Question: A financial analyst is evaluating a project that has projected cash flows as follows: CFO: -(5,628) CF1: 1,569 CF2: 1,420 CF3: 1,198 CF4: 1,174

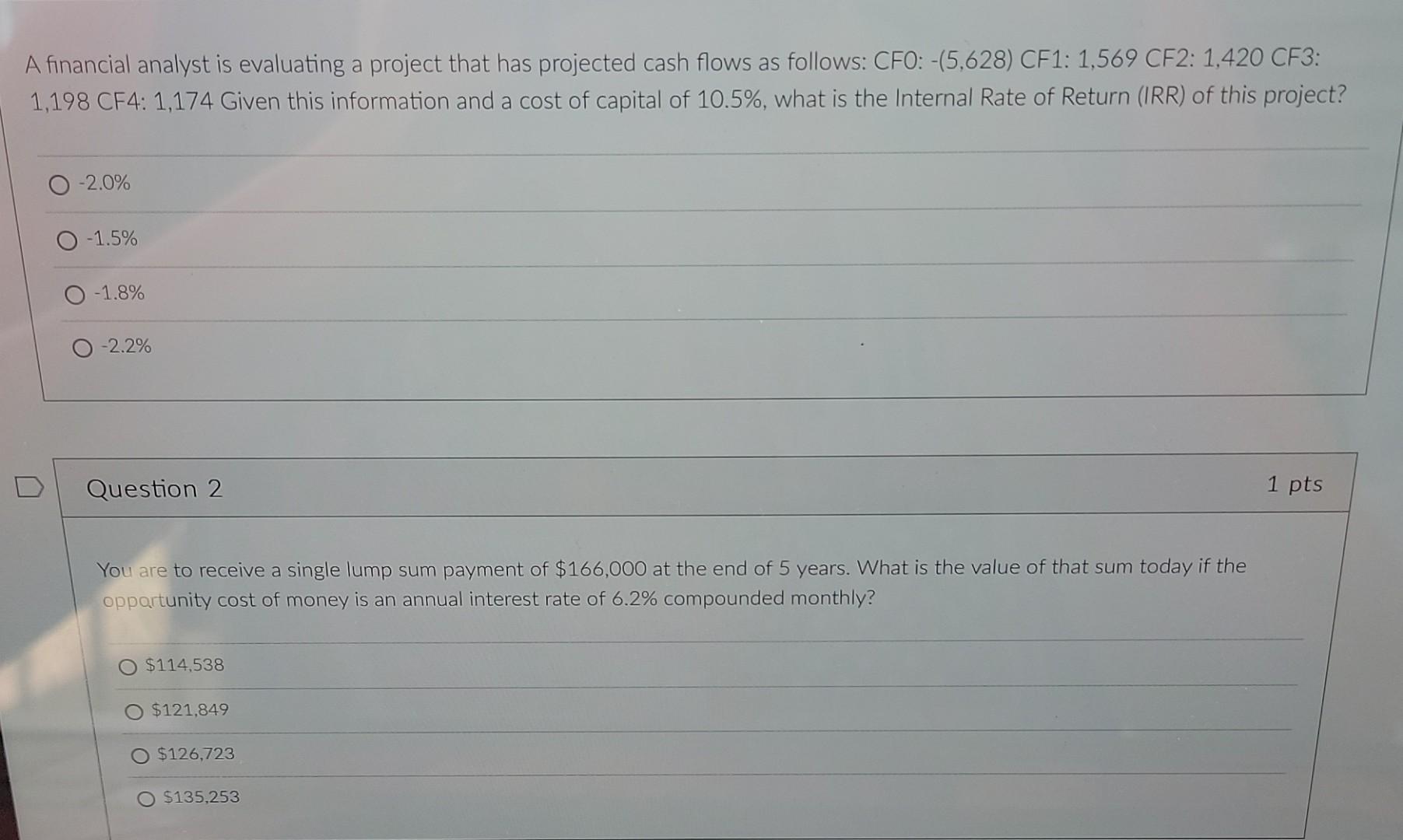

A financial analyst is evaluating a project that has projected cash flows as follows: CFO: -(5,628) CF1: 1,569 CF2: 1,420 CF3: 1,198 CF4: 1,174 Given this information and a cost of capital of 10.5%, what is the Internal Rate of Return (IRR) of this project? -2.0% -1.5% -1.8% -2.2% Question 2 You are to receive a single lump sum payment of $166,000 at the end of 5 years. What is the value of that sum today if the opportunity cost of money is an annual interest rate of 6.2% compounded monthly? O $114,538 O $121,849 O $126,723 O $135,253 1 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts