Question: Review the concept map and answer the question. Figure 1: Fulcher, Douglas R., T.C. Summary Opinion 2003-157, Concept Map Figure 2: The Boeing Company and

Review the concept map and answer the question.

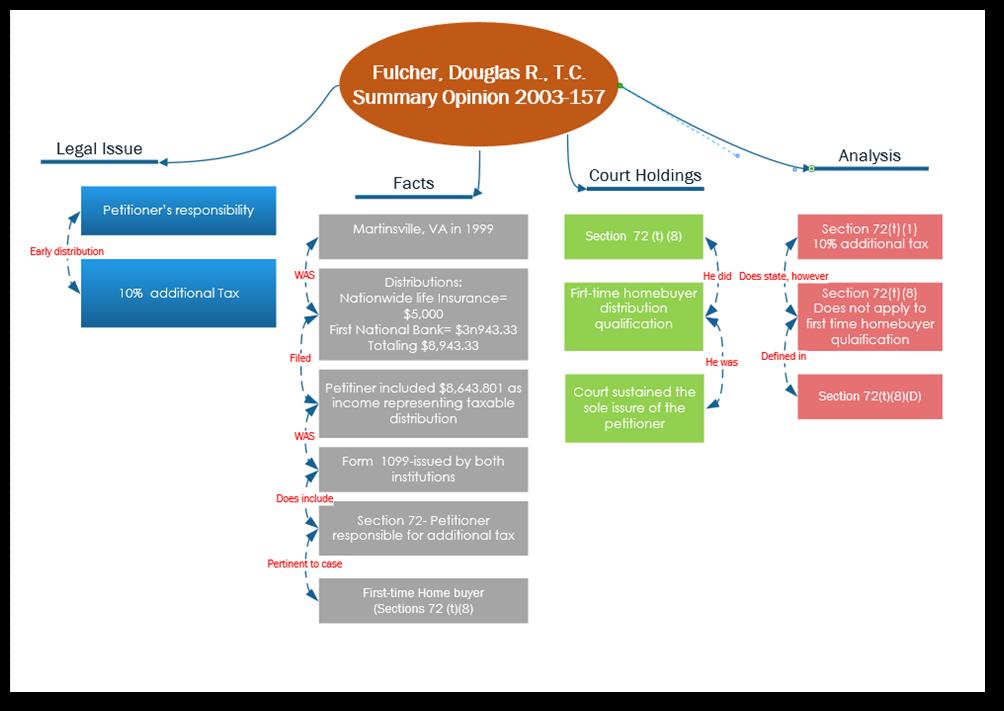

Figure 1: Fulcher, Douglas R., T.C. Summary Opinion 2003-157, Concept Map

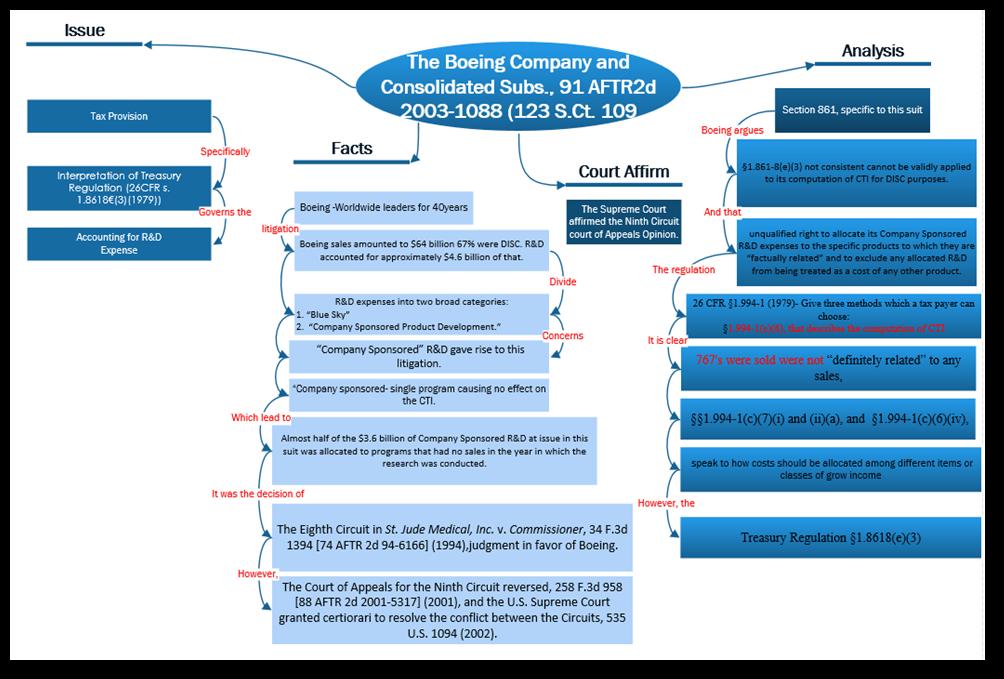

Figure 2: The Boeing Company and Consolidated Subs., 91 AFTR2d 2003-1088 (123 S.Ct. 109, Concept Map

How to write a case brief and its value in tax research?

Fulcher, Douglas R., T.C. Summary Opinion 2003-157 Legal Issue Analysis Court Holdings Facts Petitioner's responsibility Section 72(t) (1) 10% additional tax Martinsville, VA in 1999 Section 72 (t) (8) Early distribution WAS He did Does state, however Distributions: Firt-time homebuyer distribution Section 72(t) (8) Does not apply to first time homebuyer qulaification 10% additional Tax Nationwide life Insurance= $5,000 First National Bank= $3n943.33 Totaling $8,943.33 qualification Filed Defined in He was Petitiner included $8,643.801 as income representing taxable distribution Court sustained the sole issure of the Section 72(t)(8)(D) petitioner WAS Form 1099-issued by both institutions Does include, Section 72- Petitioner responsible for additional tax Pertinent to case First-time Home buyer (Sections 72 (t)(8)

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

How to Write a Case Brief and Its Value in Tax Research A case brief is a summarized structured pres... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

6050a8236f5a6_72861.docx

120 KBs Word File