Question: A financial derivative on a share whose current price is 110 is issued by an investment. bank. At expiry in 3 months' time, the

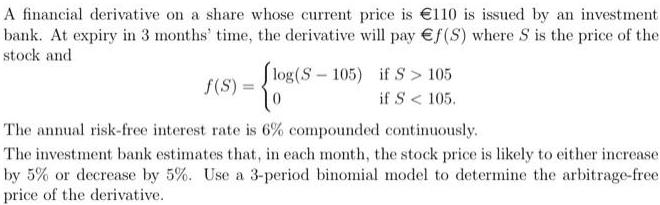

A financial derivative on a share whose current price is 110 is issued by an investment. bank. At expiry in 3 months' time, the derivative will pay f(S) where S is the price of the stock and log(S-105) if S > 105 if S < 105. f(S) = The annual risk-free interest rate is 6% compounded continuously. The investment bank estimates that, in each month, the stock price is likely to either increase. by 5% or decrease by 5%. Use a 3-period binomial model to determine the arbitrage-free price of the derivative.

Step by Step Solution

3.57 Rating (164 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts