Question: A) Find Project A's expected return, standard deviation, and coefficient of variation. B) If the projects were mutually exclusive, which alternative would you prefer? Explain

A) Find Project A's expected return, standard deviation, and coefficient of variation.

B) If the projects were mutually exclusive, which alternative would you prefer? Explain your answer

C) What is the covariance of the cash flows for projects B and C?

D) What is the correlation of the cash flows for projects B and C?

E) Would combining projects B and C change the risk of the firm, and if so, how? Explain your answer.

F) Assuming the firm is going to invest an equal amount of its available funds on each project, what is the expected return on the capital projects for next year?

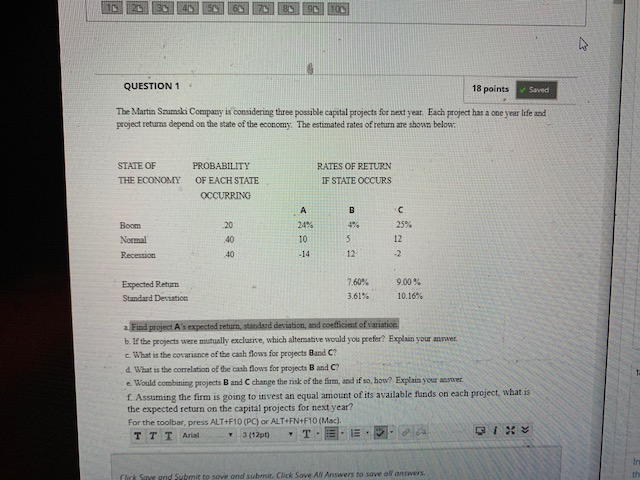

T NS 28 HOC QUESTION 1 18 points Saved The Martin Szumski Company is considering three possible capital projects for next year. Each project has a one year life and project returns depend on the state of the economy. The estimated rates of return are shown below STATE OF PROBABILITY THE ECONOMY OF EACH STATE OCCURRING RATES OF RETURN IF STATE OCCURS Boom Normal Recen Expected Return Standard Destation 760% 3.61% 9.00% 10.16% 2. Find project A's expected return, standard deviation, and coefficient of variation b. If the projects were mutually exclusive, which alternative would you prefer? Explain your answer. c. What is the covariance of the cash flows for projects and C? a. What is the correlation of the cash flows for projects Band C? Would combining projects and change the risk of the firm, and if so, how? Explain your Assuming the firm is going to invest an equal amount of its available funds on each project, what is the expected return on the capital projects for next year? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10(Mac). TTT Arial 3112p) T.E.E.. /* flick Save and submit to save and submit. Click Save All Answers to save o nwers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts