Question: A financial analyst is comparing two bonds of the same risk class. Both bonds have identical maturity dates. Their coupon interest rates do differ. The

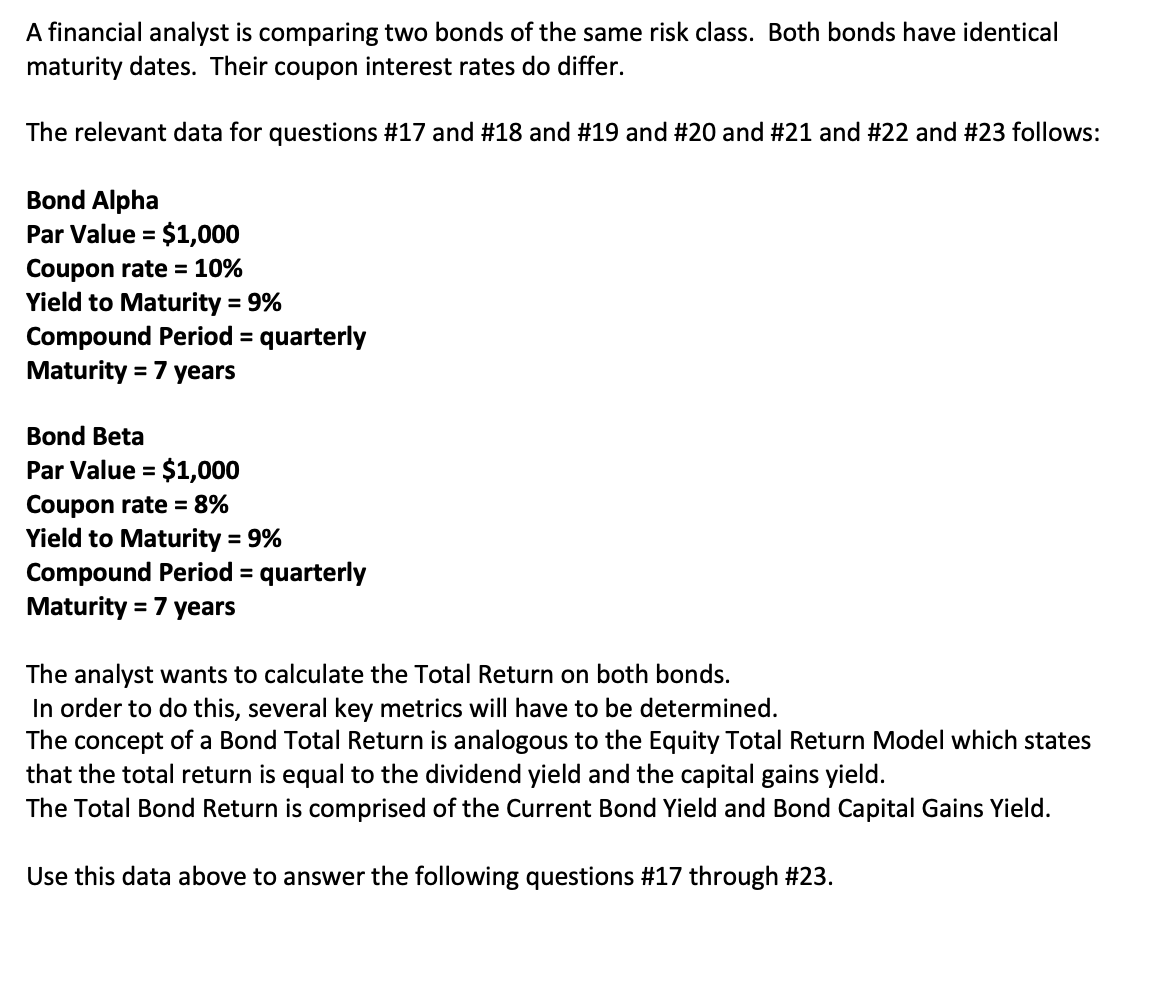

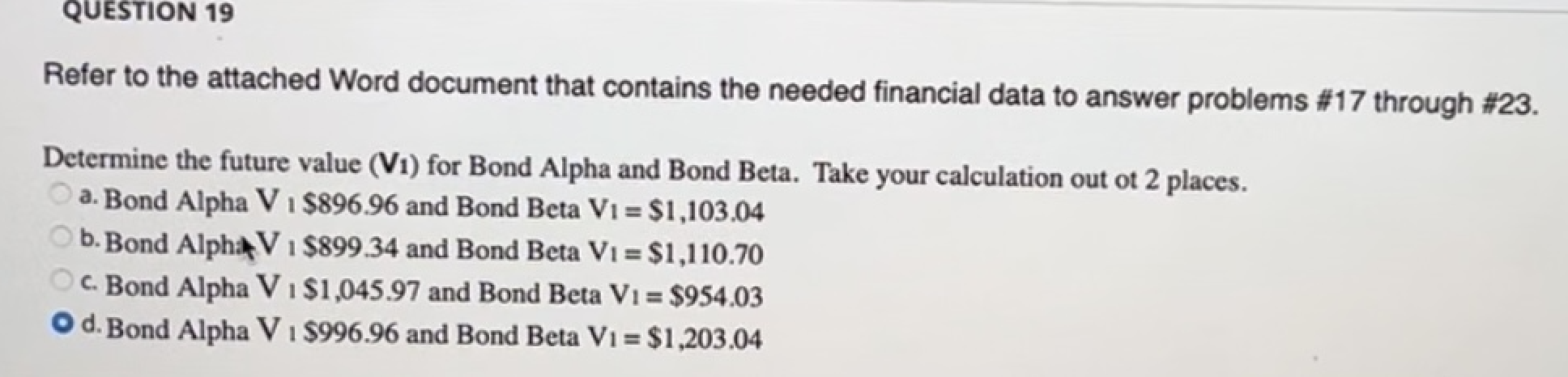

A financial analyst is comparing two bonds of the same risk class. Both bonds have identical maturity dates. Their coupon interest rates do differ. The relevant data for questions #17 and #18 and #19 and #20 and #21 and #22 and #23 follows: Bond Alpha Par Value = $1,000 Coupon rate = 10% Yield to Maturity = 9% Compound Period = quarterly Maturity = 7 years Bond Beta Par Value = $1,000 Coupon rate = 8% Yield to Maturity = 9% Compound Period = quarterly Maturity = 7 years The analyst wants to calculate the Total Return on both bonds. In order to do this, several key metrics will have to be determined. The concept of a Bond Total Return is analogous to the Equity Total Return Model which states that the total return is equal to the dividend yield and the capital gains yield. The Total Bond Return is comprised of the Current Bond Yield and Bond Capital Gains Yield. Use this data above to answer the following questions #17 through #23. QUESTION 19 Refer to the attached Word document that contains the needed financial data to answer problems #17 through #23. Determine the future value (VI) for Bond Alpha and Bond Beta. Take your calculation out of 2 places. a. Bond Alpha V1 $896.96 and Bond Beta V1 = $1,103.04 b. Bond AlphaV1 $899.34 and Bond Beta V1 = $1,110.70 C. Bond Alpha V1 $1,045.97 and Bond Beta V1 = $954.03 O d. Bond Alpha V 1 $996.96 and Bond Beta V1 = $1,203.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts