Question: A firm began its fiscal year with a book value of common equity of $823 million and net financial assets of $125 million. At

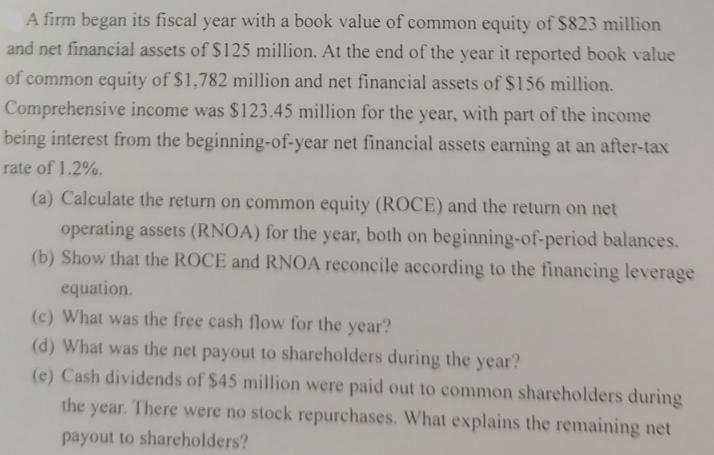

A firm began its fiscal year with a book value of common equity of $823 million and net financial assets of $125 million. At the end of the year it reported book value of common equity of $1,782 million and net financial assets of $156 million. Comprehensive income was $123.45 million for the year, with part of the income being interest from the beginning-of-year net financial assets earning at an after-tax rate of 1.2%. (a) Calculate the return on common equity (ROCE) and the return on net operating assets (RNOA) for the year, both on beginning-of-period balances. (b) Show that the ROCE and RNOA reconcile according to the financing leverage equation. (c) What was the free cash flow for the year? (d) What was the net payout to shareholders during the year? (e) Cash dividends of $45 million were paid out to common shareholders during the year. There were no stock repurchases. What explains the remaining net payout to shareholders?

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

a ROCE is calculated as comprehensive income divided by the average common equity ROCE Comprehensive Income Average Common Equity Average Common Equit... View full answer

Get step-by-step solutions from verified subject matter experts