Question: A firm considers which strategy is optimal for its globalization initiatives. It considers: 1) a Foreign Direct Investment (FDI), which has a present value of

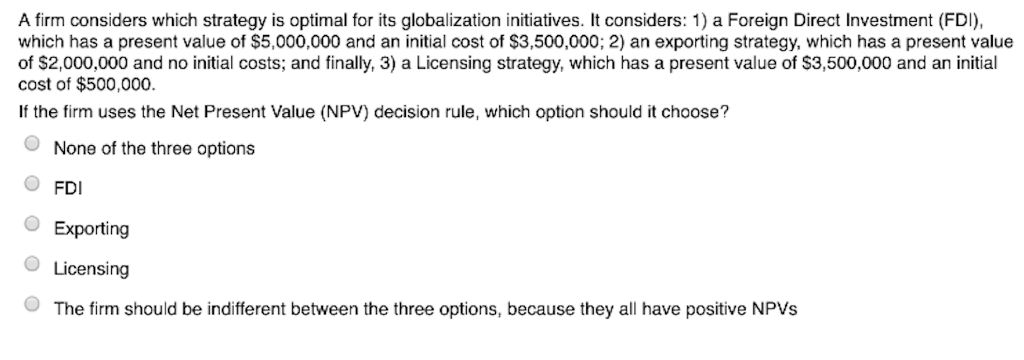

A firm considers which strategy is optimal for its globalization initiatives. It considers: 1) a Foreign Direct Investment (FDI), which has a present value of $5,000,000 and an initial cost of $3,500,000; 2) an exporting strategy, which has a present value of $2,000,000 and no initial costs; and finally, 3) a Licensing strategy, which has a present value of $3,500,000 and an initial cost of $500,000 If the firm uses the Net Present Value (NPV) decision rule, which option should it choose? None of the three options O FDI O Exporting Licensing O The firm should be indifferent between the three options, because they all have positive NPVs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts