | $5,000.00 |

|

| Add: Net Income | 15,000.00 |

|

| Subtract: Dividends | (2,402.50) |

|

| Retained Earnings, December 31 | $17,597.50 |

|

|

|

|

|

| Anne's Beauty Salon, Inc | ||||

| Balance Sheet | ||||

| At December 31, 20XX | ||||

| Assets | Liabilities |

| ||

| Current Assets | Current Liabilities |

| ||

| Cash | $949.50 | Accounts Payable | $5,000.00 | |

| Accounts Receivable | 11,948.00 | Unearned Revenue | 200.00 | |

| Supplies | 20,500.00 | Total Current Liabilities | 5,200.00 | |

| Prepaid Rent | 8,400.00 |

| ||

| Prepaid Insurance | 6,000.00 |

| ||

| Total Current Assets | 47,797.50 | Note Payable | 15,000.00 | |

| Equipment | $25,000.00 | Total Liabilities | 20,200.00 | |

| Less: Accumulated |

| Stockholders' Equity |

| |

| Depreciation | (5,000.00) | 20,000.00 | Common Stock | 30,000.00 |

| Total Long-Term Assets | Retained Earnings | 17,597.50 | ||

| Total Assets | $67,797.50 | Total Liabilities and | $67,797.50 | |

|

| Stockholders' Equity |

| ||

|

|

|

|

|

|

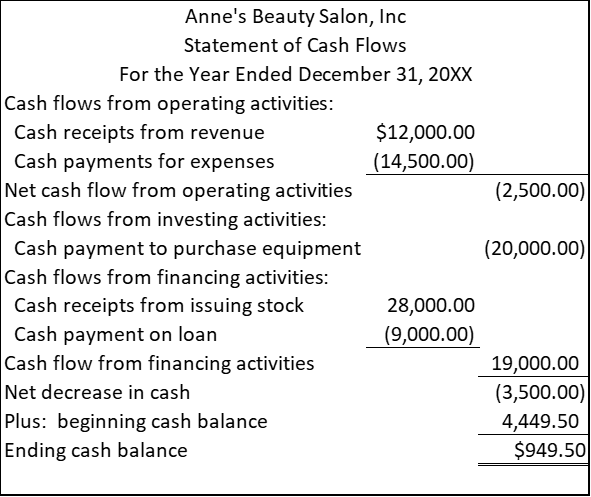

Anne's Beauty Salon, Inc Statement of Cash Flows For the Year Ended December 31, 20XX Cash flows from operating activities: Cash receipts from revenue $12,000.00 Cash payments for expenses (14,500.00) Net cash flow from operating activities (2,500.00) Cash flows from investing activities: Cash payment to purchase equipment (20,000.00) Cash flows from financing activities: Cash receipts from issuing stock 28,000.00 Cash payment on loan (9,000.00) Cash flow from financing activities 19,000.00 Net decrease in cash (3,500.00) Plus: beginning cash balance 4,449.50 Ending cash balance $949.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts